Home BancShares Inc (HOMB) Navigates Headwinds to Post Solid Q4 Earnings

Net Income: Q4 net income reached $86.2 million, a decrease from Q3's $98.5 million.

Total Revenue: Reported at $245.6 million for Q4, slightly up from $245.4 million in Q3.

Diluted EPS: Q4 diluted earnings per share was $0.43, down from $0.49 in Q3.

Net Interest Margin (NIM): NIM for Q4 stood at 4.17%, a slight decrease from 4.19% in Q3.

Non-Performing Assets: Remained stable at 0.42% of total assets from Q3 to Q4.

Liquidity: Home BancShares reported $5.59 billion in net available liquidity as of December 31, 2023.

Capital Ratios: Common equity tier 1 capital ratio improved to 14.2% in Q4 from 14.0% in Q3.

On January 18, 2024, Home BancShares Inc (NYSE:HOMB), the parent company of Centennial Bank, released its quarterly earnings, revealing the impact of external challenges on its financial performance. Despite these obstacles, the company demonstrated resilience, as detailed in its 8-K filing. The bank holding company, which provides a wide range of commercial and retail banking services, faced headwinds from West Texas and an unexpected FDIC assessment in the fourth quarter.

Financial Performance Amid Challenges

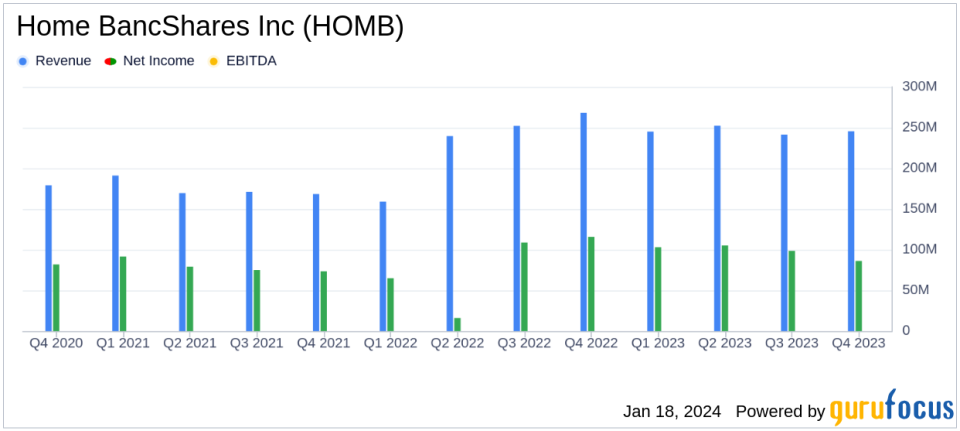

Home BancShares Inc reported a net income of $86.2 million for Q4 2023, which was lower than the previous quarter's $98.5 million and the $115.7 million from Q4 2022. The total revenue for Q4 stood at $245.6 million, slightly up from the third quarter but down from $272.3 million in the same quarter the previous year. The diluted earnings per share (EPS) for the quarter was $0.43, compared to $0.49 in Q3 and $0.57 in Q4 2022.

Chairman and CEO John Allison commented on the year's performance, stating,

2023 was a tough year for the banking sector. For HOMB, the biggest obstacles came in the form of the loss of income as a result of the actions from some individuals in West Texas that may prove to be unethical and potentially criminal. In addition, the FDIC 4th quarter surprise assessment to financial institutions to recover losses from failed banks, resulted in $13 million ($0.05 per share) expense for Home BancShares."

He added that excluding these events, the company would have surpassed its goal of $400 million plus and earned over $2.00 per share.

Robust Liquidity and Capital Position

The company maintained a strong liquidity position with $2.12 billion in net available internal liquidity and $3.47 billion in net available external liquidity as of December 31, 2023. The common equity tier 1 capital ratio improved to 14.2%, up from 14.0% in the previous quarter, indicating a robust capital position.

Home BancShares Inc's net interest margin (NIM) for Q4 was 4.17%, a slight decrease from 4.19% in Q3. The company's non-performing assets remained stable at 0.42% of total assets from Q3 to Q4. The allowance for credit losses to total loans was consistent at 2.00%.

Operational Highlights and Outlook

Despite the challenges, Home BancShares Inc continued to grow its loan portfolio, with total loans receivable reaching $14.42 billion at the end of Q4, up from $14.27 billion at the end of Q3. The company also reported an increase in total deposits and total assets, indicating continued customer trust and business growth.

The bank operates a network of 76 branches in Arkansas, 78 in Florida, 63 in Texas, 5 in Alabama, and one in New York City, maintaining a strong presence in its key markets.

Looking ahead, Home BancShares Inc remains focused on navigating the current economic environment while continuing to serve its customers and communities effectively. The company's performance in the face of adversity demonstrates its resilience and commitment to maintaining a strong financial position.

For more detailed information and analysis, investors are encouraged to review the full earnings release and financial statements provided by Home BancShares Inc.

Explore the complete 8-K earnings release (here) from Home BancShares Inc for further details.

This article first appeared on GuruFocus.