Hologic's (HOLX) Q4 Earnings Beat Estimates, Gross Margin Down

Hologic, Inc. HOLX reported adjusted earnings per share (EPS) of 89 cents in fourth-quarter fiscal 2023, up 8.5% year over year. The bottom line surpassed the Zacks Consensus Estimate by 4.7%.

The adjustments include charges and benefits related to the amortization of acquired intangible assets, restructuring and integration/consolidation costs, product line discontinuation and many others.

The company’s GAAP EPS were 37 cents in the quarter compared with the year-ago quarter’s EPS of 47 cents, down 27%.

Full year fiscal 2023 adjusted EPS was $3.96, down 34.2% from fiscal 2022 levels.

Revenues in Detail

Revenues totaled $945.3 million in the said quarter, down 0.8% year over year (down 1.5% at the constant exchange rate or CER). The metric surpassed the Zacks Consensus Estimate by 0.4%. Lower sales of COVID-19 assays dragged the top line.

Fiscal 2023 revenues were $4.03 billion, down 17.1% from fiscal 2022 levels.

Segments in Detail

In the fiscal fourth quarter, U.S. revenues totaled $715.5 million and dropped 1.8%. International revenues amounted to $229.8 million, rising 2.3% year over year and dropping 0.4% at CER.

Revenues in the Diagnostics segment declined 20.1% year over year (down 20.6% at CER) to $416.4 million in the quarter under review. Excluding COVID-19 revenues, Diagnostics revenues increased 10.2% on a reported and CER basis.

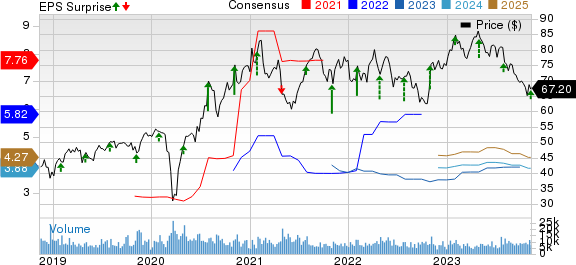

Hologic, Inc. Price, Consensus and EPS Surprise

Hologic, Inc. price-consensus-eps-surprise-chart | Hologic, Inc. Quote

Cytology & Perinatal revenues of $115.2 million were up 1.3% at CER. Molecular Diagnostics revenues of $291.9 million declined 27.5% at CER. Blood Screening revenues of $9.3 million rose 17.7% year over year at CER.

Revenues in the Breast Health segment rose 28.2% from the year-ago period’s (up 27.4% at CER) levels to $352.8 million, primarily due to higher capital equipment revenues compared with the prior-year period’s levels.

Revenues in the GYN Surgical business rose 11% year over year (up 10.6% at CER) to $148 million, primarily driven by strong results from MyoSure and Fluent Fluid Management.

Revenues at Skeletal Health increased 16.7% year over year (up 15.9% at CER) to $28 million.

Operational Update

In the fiscal fourth quarter, the company-provided adjusted gross margin contracted 210 basis points (bps) to 60.4%. According to the company, the downside in gross margin was primarily due to a year-over-year decline in COVID-19 assay sales.

The company’s adjusted operating margin was 28.3%, expanded 40 bps, primarily led by improved non-COVID base business performance and lower marketing expenses.

Financial Update

Hologic ended fourth-quarter fiscal 2023 with cash and cash equivalents of $2.72 billion compared with $2.34 billion in a year-ago period.

Total long-term debt (including the current portion) was $2.82 billion at the end of the fiscal fourth quarter, unchanged from the year-ago levels.

Net cash provided by operating activities at the end of the fiscal fourth quarter was $1.05 billion compared with $2.13 billion a year ago.

The Company repurchased 3.2 million shares of its stock for $238 million in the fourth quarter of fiscal 2023.

Guidance

Hologic issued the guidance for the first quarter of 2024 and updated the fiscal 2023 guidance.

For fiscal 2023, the company projects revenues within $3.92-$4.02 billion (previous guidance was $3.99-$4.03 billion), suggesting a year-over-year decline in the range of 2.7-0.3% on a reported basis, (2.3%)-0.2% at CER and (1.7%)-0.8% organically. The Zacks Consensus Estimate for fiscal 2023 revenues is pegged at $4.03 billion.

Adjusted EPS for fiscal 2023 are estimated to be $3.90-$4.12 (up from the previous guidance of $3.87-$3.94), with a projected growth of (1.5%)-3.5% year over year. The Zacks Consensus Estimate for fiscal 2023 EPS is pegged at $3.92.

For first-quarter fiscal 2024, the company projects revenues within $960-$985 million, suggesting a year-over-year decline in the range of 10.6-8.3% on a reported basis, 10.9-8.5% at CER and 10.7-8.3% organically. The Zacks Consensus Estimate for first-quarter fiscal 2024 revenues is pegged at $1.01 billion.

Adjusted EPS for the first quarter are estimated in the range of 92-97 cents, suggesting a decline of 14-9.3% year over year. The Zacks Consensus Estimate for first-quarter fiscal 2024 EPS is pegged at 85 cents.

Our Take

Hologic delivered better-than-expected revenues and earnings in fourth-quarter fiscal 2023. The company’s Breast Health segment registered strong growth, primarily due to higher capital equipment revenue. GYN Surgical business is driven by strong results from MyoSure and Fluent Fluid Management. The company's adjusted operating margin increased by 40 basis points, primarily driven by improved non-COVID base business performance and lower marketing expenses.

On a year-over-year basis, revenues were down. The decline in COVID-19 assay revenues dented total revenues. The company also reported a contraction in gross margins, which looks discouraging.

Zacks Rank and Key Picks

Hologic currently carries Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Abbott Laboratories ABT, DexCom, Inc. DXCM and Integer Holdings Corporation ITGR.

Abbott, carrying a Zacks Rank of 2 (Buy), reported adjusted EPS of $1.14 in third-quarter 2023, beating the Zacks Consensus Estimate by 3.6%. Revenues of $10.14 billion outpaced the consensus mark by 3.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Abbott has a long-term estimated growth rate of 5.1%. ABT’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 6.8%.

DexCom reported third-quarter 2023 adjusted EPS of 50 cents, beating the Zacks Consensus Estimate by 47.1%. Revenues of $975 million surpassed the Zacks Consensus Estimate by 4%. It currently carries a Zacks Rank #2.

DexCom has a long-term estimated growth rate of 33.6%. DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%.

Integer Holdings reported adjusted EPS of $1.27 in third-quarter 2023, beating the Zacks Consensus Estimate by 20.9%. Revenues of $404.7 million surpassed the Zacks Consensus Estimate by 8.7%. It currently carries a Zacks Rank #2.

Integer Holdings has a long-term estimated growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report