Highly Ranked Semiconductor Stocks to Keep an Eye on in October

Earnings season is upon us again and one area of the broader technology sector that investors will be watching is the results from semiconductor companies.

While many semiconductor companies won’t report their quarterly results until November there will certainly be growing sentiment and observation after a number of stellar reports last quarter with Nvidia NVDA leading the way.

With Nvidia‘s stock sporting a Zacks Rank #1 (Strong Buy) since late May and now up more than +200% this year, we point to a few semiconductor stocks that were recently added to the strong buy list in October and look poised for more upside over the next month as well.

Image Source: Zacks Investment Research

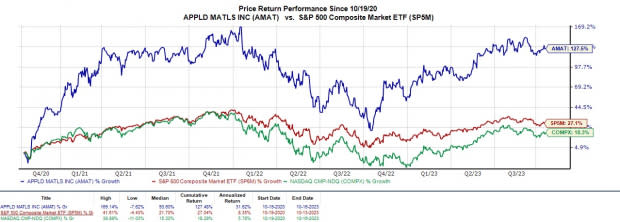

Applied Materials AMAT: Added to the strong buy list in early October, Applied Materials stock will be one to watch as the company is well-positioned to keep its reign as a global leader in supplying equipment for the fabrication of semiconductors.

Applied Materials will be releasing its fiscal fourth quarter results in mid-November and AMAT shares could very well rise leading up to the report. To that point, Applied Materials has surpassed top and bottom-line expectations in its last five quarterly reports, and over the last 60 days fiscal 2023 and FY24 earnings estimates have soared 7% and 13% respectively.

Image Source: Zacks Investment Research

Continuing to focus its strategy and investments on key technologies to accelerate the Internet of Things and AI era, AMAT shares have soared +45% this year and are up over +100% in the last three years to largely outperform the broader indexes.

Image Source: Zacks Investment Research

Qorvo QRVO: With its fiscal second quarter earnings a few weeks away on Wednesday, November 1, Qorvo’s stock got the nod as a Zacks Rank #1 (Strong Buy) this week.

Qorvo is a multinational semiconductor company that has become one of the leading providers of core technologies and radio frequency (RF) solutions for mobile, infrastructure, and aerospace applications. Leading up to its Q2 report, Qorvo has now surpassed earnings expectations for a remarkable 27 consecutive quarters and surpassed the Zacks Consensus for sales estimates in 30 straight quarterly reports.

Image Source: Zacks Investment Research

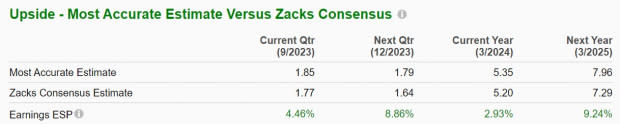

Plus, the Zacks Earnings ESP (Expected Surprise Prediction) indicates the steak of earnings beats could continue with the Most Accurate Estimate having Q2 EPS at $1.85 per share and 4% above the Zacks Consensus of $1.77 a share.

Image Source: Zacks Investment Research

Up a modest +2% year to date, Qorvo’s stock may be overlooked at the moment and trades at a reasonable 17.9X forward earnings multiple. Notably, Qorvo’s current fiscal 2024 and FY25 EPS estimates are nicely up over the last 30 days offering further support. Furthermore, annual earnings are now forecasted to dip -12% in FY24 after a tougher-to-compete-against year but rebound and soar 40% in FY25 at $7.29 per share.

Image Source: Zacks Investment Research

Bottom Line

The trend of rising earnings estimates is compelling for Applied Materials and Qorvo stock and now may be a great time to buy. This also makes their steaks of stellar quarterly results look more likely to continue and it would be no surprise if Applied Materials and Qorvo stock start to rise in October.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report