Home Bancshares: An Under-the-Radar Compounder

Bruce Berkowitz (Trades, Portfolio), head of Fairholme, recently purchased Home Bancshares Inc. (NYSE:HOMB) stock. I pay close attention to the guru's positions due to his deep experience in value investing and concentrated positions in his best ideas. Berkowitz also has notable experience in financial companies. This analysis was motivated by my desire to deduce what he finds attractive in this bank, which merited a starter position.

About Home Bancshares

Home Bancshares, operating as Centennial Bank, is a bank holding company with a head office in Conway, Arkansas and operations in Florida, Texas, Alabama and New York City. It was founded in 1998 by an investor group led by John W. Allison and Robert H. Adcock Jr. The company obtained a bank charter and established First State Bank in Conway, Arkansas in 1999. Over the years, it has acquired several community banks and expanded its presence in various states.

The company's business strategy is built around acquiring, organizing and investing in community banks that serve attractive markets. It prides itself on its community banking philosophy, which leads to exceptional service and strong customer relationships. The company emphasizes financial strength and disciplined, patient and liquid growth to provide stability and support to its customers, especially during challenging economic times.

Home Bancshares has acquired and integrated a total of 23 banks over the years, with a focus on maintaining strong credit quality, increasing profitability and finding experienced bankers. Its main funding sources include deposits and borrowed funds from the Federal Home Loan Bank.

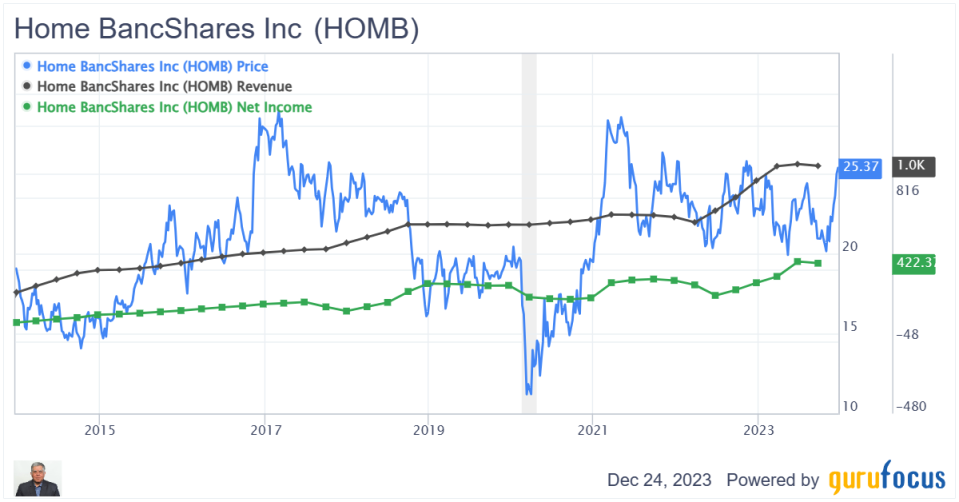

As of the third quarter of 2023, the company's total assets amounted to $21.9 billion, with a substantial exposure to the commercial real estate market. Its revenue and net income are at record highs since 2014, and its debt-equity ratio is down 74% from its peak in the fourth quarter of 2015.

