Hibbett (NASDAQ:HIBB) Reports Sales Below Analyst Estimates In Q4 Earnings, Stock Drops 12.7%

Athletic apparel and footwear retailer Hibbett (NASDAQ:HIBB) missed analysts' expectations in Q4 FY2024, with revenue up 1.8% year on year to $466.6 million. It made a GAAP profit of $2.55 per share, down from its profit of $2.92 per share in the same quarter last year.

Is now the time to buy Hibbett? Find out by accessing our full research report, it's free.

Hibbett (HIBB) Q4 FY2024 Highlights:

Revenue: $466.6 million vs analyst estimates of $477.5 million (2.3% miss)

EPS: $2.55 vs analyst expectations of $2.56 (small miss)

EPS guidance for 2025: $8.38 at the midpoint vs analyst expectations of $8.82 (5.0% miss)

Gross Margin (GAAP): 34.5%, down from 35.2% in the same quarter last year

Same-Store Sales were down 6.4% year on year (miss)

Store Locations: 1,169 at quarter end, increasing by 36 over the last 12 months

Market Capitalization: $859.7 million

Mike Longo, President and Chief Executive Officer, stated, “We are pleased to report a solid financial performance for the fourth quarter of Fiscal 2024, as we continued to execute our strategy in a dynamic and challenging retail environment. Notably, we finished the year with $1.73 billion in sales, a new full fiscal year record for Hibbett. Our sales performance for the fourth quarter reflects the busy holiday selling season, which was in line with our expectations. During the quarter, we also benefited from new product launches and a favorable customer response for our popular footwear brands. The fourth quarter also benefited from our integrated Hibbett Rewards X Nike Membership, which brings together the Hibbett and Nike loyalty programs and supports sales growth across all retail channels. This loyalty partnership will provide exclusive shopping experiences, personalized content, and early access to the latest product launches for our Connected members.”

With a focus on small and mid-sized markets, Hibbett (NASDAQ:HIBB) is a specialty retailer that sells athletic apparel and footwear as well as select sports equipment.

Athletic Apparel and Footwear Retailer

Apparel and footwear was once a category thought to be relatively safe from major e-commerce penetration because of the need to try on, touch, and feel products, but the category is now meaningfully transacted online. Everyone still needs clothes and shoes to go outside unless they want some curious (or horrified) looks. But this ongoing digitization is forcing apparel and footwear retailers–that once only had brick-and-mortar stores–to respond with omnichannel offerings. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stagnate, so the evolution of clothing and shoes sellers marches on.

Sales Growth

Hibbett is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

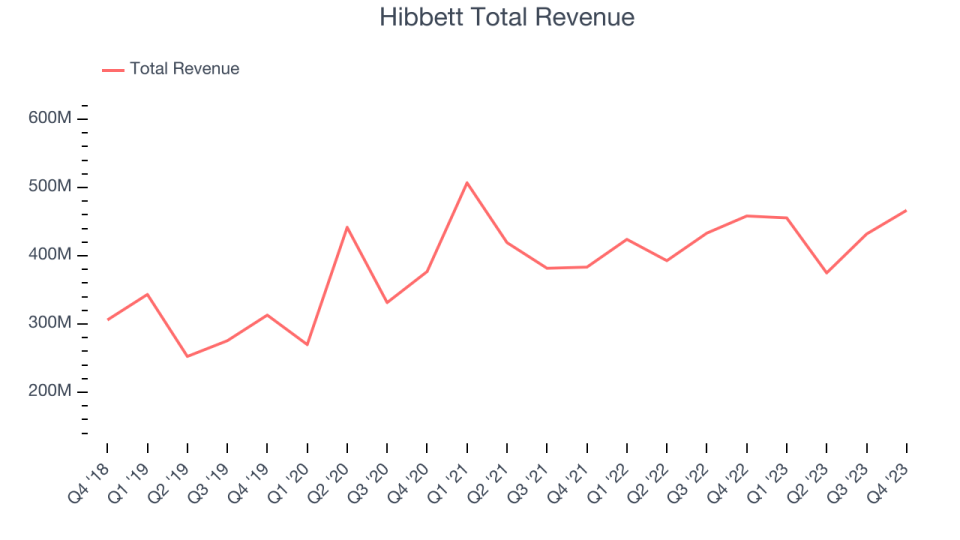

As you can see below, the company's annualized revenue growth rate of 9.9% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre as it opened new stores and expanded its reach.

This quarter, Hibbett's revenue grew 1.8% year on year to $466.6 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 4.4% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

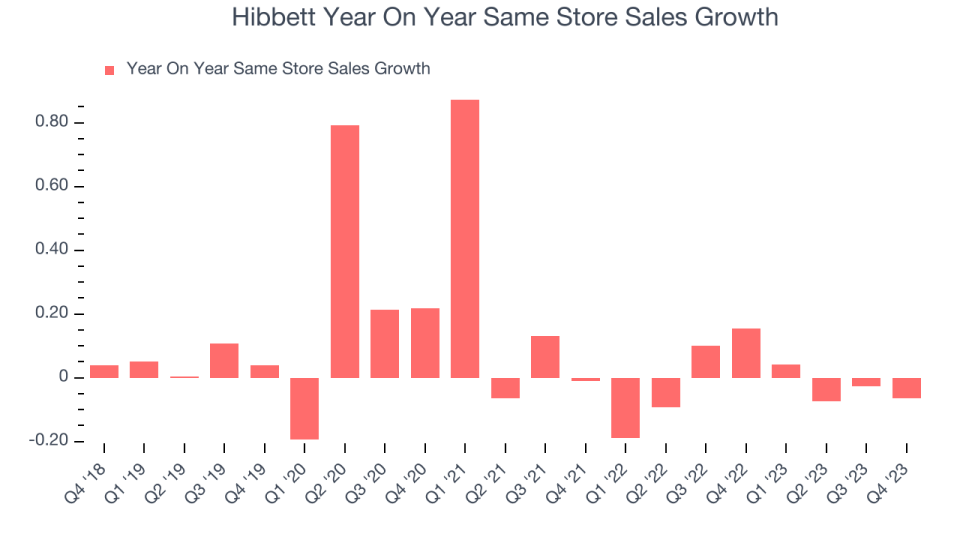

Hibbett's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 1.9% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Hibbett's same-store sales fell 6.4% year on year. This decline was a reversal from the 15.5% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Hibbett's Q4 Results

We struggled to find many strong positives in these results. Its same store sales, revenue, and EPS all missed Wall Street's estimates. To add insult to injury, the full year EPS guidance was well below expectations. Overall, the results could have been better. The company is down 12.7% on the results and currently trades at $64 per share.

Hibbett may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.