Hillenbrand (HI) Q4 Earnings Beat Estimates, Revenues Up Y/Y

Hillenbrand HI reported adjusted earnings per share (EPS) of $1.13 in fourth-quarter fiscal 2023 (ended Sep 30, 2023), beating the Zacks Consensus Estimate of $1.07. The bottom line improved 45% year over year, aided by acquisitions. Favorable pricing and productivity improvements in both of its segments also led to higher earnings in the quarter.

Hillenbrand’s quarterly revenues rose 26% year over year to $763 million. The Schenck Process Food and Performance Materials acquisition, which was completed on Sep 1, 2023, contributed $43 million to sales in the quarter under review.

Organic revenues decreased 1% year over year, as lower volume in the Molding Technology Solutions segment more than offset favorable pricing and higher volume in the Advanced Process Solutions segment.

Hillenbrand Inc Price, Consensus and EPS Surprise

Hillenbrand Inc price-consensus-eps-surprise-chart | Hillenbrand Inc Quote

Operational Update

The cost of sales climbed 23.3% year over year to $495 million. The gross profit rose 32% year over year to $267.5 million. The gross margin expanded to 35.1% in the quarter compared with the year-ago quarter’s 33.5%.

Operating expenses rose 38% year over year to $153 million. Adjusted EBITDA increased 33% from the year-ago quarter to $147 million. Favorable pricing, productivity improvements and lower variable compensation helped offset the impact of higher costs and low volumes at the Molding Technology Solutions segment. Adjusted EBITDA margin was 19.3% in the fourth quarter of fiscal 2023, which marked a 90 basis point expansion from the year-ago quarter.

Segment Performances

Revenues for the Advanced Process Solutions segment in the quarter under review were $516 million. The 57% year-over-year increase was mainly attributed to acquisitions. Organic revenues increased 7% year over year on favorable pricing and higher aftermarket parts and service revenues. The segment’s backlog, as of fiscal 2023 end, was $1.9 billion.

Adjusted EBITDA of $118 million increased 72% year over year, or 23% organically. Favorable pricing, productivity improvements, high volume, favorable mix and lower variable compensation were partially offset by elevated costs. Adjusted EBITDA margin in the reported quarter was 22.8%, which increased 190 basis points from the fourth quarter of fiscal 2022.

The Molding Technology Solutions segment’s revenues were $247 million, which decreased 10% year over year due to lower hot runner and injection molding equipment sales. The segment’s backlog was $233 million at the end of fiscal 2023, which was down 36% compared with the prior fiscal year’s end.

Adjusted EBITDA for the segment was $46 million, which declined 23% year over year, as lower volume, cost inflation and unfavorable product mix were partially offset by productivity improvements, lower variable compensation and favorable pricing. Adjusted EBITDA margin was 18.5%, which marked a 310-basis points year-over-year contraction.

Financial Position

The company had cash and cash equivalents of $250 million at the end of fiscal 2023, up from $238 million at the fiscal 2022-end. Cash flow from operating activities was $207 million in fiscal 2023 compared with $63 million in the last fiscal year. Hillenbrand returned $61 million to shareholders through dividends.

HI’s net-term debt was $1,767 million as of Sep 30, 2023 compared with $2,284 million as of Dec 31, 2022. Liquidity was around $718 million, including $243 million in cash on hand and the remainder available under its revolving credit facility.

Fiscal 2023 Performance

Hillenbrand’s adjusted EPS improved 31% year over year to $3.52 in fiscal 2023, beating the Zacks Consensus Estimate of $3.45. Including one-time items, earnings in fiscal 2023 were $1.53 compared with $1.51 in fiscal 2022. Revenues rose 26% year over year to $2.83 billion, driven by acquisitions.

Fiscal 2024 Outlook

The company expects revenues to be in the range of $3.28-$3.44 billion, which suggests year-over-year growth of 16-22%. Adjusted EBITDA is expected to be between $530-$588 million in fiscal 2024. The range suggests growth in the range of 10% to 22% from fiscal 2022 levels.

HI expects adjusted EPS between $3.60 and $3.95 for fiscal 2024. Compared to the adjusted earnings per share of $3.52 in fiscal 2023, the guidance suggests year-over-year growth of 2-12%.

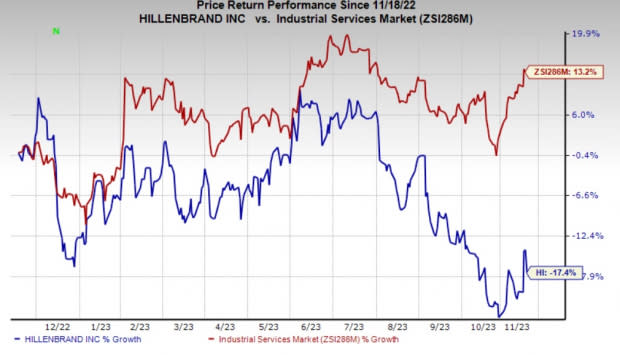

Price Performance

In the past year, Hillenbrand’s shares have declined 17.4% against the industry’s growth of 13.2%.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

Hillenbrand currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Alamo Group ALG, Flowserve FLS and A. O. Smith AOS. ALG and FLS sport a Zacks Rank #1 (Strong Buy) each at present, while AOS has a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Alamo has an average trailing four-quarter earnings surprise of 19.8%. The Zacks Consensus Estimate for ALG’s fiscal 2023 earnings is pegged at $11.59 per share, which indicates year-over-year growth of 34.5%. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. Its shares have gained 24% in the past year.

The Zacks Consensus Estimate for Flowserve’s fiscal 2023 earnings per share is pinned at $2.01, indicating growth of 83% from the prior-year actual. Earnings estimates have moved 2% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 27.3%. FLS shares have gained 20% in the past year.

A. O. Smith has an average trailing four-quarter earnings surprise of 14%. The Zacks Consensus Estimate for AOS’ 2023 earnings is pegged at $3.75 per share. The estimate projects year-over-year growth of 19.4%. Earnings estimates have gone up 4.5% in the past 60 days. AOS shares have gained 23% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Hillenbrand Inc (HI) : Free Stock Analysis Report