HOMB Data by GuruFocus

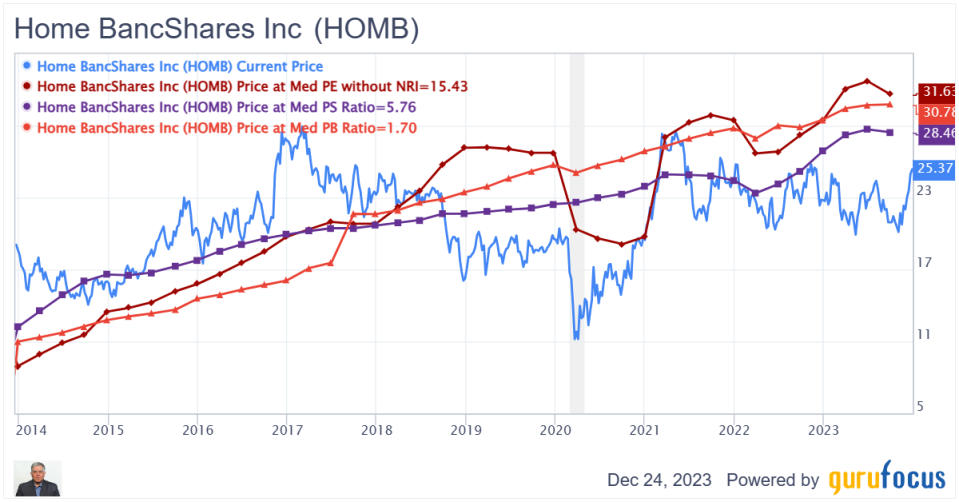

The company's price-book, price-sales and price-earnings ratios are also down from their respective peaks, and its return on assets ranks eighth among the top 200 exchange-traded U.S. banks for second-quarter 2023. The chart below shows solid value based on 10-year median justified ratios. As you can see, the stock price is substantially below the 10-year median justified prices.

HOMB Data by GuruFocus

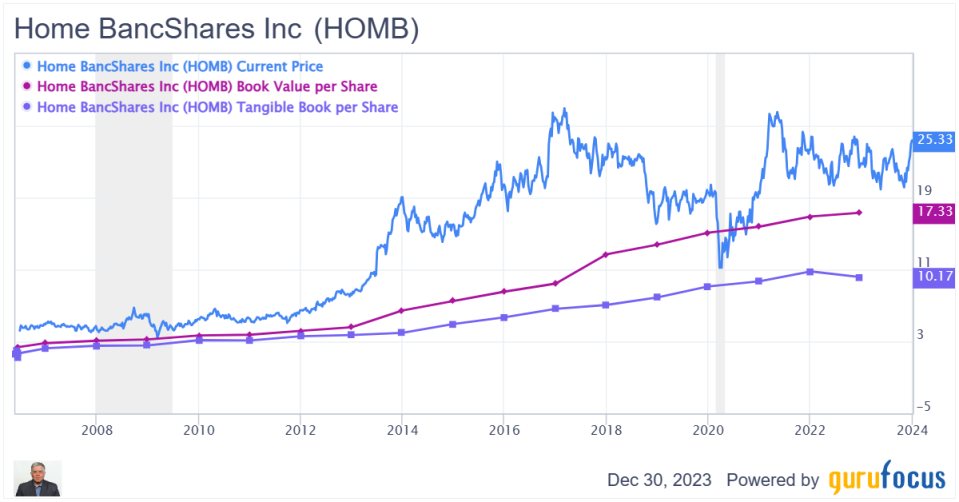

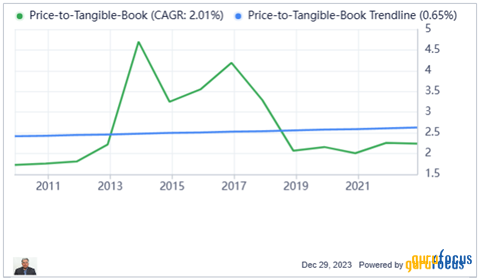

Currently, Home Bancshares is trading with a price-to-tangible book value ratio of 2.30, which is reasonable when looking at the chart below. The ratio has exceeded 4 a few times in the past decade. With interest rates trending downward, I believe the value of real estate will bounce back, resulting in multiple expansion in regional banks like Home Bancshares.

Home Banc's growth numbers are impressive, as laid out below. The company is a serial acquirer of community banks in the region is operates. Impressively, it has maintained double-digit growth in book value per share over the past 20 years.

