Hillenbrand Inc (HI) Faces Organic Revenue Decline Despite Overall Growth in Q1 2024

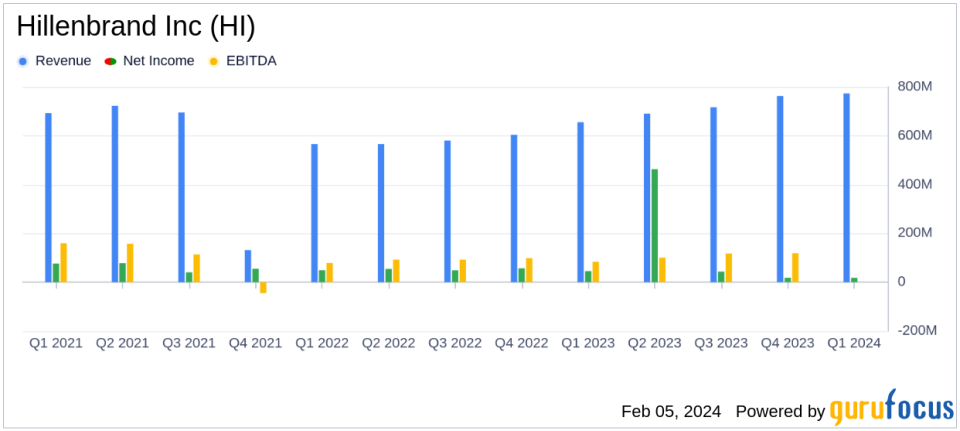

Revenue: Reported $773 million, an 18% increase, with organic revenue down by 7%.

GAAP EPS: Decreased to $0.25 from $0.35 in the prior year; adjusted EPS at $0.69, a slight 1% decrease.

Backlog: Grew to $2.15 billion, marking a 10% increase over the previous year.

Cost Savings: Announced a restructuring program in the Molding Technology Solutions segment to save $15 million annually.

Fiscal 2024 Outlook: Maintains adjusted EPS guidance of $3.60 - $3.95; Q2 adjusted EPS forecasted at $0.71 to $0.76.

On February 5, 2024, Hillenbrand Inc (NYSE:HI) released its 8-K filing, detailing the fiscal first quarter 2024 results. Hillenbrand, a global industrial company, operates through segments including Advanced Process Solutions, Molding Technology Solutions, and Batesville. The company's diverse portfolio serves markets such as durable plastics, food, and recycling.

The reported revenue increase was primarily attributed to acquisitions, while organic revenue, which excludes the impacts of acquisitions and foreign currency exchange, saw a decrease. This decline in organic revenue was due to lower capital volume, which overshadowed favorable pricing and aftermarket parts and service revenue growth.

Net income for the quarter stood at $18 million, or $0.25 per share, a decrease from the previous year's $0.35 per share. Adjusted net income resulted in $0.69 per share, a marginal 1% decrease. The adjusted effective tax rate for the quarter rose to 28.6%, up 360 basis points from the prior year, primarily due to a non-repeating discrete tax benefit.

Adjusted EBITDA of $114 million marked a 13% year-over-year increase, but on an organic basis, it decreased by 14%. The adjusted EBITDA margin fell by 60 basis points to 14.8%, mainly due to cost inflation.

In response to the challenges faced, particularly in the Molding Technology Solutions segment, Hillenbrand is implementing a cost savings and restructuring program expected to yield annual savings of approximately $15 million. President and CEO Kim Ryan stated:

"Given the sustained demand softness within the Molding Technologies Solutions segment, were executing additional cost savings actions, including structural changes... Were not satisfied with the current performance, and were confident these actions will help optimize our cost structure as we manage through the current demand environment."

The company's operating cash flow represented a use of cash of $24 million in the quarter, an increase from the prior year, primarily due to lower earnings and the timing of working capital requirements. Hillenbrand's net debt was approximately $1,843 million, with a net debt to pro forma adjusted EBITDA ratio of 3.4x. Liquidity was about $647 million.

Looking ahead, Hillenbrand is maintaining its fiscal 2024 outlook, with an adjusted EPS range of $3.60 to $3.95. The company expects to achieve its preferred net leverage range of 1.7x to 2.7x by Q2 fiscal 2025, a slight delay from the previous goal of Q1 fiscal 2025.

Hillenbrand's financial statements on Form 10-Q are expected to be filed jointly with this release and will be made available on the companys website.

For value investors, Hillenbrand's commitment to cost savings and operational efficiency, despite the organic revenue decline, may present a long-term opportunity as the company navigates through current market challenges and positions itself for future growth.

Explore the complete 8-K earnings release (here) from Hillenbrand Inc for further details.

This article first appeared on GuruFocus.