Hilton Grand Vacations Inc. (HGV) Navigates Challenges to Deliver Solid Year-End Results

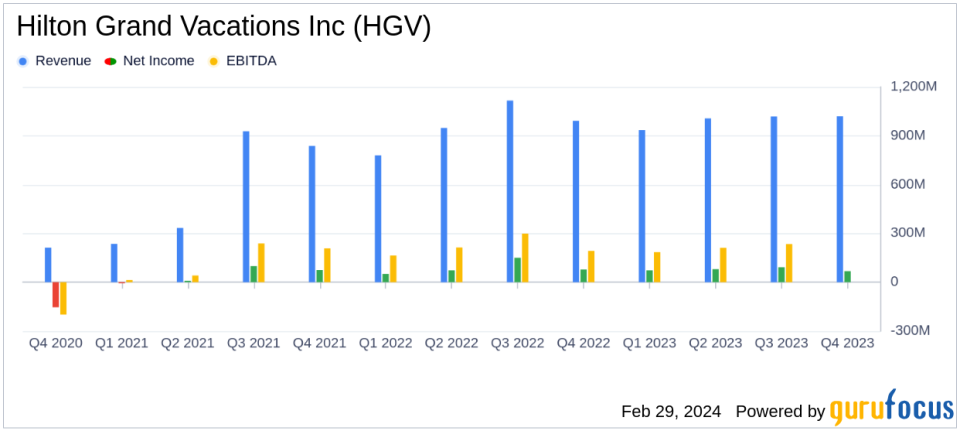

Total Revenues: $1,019 million in Q4 2023, up from $992 million in Q4 2022.

Net Income: $68 million in Q4 2023, down from $78 million in Q4 2022.

Diluted EPS: $0.62 in Q4 2023, compared to $0.67 in Q4 2022.

Adjusted EBITDA: $270 million in Q4 2023, an increase from $252 million in Q4 2022.

Member Count: Reached 529,000 with a Consolidated Net Owner Growth (NOG) of 2.0% for the year.

Stock Repurchase: Repurchased 2.7 million shares for $99 million during the quarter.

Full-Year 2024 Outlook: Adjusted EBITDA expected to be between $1.2 billion and $1.26 billion.

On February 29, 2024, Hilton Grand Vacations Inc (NYSE:HGV), a leading timeshare company, released its 8-K filing, detailing the fourth quarter and full-year 2023 results. The company, known for its high-quality vacation ownership resorts, operates primarily through its Real Estate Sales and Financing, and Resort Operations and Club Management segments, with the latter being the major revenue contributor.

HGV's performance in the fourth quarter showed resilience amidst challenges, including the Maui wildfires and a temporary sales system outage. Total contract sales were $572 million, impacted by approximately $40 million due to these events. Despite these headwinds, the company managed to increase its total revenues to $1,019 million for the quarter, up from $992 million in the same period last year. However, net income saw a decline to $68 million from $78 million in Q4 2022, with adjusted net income also falling slightly to $111 million from $118 million.

The diluted EPS for the quarter stood at $0.62, a decrease from $0.67 in the prior year, while adjusted diluted EPS remained stable at $1.01. Adjusted EBITDA for the quarter rose to $270 million from $252 million in Q4 2022, reflecting a solid margin performance despite the $21 million impact from the Maui wildfires and sales system issues.

HGV's financial achievements, particularly the growth in adjusted EBITDA, underscore the company's ability to manage operational efficiency and profitability in the Travel & Leisure industry, even in the face of external challenges. The company's focus on delivering EBITDA and cash flow growth is crucial for sustaining its market position and delivering value to shareholders.

Financial Highlights and Segment Performance

The Real Estate Sales and Financing segment experienced a slight decrease in revenues to $591 million, with adjusted EBITDA for the segment at $191 million. The Resort Operations and Club Management segment, however, saw an increase in revenue to $347 million and adjusted EBITDA to $146 million, driven by an expanding member base and robust rental performance.

HGV's balance sheet remains strong with total cash and cash equivalents of $589 million and a solid liquidity position. The company's net leverage on a trailing 12-month basis was approximately 2.44x as of December 31, 2023.

Looking ahead, HGV anticipates a full-year 2024 Adjusted EBITDA excluding deferrals and recognitions to be in the range of $1.2 billion to $1.26 billion. This outlook includes the operations of Bluegreen Vacations and expected synergies from the recent acquisition, which is set to enhance cash flow and recurring EBITDA through increased scale and diversification.

Management's Perspective

"We closed out the year on a positive note, with a solid margin performance enabling us to deliver annual adjusted EBITDA slightly ahead of our revised guidance," said Mark Wang, president and CEO of Hilton Grand Vacations. "Looking back at 2023, we generated strong tour growth and navigated several challenges through the year to deliver solid adjusted free cash flow, enabling us to return significant cash to shareholders as well as to capitalize on the opportunity to acquire Bluegreen Vacations. Were very excited about this transaction, which will enhance our cash flow and recurring EBITDA through increased scale and diversification, while providing us new avenues for growth with our strategic partners and reinforcing our position as the premier vacation ownership and experiences company. Our focus for the coming year will be on engaging with our teams, members, and partners to ensure a smooth integration of Bluegreen, along with enhancing the efficiency of our tour flow to deliver EBITDA and cash flow growth."

As HGV moves forward with its strategic initiatives, including the integration of Bluegreen Vacations, investors and stakeholders can anticipate a continued emphasis on operational excellence and growth in the vacation ownership and experiences sector.

Explore the complete 8-K earnings release (here) from Hilton Grand Vacations Inc for further details.

This article first appeared on GuruFocus.