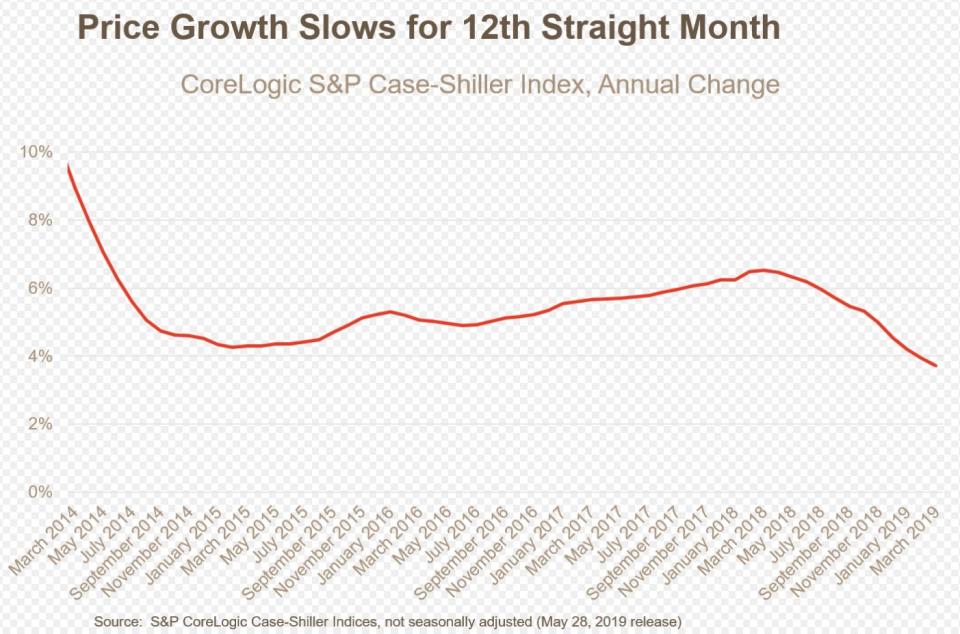

Home price growth slows for 12th straight month

Home price growth slowed in March but price increases are still rising almost twice as fast as inflation.

Standard & Poor’s said Tuesday that its S&P CoreLogic Case-Shiller national home price index posted a 3.7% annual gain in March, down from 3.9% in the previous month. It is the 12th straight month that home price growth has been on a decline. The 20-City Composite posted a 2.7% year-over-year gain, down from 3.0% in the previous month — beating analyst estimates of a 2.55% annual increase.

“At the currently lower pace of home price increases, prices are rising almost twice as fast as inflation: In the last 12 months, the S&P Corelogic Case-Shiller National Index is up 3.7%, double the 1.9% inflation rate,” said David M. Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices, in a press statement. “Measured in real, inflation-adjusted terms, home prices today are rising at a 1.8% annual rate. This compares to a 1.2% real annual price increases in housing since 1975.”

The results follow new home sales and existing home sales data that show a slowing in activity. New home sales fell 6.9% to a 673,000 annualized pace in April, down from an 11-year high a month earlier, while existing home sales fell 0.4% from March to a seasonally adjusted annual rate of 5.19 million in April, according to the National Association of Realtors. Total sales are down 4.4% from a year ago (5.43 million in April 2018).

Later this week, pending home sales for April will be released. Nomura predicts that pending home sales growth will also slow in April despite an uptick in March — “highlighting ongoing headwinds in the housing sector as consumers grapple with the past ramp-up of home price appreciation and the ongoing shortage of homes for sale.”

‘Double-digit annual gains have vanished’

“The shift to smaller price increases is broad-based and not limited to one or two cities where large price increases collapsed,” said Blitzer.

Las Vegas, Phoenix and Tampa reported the highest year-over-year gains among the 20 cities covered in the 20-City Composite. In March, Las Vegas led the way with an 8.2% annual increase, followed by Phoenix with a 6.1% increase, and Tampa with a 5.3% increase

“Double-digit annual gains have vanished,” he said. The largest annual gain was 8.2% in Las Vegas; one year ago, Seattle had a 13% gain. In this report, Seattle prices are up only 1.6%.”

In major markets like Seattle homes aren’t selling as fast as they used to, an indication that sellers may have to start adjusting prices. As homes sit on the market longer inventory is beginning to ease, which is good news for the housing market. A shortage in inventory drives prices up.

Total inventory at the end of April rose to 1.83 million, up from 1.67 million existing homes available for sale in March and a 1.7% increase from 1.80 million a year ago, according to the NAR. Unsold inventory is at a 4.2-month supply at the current sales pace, up from 3.8 months in March and up from 4.0 months in April 2018.

“We see that the inventory totals have steadily improved and will provide more choices for those looking to buy a home,” NAR’s Chief Economist Lawrence Yun said in a statement. “When placing their home on the market, home sellers need to be very realistic and aware of the current conditions.”

Amanda Fung is an editor at Yahoo Finance.

Read the latest financial and business news from Yahoo Finance

It's taking longer to sell a home in the U.S.

The slowing U.S. housing market may have finally bottomed

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.