Can Hilton (HLT) Stock Keep the Bull Run Alive in 2024?

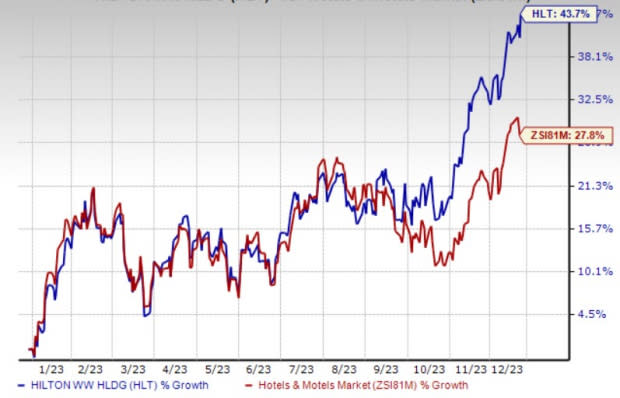

Hilton Worldwide Holdings Inc. HLT experienced a phenomenal 2023, as reflected in its stock performance. Year to date, the company's shares have gained 43.7%, outpacing the industry's and S&P 500's 27.8% and 23.1% growth, respectively. Improving RevPAR, occupancy and ADR continues to drive its performance.

The question lingering in investors’ minds now is whether HLT will be able to repeat its performance in 2024. In the past 60 days, earnings estimates for 2024 have witnessed upward revisions of 2.2% to $6.98. In 2024, HLT’s earnings and sales are likely to witness growth of 14.9% and 7.9% year over year, respectively.

Let’s delve deeper.

Growth Catalysts

The Zacks Rank #3 (Hold) company continues to witness substantial RevPAR gains in Europe, the Middle East and Africa region owing to strong leisure demand and recovery in international inbound travel. Management anticipates the momentum to persist for some time.

In a bid to maintain its position as the fastest-growing global hospitality company, Hilton is continuing to drive unit growth. During third-quarter 2023, it opened 107 new hotels. Room additions during the quarter totaled nearly 16,000, reflecting a rise of 22% year over year and 12% on a sequential basis. As of Sep 30, 2023, Hilton's development pipeline comprised nearly 3,190 hotels, with almost 457,300 rooms across 119 countries and territories, including 29 countries and territories where it currently has no running hotels. HLT’s expansion efforts will continue to drive growth in 2024.

Moreover, the company will continue to benefit from its robust loyalty program. With membership levels increasing 19% on a year-over-year basis (as of third-quarter 2023), it continues to outline opportunities to engage its Honors members through enhanced partnerships and points redemption offerings. Management intends to focus on new opportunities to drive customer engagement to reach pre-pandemic levels.

Hilton has transformed into a capital-light operating business backed by the spin-offs of a portfolio of hotels and resorts as well as its timeshare business. Post-spinoff, the company expects to be a resilient, fee-driven business with disciplined strategies. In fact, the focus is expected to be on growing market share, units and free cash flow per share as well as preserving its strong balance sheet and accelerating return of capital. Furthermore, as third parties mostly finance Hilton’s unit growth, it is capable of generating substantial returns on minimal capital investment.

Image Source: Zacks Investment Research

Concerns

The company’s operations are pursuant to uncertainties in financial markets on account of liquidity constraints. Financing conditions in certain regions have been challenging due to a rise in interest rates. Management is cautious in this regard as further challenges pave the path for the inability to access cash and the threat of new financing arrangements.

Key Picks

Some better-ranked stocks in the Zacks Consumer Discretionary sector are:

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank #1 (Strong Buy). RCL has a trailing four-quarter earnings surprise of 28.3% on average. Shares of RCL have surged 138% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates a rise of 57.7% and 187.9%, respectively, from the year-ago levels.

Live Nation Entertainment, Inc. LYV flaunts a Zacks Rank #1 at present. It has a trailing four-quarter earnings surprise of 37.5% on average. Shares of LYV have gained 36% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS suggests a jump of 29.5% and 132.8%, respectively, from the prior-year numbers.

JAKKS Pacific, Inc. JAKK currently sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 61.8% on average. Shares of JAKK have climbed 121.4% in the past year.

The Zacks Consensus Estimate for JAKK’s 2024 sales implies an improvement of 3.6% from the year-earlier figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

JAKKS Pacific, Inc. (JAKK) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report