Will Higher Ad Revenues Aid Meta Platforms (META) Q3 Earnings?

Meta Platforms’ META third-quarter 2023 results, set to be reported on Oct 25, are expected to reflect the benefits of higher advertising revenues.

Our model estimate for third-quarter advertising revenues is pegged at $32.37 billion, indicating growth of 18.8% year over year.

In the second quarter of 2023, advertising revenues (99.3% of Family of Apps revenues) increased 11.9% year over year to $31.5 billion and accounted for 98.4% of revenues.

Meta Platforms’ focus on improving ad ranking and measurement by leveraging artificial intelligence (AI) has been a key catalyst, driving advertisers’ return on investment. The increasing level of automation supported by AI is expected to have driven adoption for its solutions like Advantage+ and Shopping. The introduction of new AI solutions like Meta Lattice and AI Sandbox are noteworthy in this regard.

Advertising revenues in Asia-Pacific are likely to grow 20.7% in the third quarter of 2023, per our model. United States and Canada advertising revenues are expected to grow 14.6%, while the Rest of the World is anticipated to increase 19.7% year over year, per our estimate.

The company’s plan to tackle ad targeting-related headwinds is expected to have positively impacted the ad-revenue growth rate in the to-be-reported quarter. It is worth mentioning that changes made by Apple AAPL and Google in their mobile operating systems and browser platforms have limited META’s ability to track the user-activity trend.

Apple’s iOS changes have made ad targeting difficult, which has increased the cost of driving outcomes. Measuring these outcomes has also become difficult, thereby hurting its ad revenue growth.

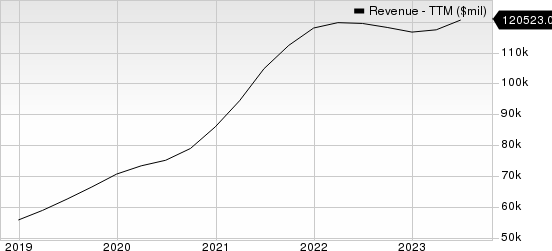

Meta Platforms, Inc. Revenue (TTM)

Meta Platforms, Inc. revenue-ttm | Meta Platforms, Inc. Quote

Click here to know how Meta Platforms’ overall third-quarter performance is likely to be.

AI, ML & Metaverse Driving Prospects

The company, which currently carries a Zacks Rank #3 (Hold), is banking its future on building the metaverse, which is a shared virtual 3D world or multiverse created using virtual and augmented reality.

Instagram’s growing popularity in international markets, particularly in Asia, has been helping the company expand its user base. Much of it can be attributed to the growing popularity of short-form videos, Reels on Instagram.

Reels have been attracting Gen-Z to the platform amid competition from Snapchat, Twitter and TikTok. AI has helped in improving recommendations, which drove a more than 24% increase in time spent on Instagram.

Threads growth has been noteworthy for Meta Platforms. The company has been focusing on the retention of users, which is expected to have benefited user growth.

To increase revenues, it has been growing video monetization, especially in short-form videos like Reels using AI and machine learning.

At the end of the second quarter, AI-recommended content from accounts that users don't follow became the fastest-growing category of content on Facebook’s feed, improving engagement by 7% since the introduction of this recommendation, which the company terms as Discovery Engine.

Reels is a key part of this Discovery Engine, and Reels plays exceed 200 billion per day across Facebook and Instagram.

Meta Platforms has also shown commitment to prioritizing user safety and well-being through initiatives aimed at enhancing parental supervision, messaging privacy and time management on its platforms. These factors are expected to have driven user base growth in third-quarter 2023.

Family Daily Active People or DAP, defined as a registered and logged-in user who visited at least one of the Family products (Facebook, Instagram, Messenger or WhatsApp) on a given day, is expected to be 3.081 billion, indicating growth of 5.2% year over year, per our model.

Family Monthly Active People or MAP is expected to increase 4.7% year over year to 3.884 billion, per our model.

What Do the Estimates Say?

The Zacks Consensus Estimate for third-quarter earnings is pegged at $3.57 per share, up 1.11% over the past 30 days. Meta Platforms had reported earnings of $1.64 per share in the year-ago quarter.

It expects total revenues between $32 billion and $34.5 billion for the third quarter of 2023. Favorable forex is expected to aid year-over-year top-line growth by roughly 3%.

The consensus estimate for third-quarter revenues is currently pegged at $33.43 billion, indicating growth of 20.62% from the figure reported in the year-ago quarter.

Upcoming Earnings to Watch For

Meta Platforms belongs to the Zacks Internet Software industry. Investors are eagerly waiting for the upcoming earnings of Pinterest PINS and Model N MODN, two top-ranked stocks in the same industry.

Pinterest and Model N sport a Zacks Rank #1 (Strong Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

While Pinterest is set to report its quarterly earnings on Oct 30, Model N is scheduled to report on Nov 9.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report