HNI Corp (HNI) Reports Earnings Growth and Margin Expansion in Q4 and Full Year 2023

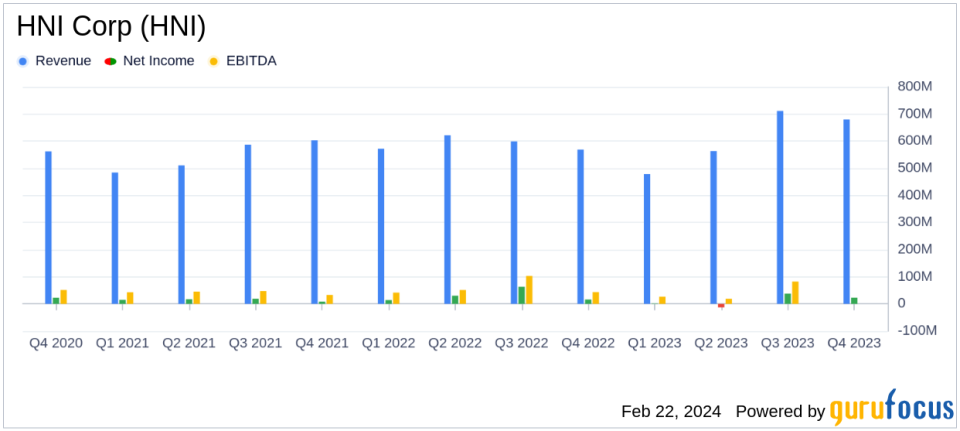

Net Sales: Full year net sales increased to $2.434 billion, up 3.1% from the previous year.

Net Income: Reported net income of $49.2 million for the full year, with a significant increase in fourth-quarter earnings.

Earnings Per Share (EPS): GAAP EPS for the full year was $1.09, while non-GAAP EPS was $2.65, reflecting a 20.5% increase from the previous year.

Operating Income: Fourth-quarter operating income grew by 33.6% to $30.7 million, with a full year increase of 38.8% to $178.1 million on a non-GAAP basis.

Gross Margin: Gross profit margin expanded by 360 basis points for the full year, indicating improved profitability.

Debt Reduction: Reduced total debt by $162 million during the second half of 2023, ending the year with a gross leverage ratio of 1.9x.

Kimball International Acquisition: The acquisition added approximately $16 million to fourth-quarter operating profit and is expected to contribute $215 to $225 million in incremental revenue for 2024.

On February 22, 2024, HNI Corp (NYSE:HNI) released its 8-K filing, detailing its financial results for the fourth quarter and full fiscal year of 2023. The company, a leading provider of office furniture and hearth products, reported a year-over-year increase in fourth-quarter sales by 19 percent to $679.8 million, and a full-year sales increase of 3.1 percent to $2.434 billion. Despite a challenging macroeconomic environment, HNI demonstrated resilience with a net income of $49.2 million for the year and a notable increase in fourth-quarter net income to $22.7 million.

Performance and Financial Highlights

HNI's performance in the fourth quarter was marked by strong earnings growth, with GAAP earnings per share increasing by 23 percent year-over-year. The non-GAAP diluted earnings per share saw a significant rise of 56 percent compared to the fourth quarter of the previous fiscal year. This growth was achieved despite a 6.4 percent year-over-year organic revenue decline, highlighting the company's ability to enhance profitability through margin expansion and cost control measures.

The Workplace Furnishings segment saw a substantial margin expansion, with GAAP operating margin growing by 410 basis points year-over-year. The non-GAAP operating profit margin for legacy HNI workplace furnishings increased by 480 basis points, driven by price-cost improvement, productivity gains, and recent cost savings initiatives.

Kimball International, acquired by HNI, proved to be solidly accretive to the company's earnings, contributing approximately $16 million to the fourth-quarter operating profit and adding an estimated $0.07 to the non-GAAP EPS. HNI now expects to achieve total annual cost synergies of $35 million from the acquisition, surpassing the initial projection of at least $25 million.

The Residential Building Products segment also showed resilience, with GAAP operating margin expanding by 310 basis points year-over-year to 22.3 percent, despite a 13.1 percent year-over-year revenue decline due to continued housing market weakness.

HNI's balance sheet was further strengthened as the company reduced its debt by $73 million in the fourth quarter, resulting in a gross leverage ratio of 1.9x. This positions the company well for future growth and capital deployment opportunities.

Outlook and Strategic Direction

Looking ahead to 2024, HNI anticipates non-GAAP earnings per share to increase year-over-year, primarily driven by continued margin expansion in Workplace Furnishings and accretion from Kimball International. The company expects organic revenue growth at a low-single-digit rate in both segments, assuming demand conditions remain generally in-line with those experienced in the second half of 2023.

Jeff Lorenger, Chairman, President, and Chief Executive Officer of HNI, expressed confidence in the company's strategic direction, citing the profit transformation initiatives and the Kimball International acquisition as key drivers of margin expansion and operating profit growth. He also highlighted the company's quick response to the housing market reset in 2023 and the strong positioning of the Residential Building Products segment for high-margin growth as the market stabilizes.

HNI's solid financial performance, strategic acquisitions, and effective cost management have positioned the company for sustained growth and profitability. Investors and stakeholders can look forward to HNI's continued execution of its strategies and capital deployment in the coming year.

For more detailed information on HNI Corp's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from HNI Corp for further details.

This article first appeared on GuruFocus.