Will Higher Costs Affect HCA Healthcare's (HCA) Q2 Earnings?

HCA Healthcare, Inc. HCA is set to report its second-quarter 2023 results on Jul 27, before the opening bell.

What Do the Estimates Say?

The Zacks Consensus Estimate for second-quarter earnings per share of $4.28 suggests a 1.7% increase from the prior-year figure of $4.21. The consensus mark witnessed one upward estimate revision in the past month against no downward movement. The consensus estimate for second-quarter revenues of $15.6 billion indicates a 5.1% increase from the year-ago reported figure.

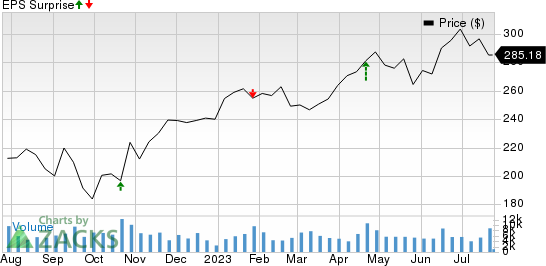

HCA Healthcare beat the consensus estimate for earnings in three of the prior four quarters and missed on one occasion, with the average surprise being 9%. This is depicted in the graph below:

HCA Healthcare, Inc. Price and EPS Surprise

HCA Healthcare, Inc. price-eps-surprise | HCA Healthcare, Inc. Quote

Before we get into what to expect in the to-be-reported quarter in detail, let’s see how the company performed in the last quarter.

Q1 Earnings Rewind

In the last reported quarter, the hospital company’s adjusted earnings per share of $4.93 beat the Zacks Consensus Estimate by 23.6%. The quarterly results gained on the back of expanding patient volumes and increased surgeries, which contribute a substantial amount to the top line of HCA Healthcare. However, the upside was partly offset by escalating salaries and benefits expenses.

Now let’s see how things have shaped up before the second-quarter earnings announcement.

Q2 Factors to Note

In the second quarter, HCA Healthcare’s revenues are expected to have gained on improved patient volumes. As seniors undergoing elective procedures, which were delayed due to pandemic-related constraints, increased in the second quarter, patient volumes, occupancy rate and other related metrics are expected to have increased for HCA.

Our estimate for equivalent admissions indicates a 3% rise from the prior-year quarter’s reported figure. We expect emergency room visits to have increased more than 10% year over year in the second quarter. Our estimate for the total number of hospitals is pegged at 182, flat from a year ago.

Our estimate for outpatient surgery cases suggests nearly 1% year-over-year growth in the quarter under review. We expect revenue per equivalent admission to have increased 0.5% from a year ago. Also, we expect inpatient surgery cases to jump almost 1% year-over-year.

Furthermore, our estimate for the occupancy rate is pegged at 71.1% for the second quarter, indicating an increase from the year-ago level of 67.4%. The above-mentioned factors are likely to have positioned the company for year-over-year growth. However, with increased occupancy levels, HCA’s costs and expenses are expected to have increased in the second quarter, partially offsetting the upside.

Our estimate for total operating expenses suggests a nearly 5% year-over-year increase due to higher supplies, salaries and benefits costs, affecting profit growth levels, making an earnings beat uncertain. We expect the cost of supplies to have increased more than 6% year-over-year in the quarter under discussion.

Also, our model predicts weighted average beds in service to have declined 0.2% year-over-year in the second quarter. We expect equivalent patient days to have witnessed a 1% year-over-year decrease.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for HCA Healthcare this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: The company has an Earnings ESP of -1.34%. This is because the Most Accurate Estimate currently stands at $4.22 per share, lower than the Zacks Consensus Estimate of $4.28.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: HCA Healthcare currently sports a Zacks Rank #1.

Stocks to Consider

While an earnings beat looks uncertain for HCA Healthcare, here are some companies from the broader medical space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

SI-BONE, Inc. SIBN has an Earnings ESP of +12.20% and is a Zacks #2 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for SI-BONE’s earnings per share for the to-be-reported quarter suggests an improvement of 24.1% from the year-ago period. SIBN beat earnings estimates thrice in the past four quarters and missed once, the average surprise being 11.1%.

AstraZeneca PLC AZN has an Earnings ESP of +1.88% and a Zacks Rank #3.

The Zacks Consensus Estimate for AstraZeneca’s bottom line for the to-be-reported quarter is pegged at 98 cents per share, signaling 14% year-over-year growth. AZN beat earnings estimates in all the past four quarters, the average surprise being 8.1%.

Community Health Systems, Inc. CYH has an Earnings ESP of +33.72% and is a Zacks #2 Ranked player.

The Zacks Consensus Estimate for Community Health’s bottom line for the to-be-reported quarter indicates an improvement of 88.5% from the year-ago period. The consensus mark for CYH’s revenues is pegged at more than $3 billion, signaling 2.9% year-over-year growth.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Community Health Systems, Inc. (CYH) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

SiBone (SIBN) : Free Stock Analysis Report