Ho Bee Land's (SGX:H13) Dividend Is Being Reduced To SGD0.03

Ho Bee Land Limited's (SGX:H13) dividend is being reduced from last year's payment covering the same period to SGD0.03 on the 24th of May. This means that the dividend yield is 1.8%, which is a bit low when comparing to other companies in the industry.

View our latest analysis for Ho Bee Land

Ho Bee Land Might Find It Hard To Continue The Dividend

If it is predictable over a long period, even low dividend yields can be attractive. While Ho Bee Land is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. This gives us some comfort about the level of the dividend payments.

Over the next year, EPS might fall by 29.9% based on recent performance. This means that the company won't turn a profit over the next year, but with healthy cash flows at the moment the dividend could still be okay to continue.

Dividend Volatility

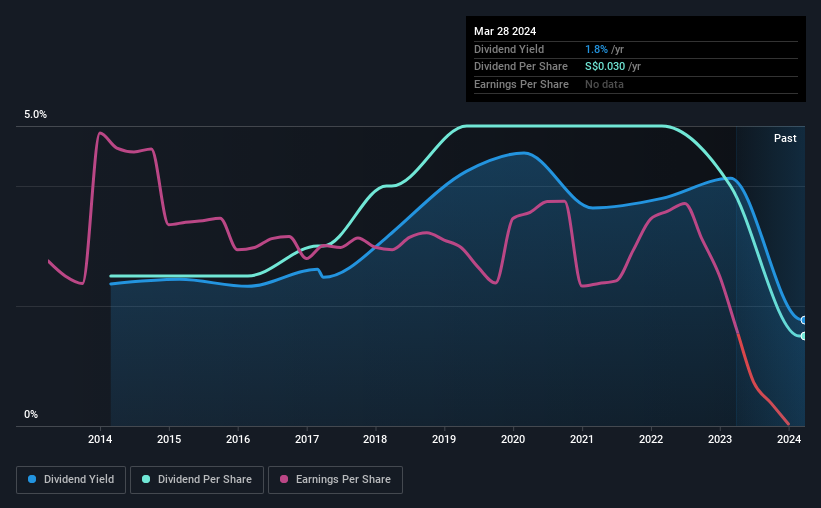

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was SGD0.05 in 2014, and the most recent fiscal year payment was SGD0.03. Doing the maths, this is a decline of about 5.0% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Ho Bee Land's EPS has fallen by approximately 30% per year during the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

Ho Bee Land's Dividend Doesn't Look Sustainable

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 2 warning signs for Ho Bee Land that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.