HMN Financial Inc. Reports Decreased Earnings in Q4 and Full Year 2023, Declares Dividend

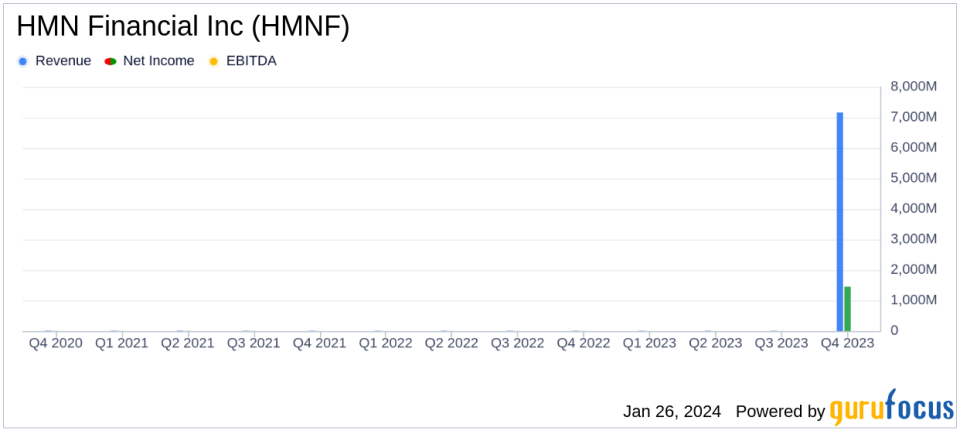

Net Income: Q4 net income fell to $1.45 million from $2.44 million in Q4 2022; annual net income decreased to $6.0 million from $8.04 million in 2022.

Diluted EPS: Earnings per share for Q4 declined to $0.33 from $0.56 in the same quarter last year; annual EPS dropped to $1.37 from $1.83.

Net Interest Margin: Q4 net interest margin decreased by 77 basis points to 2.58%; annual net interest margin fell by 30 basis points to 2.84%.

Provision for Credit Losses: Q4 provision remained stable at $0.1 million; annual provision decreased by $0.4 million to $0.7 million.

Dividend: A quarterly dividend of $0.08 per share declared, payable on March 6, 2024.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On January 25, 2024, HMN Financial Inc (NASDAQ:HMNF), the holding company for Home Federal Savings Bank, released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company reported a decrease in net income for both the quarter and the year, citing challenges in maintaining net interest income due to increased funding costs.

Company Overview

HMN Financial Inc is a stock savings bank holding company for Home Federal Savings Bank, which operates retail banking and loan production facilities in Minnesota, Iowa, and Wisconsin. The bank's business includes attracting deposits and originating various loans, while also investing in mortgage-backed securities, U.S. government agency obligations, and other permissible investments. It offers a range of products and services, such as checking and savings accounts, online services, and credit cards.

Financial Performance and Challenges

Bradley Krehbiel, President and CEO of HMN, acknowledged the difficulties in maintaining net interest income as deposit and funding costs increased more rapidly than the rates on interest-earning assets. However, he expressed optimism about the stabilization of deposit balances and interest rates observed in the fourth quarter. Krehbiel anticipates that net interest margin compression will slow as deposit costs stabilize and earning assets reprice to current market rates.

The company's net interest income for Q4 2023 was $7.2 million, a decrease of 19.7% from Q4 2022. This was primarily due to a decrease in net interest margin resulting from increased funding costs, despite a $1.5 million increase in interest income attributed to a rise in average interest-earning assets and yields. Interest expense for Q4 2023 surged by 303.8% due to higher average interest rates paid on liabilities and an increase in brokered deposits and certificates of deposit used as funding sources.

Non-interest income for Q4 2023 increased by 13.0% to $2.2 million, with gains in loan sales and commissions from the sale of uninsured investment products. Non-interest expense saw a slight decrease of 0.7% to $7.3 million for the quarter, with reductions in occupancy, equipment, and professional services expenses.

Annual Results and Dividend Announcement

For the full year 2023, HMN Financial Inc reported a net income of $6.0 million, a 25.4% decrease from 2022. The annual net interest income decreased by 4.6% to $30.8 million, and the net interest margin fell by 30 basis points to 2.84%. The provision for credit losses for the year was $0.7 million, a decrease from the previous year's $1.1 million. Non-interest income for the year decreased by 6.8% to $8.3 million, while non-interest expense increased by 3.4% to $29.8 million.

The Board of Directors declared a quarterly dividend of $0.08 per share, underscoring the company's commitment to providing shareholder value despite the challenging interest rate environment.

Outlook and Strategic Focus

HMN Financial Inc is focused on profitably growing the company and improving net interest income in the new year. The bank's strategic efforts will be directed towards managing the impact of market interest rates on its operations and maintaining a strong capital position to support its growth objectives.

The company's full financial statements and additional details can be found in the 8-K filing.

Explore the complete 8-K earnings release (here) from HMN Financial Inc for further details.

This article first appeared on GuruFocus.