Growth Rates (Per Share) | Annuals (Year End) | ||

Fiscal Period | 10-Year | 5-Year | 1-Year |

Revenue | 9.00% | 5.20% | 12.90% |

EPS without NRI | 12.70% | 4.60% | 12.00% |

Free Cash Flow | 7.60% | 16.50% | 1.50% |

Dividends | 18.90% | 9.40% | 11.00% |

Book Value | 13.80% | 6.50% | 6.60% |

Price (Total Return) | 5.20% | 12.70% | 15.80% |

*12-month growth rate is calculated with the quarterly per share revenue (Ebitda, FCF, earnings) of the last 12 months over the per share revenue (Ebitda, FCF, earnings) over the previous 12 months. Five-year and 10-year growth rates are calculated with least-square regression based on the six-year and 11-year annual numbers.

Another important measure for banks is return on equity. Home Bancshare's current ROE of 11.78% is quite good and its return on tangible equity of 19.81% (trailing 12 months) is superb.

The company offers a 2.84% dividend yield, a low 0.34 dividend payout ratio and a 9.4% growth rate over the preceding five years and 18.9% over the last 10 years. The company has been increasing its dividend for 13 years and pays a meaningful dividend, higher than the bottom 25% of all bank stocks that pay dividends. Even though the dividend is not high, the payout is low, growth is high and thus, in my opinion, Home Bancshares is a strong dividend growth stock.

Technical analysis

The stock's one-year price chart shows an interesting W-bottoming pattern, as well as a golden cross. I consider both to be strong bullish signs.

HOMB Data by GuruFocus

A W-bottoming pattern, also known as a double bottom, is a bullish chart pattern that indicates a potential reversal of a downward trend. It is characterized by two consecutive troughs that form a "W" shape. The first trough shows a downward price movement, followed by a temporary upward movement, and then a second trough of similar depth to the first one. This pattern suggests a shift from a downtrend to an uptrend. The second trough is often accompanied by a decrease in trading volume, indicating a weakening of selling pressure. The stock is now showing signs of breaking out over the preceding W pattern. This is a bullish turn of events, at least in the short term.

A golden cross is a bullish chart pattern in technical trading. It occurs when a shorter-term moving average, such as the 50-day moving average, crosses above a longer-term moving average, such as the 200-day moving average (as in this case). This pattern is interpreted as a potential signal of a bullish trend reversal or the emergence of a long-term bull market. The golden cross is often used by traders as a confirmation signal for a bullish trend reversal and may be accompanied by an increase in trading volume, reinforcing the indicator. It is considered a significant technical indicator and is used by many traders to make investment decisions. The golden cross is the opposite of the death cross, which indicates a bearish trend. Traders often use both the golden cross and the death cross to determine the timing of their market entries and exits. A golden cross is considered bullish in the short to medium term (months as opposed to weeks).

Another thing to note is the share price has now totally recovered from the "banking crisis," which enveloped the U.S. regional banking system following the failure of some banks in the U.S. in March to May 2023, which included Silicon Valley Bank, Signature Bank and First Republic Bank, among others. This shows that investor confidence has returned to the bank and the sector.

Conclusion

Despite risks such as a concentrated geographical presence in the Southern U.S. states and heightened regulatory requirements, Home's strong financials and upward price momentum present an interesting opportunity for investors like Berkowitz. The Southern U.S. enjoys strong demographic tailwinds and is a net benefit of intra-country migration patterns and strong local economies, which favor small business and family formation. This should bode well for local banking activity.

I am particularly impressed by the consistent compounding of equity (book value per share) the bank has demonstrated over long periods, which shows management has avoided major writedowns and maintained high credit quality. Book value per share has compounded at the rate of more than 13% over the last 20 years. In my opinion, compounding book value is an unappreciated quality by most investors who tend to focus on earnings. However, earnings per share have also compounded at 12.7% annually over the last decade.

HOMB Data by GuruFocus

Apart from Berkowitz, small-cap maven fund manager Chuck Royce (Trades, Portfolio), who focuses on high-quality, small-capitalization stocks, and growth investor Ken Fisher (Trades, Portfolio) have significant positions in this stock. I will be watching with interest if Berkowitz and Royce continue to add to their positions in the coming quarters.

This article first appeared on GuruFocus.