High Costs Ail Avery Dennison (AVY) Despite Strategic Actions

Avery Dennison Corporation AVY has been witnessing elevated costs of raw materials, labor and shipping, which is likely to persist this year. The company has also been facing lower volumes due to apparel inventory reductions.

However, the company’s restructuring activities and a disciplined capital allocation strategy are likely to partially offset these headwinds. Its focus on freeing up resources to invest further will likely drive margins.

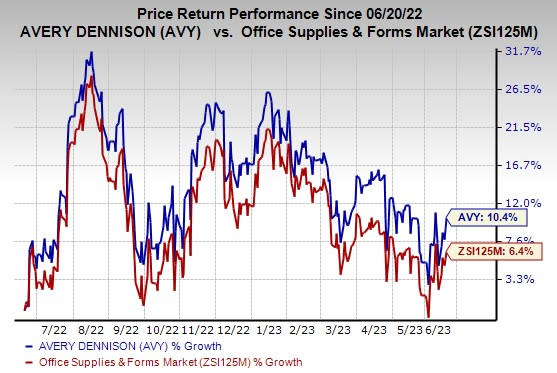

Shares of this Zacks Rank #4 (Sell) company have gained 10.4% in the past year compared with the industry’s growth of 6.4%.

Image Source: Zacks Investment Research

Elevated Costs & Supply-Chain Issues to Dent Margins

Avery Dennison is bearing the brunt of input cost inflation. Particularly, paper and energy costs are likely to be higher in the ongoing quarter. It expects inflation to continue to have an impact on its margins.

Strong demand and supply constraints continue to further push raw material, labor and freight costs. Avery Dennison has also been dealing with supply-chain challenges, which are likely to continue impacting its results. Currency translation is also likely to hurt its top-line growth.

Ongoing Apparel Inventory Reductions Act as Woes

In the first quarter of 2023, apparel inventory reductions were widespread across all segments, which led to a decline in volumes.

The company anticipates destocking to continue in the Materials Group segment in the coming quarters as retailers factor in high inventories, muted holiday performance and lower sentiment into their short-term sourcing plans.

Strong Segmental Performance to Aid Growth

Strong demand for consumer-packaged goods and e-commerce trends continues to drive the Materials group segment.

The segment is well-poised for profitable growth, driven by solid top-line growth, and continued margin expansion, volume improvement, growth in base business and high-value categories led by specialty labels.

Avery Dennison’s Solutions Group segment continues to benefit from solid margin expansions, driven by strength in high-value categories and the base business. The segment is witnessing strong volume growth in Intelligent Labels, RFID and the core apparel label business, with particular strength and performance in premium channels, as well as continued double-digit growth in external embellishments.

Strategic Actions Bode Well

Avery Dennison focuses on five overarching priorities — driving outsized growth in high-value product categories, growing profitability in base businesses, relentlessly pursuing productivity improvement, disciplined capital-management approach, and leading with environmentally and socially responsible practices and solutions.

It is executing long-term restructuring initiatives to enhance the company’s competitive position in the base business, freeing up resources to invest in high-value categories while supporting margins.

Stocks to Consider

Some better-ranked stocks from the Industrial Products sector are Hubbell Incorporated HUBB, The Manitowoc Company, Inc. MTW and W.W. Grainger, Inc. GWW. HUBB and MTW flaunt a Zacks Rank #1 (Strong Buy) at present, and GWW has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hubbell has an average trailing four-quarter earnings surprise of 21%. The Zacks Consensus Estimate for HUBB’s fiscal 2023 earnings is pegged at $13.81 per share. The consensus estimate for 2023 earnings has moved north by 22.5% in the past 60 days. Its shares gained 87% in the last year.

Manitowoc has an average trailing four-quarter earnings surprise of 38.8%. The Zacks Consensus Estimate for MTW’s 2023 earnings is pegged at 85 cents per share. The consensus estimate for 2023 earnings has moved 63.5% north in the past 60 days. MTW’s shares gained 66.8% in the last year.

The Zacks Consensus Estimate for Grainger’s 2023 earnings per share is pegged at $35.83. The estimate has moved up 7.6% in the past 60 days. It has a trailing four-quarter average earnings surprise of 9.1%. GWW gained 65.7% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

Avery Dennison Corporation (AVY) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Hubbell Inc (HUBB) : Free Stock Analysis Report