Will Higher Expense Ratio Hurt ProAssurance's (PRA) Q4 Earnings?

ProAssurance Corporation PRA is slated to report fourth-quarter 2023 earnings on Feb 27, after the closing bell. The company’s earnings missed estimates in the last reported quarter.

What Do the Estimates Say?

The Zacks Consensus Estimate for fourth-quarter earnings per share (EPS) of 4 cents indicates a 33.3% decrease from the year-ago quarter’s reported EPS of 6 cents. The consensus estimate has witnessed no movement in the past week.

The Zacks Consensus Estimate for fourth-quarter revenues is pegged at $279.5 million, suggesting a fall of 1.3% from the year-ago quarter’s reported figure.

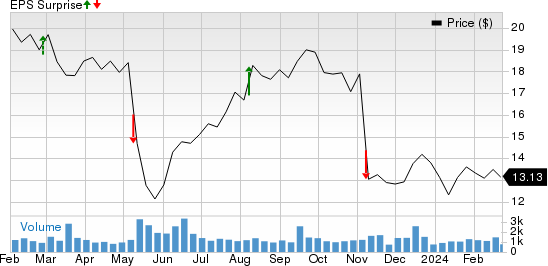

ProAssurance’s earnings beat estimates in two of the trailing four quarters, while it missed on the other occasions, the average being -56.7%.This is depicted in the graph below.

ProAssurance Corporation Price and EPS Surprise

ProAssurance Corporation price-eps-surprise | ProAssurance Corporation Quote

Before we get into what to expect for the to-be-reported quarter in detail, it is worth looking at PRA’s third-quarter performance.

Q3 Earnings Rewind

In the third quarter, this property and casualty insurance reported an adjusted operating loss of 7 cents per share against the Zacks Consensus Estimate of earnings of 15 cents per share. A decline in net premiums earned across its segments, feeble underwriting results, as well as an elevated expense level, hurt its performance. Nevertheless, the downside was partly offset by strong investment returns resulting from higher interest rates.

Now, let’s see how things have shaped up prior to the fourth-quarter earnings announcement.

Factors to Note

The Zacks Consensus Estimate for net premiums earned indicates a 5.4% year-over-year decline. Our estimate also suggests a year-over-year decline this time around. Competitive pressures and PRA’s re-underwriting efforts are likely to have affected the top line.

The consensus mark for the combined ratio is pegged at 111%, while our estimate predicts 109.4% compared with the year-ago level of 104%. A higher combined ratio suggests that the company has less premium left after claim settlements. This is expected to have positioned the company for a year-over-year decline, making earnings beat uncertain.

The bottom line of the company is likely to have suffered a setback due to escalating underwriting, policy acquisition and operating expenses and dividend expenses. Our estimate for the underwriting expense ratio suggests a 58 basis points deterioration from the year-ago figure to 30%.The company expects an increase in expense ratio in the upcoming quarters due to the timing of general expenses.

The consensus mark for Specialty P&C Segment revenues predicts a 1.5% decline from a year ago, while our estimate also suggests a year-over-year decline.This reflects the loss of business due to rate increases and highlights the company’s focus on walking away from businesses that are not adequately priced. Further, the Zacks Consensus Estimate for Workers’ Compensation Insurance revenues indicates a 2.2% year-over-year fall. Renewal rate is expected to decline year over year in the fourth quarter, driven by rate pressures to cover loss cost trends.

The negatives are expected to have been partially offset by higher investment income, thanks to the high-interest rate environment. The Zacks Consensus Estimate for net investment income indicates a 14.2% year-over-year increase, while our estimate also suggests year-over-year growth.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for ProAssurance this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here, as you will see below.

Earnings ESP: The company currently has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate currently is pegged at 4 cents per share, in line with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: ProAssurance currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

How Other Stocks Performed

Here are some companies from the broader Finance space that have already reported earnings for the December quarter: Aflac Incorporated AFL, Unum Group UNM and Lincoln National Corporation LNC.

Aflac reported fourth-quarter 2023 adjusted earnings of $1.25 per share, missing the Zacks Consensus Estimate by 15%. Higher benefits and claims, lower adjusted net investment income and declining profit levels from the U.S. businesses affected AFL’s earnings. However, improving profit levels in the Japan segment partially offset the negatives.

Unum Group’s fourth-quarter 2023 operating net income of $1.79 per share missed the Zacks Consensus Estimate by 3.8% due to higher policy benefits, commissions, interest and debt expenses and weaker performance in Unum International and Colonial Life. The negatives were partly offset by strong operations in the Unum U.S. unit.

Lincoln National reported fourth-quarter 2023 adjusted earnings of $1.45 per share, which outpaced the Zacks Consensus Estimate by 9.9% on the back of solid contributions from the Group Protection business, a strong fixed annuity business and positive flows in the Retirement Plan Services unit. However, the upside was partly offset by changes in market risk benefits.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

Unum Group (UNM) : Free Stock Analysis Report

ProAssurance Corporation (PRA) : Free Stock Analysis Report