Hims & Hers Health Surges 30% After Earnings. Here Is Why the Stock Is Still a Magnificent Buy.

Shares of direct-to-consumer telehealth business Hims & Hers Health (NYSE: HIMS) are up 30% since the company reported its Q4 earnings. The little-known $2 billion company is grabbing investors' attention with eye-popping growth and rapidly improving financials.

It often feels like you've missed the boat when you sit there reading about another stock that got hot before you realized what was happening, but you haven't -- Hims & Hers is still a magnificent buy for long-term investors today.

I'll detail why the company's performance is no fluke, and why investors can confidently buy this potential future multibagger.

Building its business around five core market opportunities

Hims & Hers is a telehealth business that works directly with patients rather than forcing them to go through insurance. The company started with taboo conditions for men like erectile dysfunction and hair loss, but has vastly expanded to what CEO Andrew Dudum outlined in the company's Q4 shareholder letter as five core specialties:

Sexual Health

Men's Dermatology

Women's Dermatology

Mental Health

Weight Loss

These are all substantial markets. The obesity rate in America is 40% among adults, and investors may have seen how hot weight loss drugs like Ozempic have become. The great thing about Hims & Hers is that the business can personalize treatments to the individual patient and then prescribe them in user-friendly forms. For example, men can take medicated breath mints to treat erectile dysfunction.

The growth validates the business model

A 30% stock move will grab your attention, but Hims & Hers has been putting up eye-popping growth ever since going public back in 2021. The company has roughly tripled its subscriber base to over 1.5 million over the past three years, and revenue growth has been similarly dynamic.

Patients find Hims & Hers' total brand experience attractive. You can seek a consultation or treatment on the company's website or smartphone app. The Hims app is currently ranked 12th in the medical category on the App Store and has over 28,000 reviews, averaging 4.8 stars out of five.

Competition has always been a concern for Hims & Hers. Management included data in its Q4 shareholder letter that shows the company is the one taking market share, not the other way around:

Hims & Hers must continue to execute, but the evidence supports the idea that the company has established a winning formula, and continuing it could fuel excellent long-term growth. Every adult is a potential customer when discussing healthcare, and Hims & Hers' 1.5 million patient base is just a fraction of the population in the U.S. alone. Management estimates each specialty focus is a market of between 80 million to 100 million U.S. adults.

Hyper-speed earnings growth potential at a low price

The fourth quarter was Hims & Hers' first with positive GAAP profit, a significant milestone for any business. Management didn't issue earnings guidance for 2024 (guiding on EBITDA instead) but did indicate that GAAP net income is here to stay.

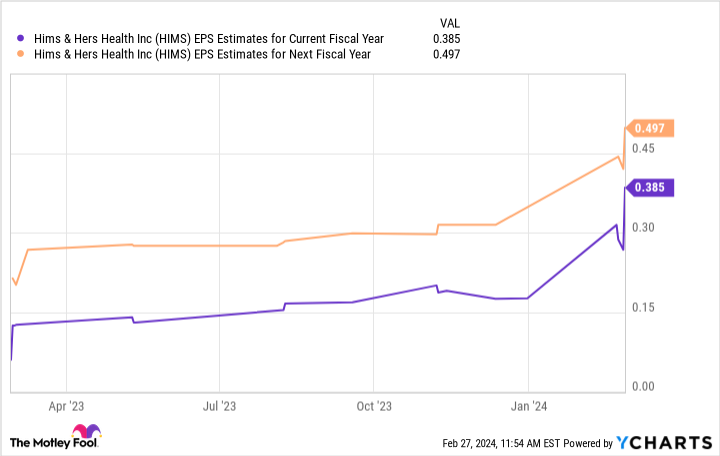

Analysts have begun to raise their estimates for this year based on these recent developments:

Even after its surge, the stock trades at approximately 35 times its estimated 2024 earnings. Management is guiding for $1.2 billion in revenue this year, a 38% increase over 2023. First, the company's 2023 revenue grew 65% year over year in 2023 after initially guiding for 43%. It's possible that management is guiding conservatively, and actual performance exceeds this. That could mean that earnings estimates are also aiming low.

Second, next year's estimates call for earnings per share of $0.50, a 31% increase. That would be fine, but it doesn't seem to give much credit to Hims & Hers' newly realized operating leverage. In other words, earnings grow the fastest right after a business turns profitable because all that momentum of revenue outrunning costs carries over.

The bottom line? The stock is a bargain if you apply the current 31% earnings growth rate against Hims & Hers' P/E ratio of 35. That's a PEG ratio of just over one, meaning it's a great value. The potential to outperform again could mean even better actual performance moving forward. That makes Hims & Hers a magnificent long-term growth stock to buy and hold.

Should you invest $1,000 in Hims & Hers Health right now?

Before you buy stock in Hims & Hers Health, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Hims & Hers Health wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Justin Pope has positions in Hims & Hers Health. The Motley Fool has positions in and recommends Teladoc Health. The Motley Fool has a disclosure policy.

Hims & Hers Health Surges 30% After Earnings. Here Is Why the Stock Is Still a Magnificent Buy. was originally published by The Motley Fool