Homebuilder Stocks on a Roll: Grab These 5 Stocks for Solid Return

Homebuilders are taking advantage of an insatiable demand for new housing, fueled by limited inventories and refining supply chain efficiency. New residential construction sector has demonstrated positive growth across various metrics as the lack of existing inventory is shifting demand to the new home market.

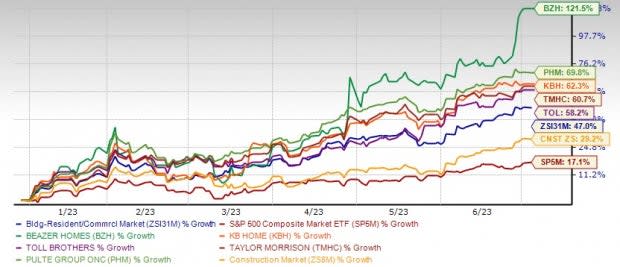

The Zacks Building Products - Home Builders industry, which includes homebuilders stocks, has fared relatively well thus far in 2023, rising by 47% year to date (YTD). This compares with the Zacks S&P 500 composite and the broader Zacks Construction sector that gained 17.1% and 29.2%, respectively, over the same period.

Many notable homebuilding companies have been registering gains from the industry’s positive momentum. Among them Beazer Homes USA, Inc. BZH, Landsea Homes Corporation LSEA, PulteGroup PHM, KB Home KBH and Taylor Morrison Home Corporation TMHC have managed to soar more than 50% YTD.

Promising Future: Key Metrics Showcase Solid Prospects

Various metrics of the industry, like builder confidence, building permits, new home sales, housing starts and housing completions, showed encouraging signs.

Despite ongoing challenges such as a shortage of skilled labor and a tight credit market, builders are optimistic about the market. According to the National Association of Home Builders /Wells Fargo Housing Market Index, builder confidence in the market for newly-built single-family homes has risen by five points in June, reaching 55 from May. This marks the sixth consecutive month of increasing confidence and a significant milestone as the index has now reached 50 for the first time since July 2022.

The latest report reveals promising trends in the homebuilding market for May 2023. Building permits showed robust growth, increasing 5.2% from April levels, indicating a positive trajectory. Housing starts experienced even more substantial expansion, with a remarkable 21.7% increase from the previous month’s figure. Housing completions also displayed positive growth, rising by 9.5% compared with the previous month’s levels. These encouraging indicators signal a potentially strong and thriving homebuilding market, presenting opportunities for investors and homebuyers.

Sales of new U.S. single-family homes surged 12.2% in May from April and 20% from a year ago, benefiting from a dearth of previously-owned homes available for sale, according to a joint report from the US Department of Housing and Urban Development and the US Census Bureau.

Homeowners with ultra-low mortgage rates are hesitant to sell their homes and purchase another at higher rates, contributing to the low inventory. As a result, sales of existing homes have declined in recent months, while new home sales have been on the rise.

Industry Rank

The Zacks Building Products - Home Builders industry falls within the top 5% (12 out of more than 250 industries) of the Zacks Industry Rank, which hints at further growth.

Key Homebuilding Stocks

Adding some homebuilding stocks to your portfolio seems to be a judicious move at this point, given the solid demand. With the help of the Zacks Stock Screener, we have zeroed in on five stocks that have a Zacks Rank #1 (Strong Buy) or 2 (Buy) and have gained more than 50% YTD. A top Zacks Rank indicates that these stocks have been witnessing positive estimate revisions, which generally translate into rapid price appreciation. You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

Beazer Homes USA: This Atlanta, GA-based homebuilder designs, constructs and sells single-family and multi-family homes under the Beazer Homes, Gatherings and Choice Plans names. An ample availability of lots and a more efficient and less leveraged balance sheet will drive growth.

BZH — a Zacks Rank #1 stock — has gained 121.5% this year. The Zacks Consensus Estimate for its fiscal 2023 and 2024 earnings has been revised upward by 11% and 4.9%, respectively, in the past 60 days. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 25.1%. It carries an impressive VGM Score of A. This helps to identify stocks with the most attractive value, growth and momentum.

PulteGroup: Based in Atlanta, GA, this homebuilder has been benefiting from a prudent land investment strategy, focus on entry-level buyers and return of more free cash flow to shareholders. PulteGroup’s annual land acquisition strategies have been resulting in improved volumes, revenues and profitability for quite some time now. The company has been reaping benefits from the successful execution of strategic initiatives to boost profitability, with a focus on entry-level homes.

PHM — a Zacks Rank #2 stock — has rallied 69.8% year to date. The Zacks Consensus Estimate for its 2023 and 2024 earnings has been upwardly revised by 1.9% and 3.9%, respectively, in the past 60 days. Its earnings topped consensus estimates in three of the trailing four quarters and missed on one occasion, with the average surprise being 15.6%. Again, it carries an impressive VGM Score of A.

KB Home: This Los Angeles, CA-based homebuilder builds and sells attached and detached single-family residential homes, townhomes and condominiums primarily for first-time, first move-up, second move-up and active adult homebuyers. Its strong land pipeline and built-to-order approach along with solid liquidity level will drive growth.

KBH — a Zacks Rank #1 stock — has jumped 62.3% year to date. The Zacks Consensus Estimate for its 2023 and 2024 earnings has been upwardly revised by 18.9% and 15.6%, respectively, over the past 60 days. Its earnings topped consensus estimates in three of the trailing four quarters and missed on one occasion, with the average surprise being 20.7%.

Taylor Morrison Home: This Scottsdale, AZ-based homebuilder’s ongoing operational enhancements and acquisition synergies are encouraging. The company’s well-balanced, diverse mix of portfolio and operating strategy bode well. TMHC expanded its market footprint and product positioning in recent years through acquisitions and impressive organic growth. It serves a broad range of consumers in the entry-level, first-and-second move-up and resort lifestyle segments across the country. The success of these efforts has been driving growth for the company and has been enhancing its liquidity level, enabling the company to take advantage of investment opportunities as the market evolves.

TMHC — a Zacks Rank #2 stock — has jumped 60.7% year to date. The Zacks Consensus Estimate for its 2023 earnings has been upwardly revised by 1.5% in the past 60 days. Its earnings topped consensus estimates in all of the trailing four quarters, with the average surprise being 17.3%.

Toll Brothers: Based in Horsham, PA, Toll Brothers is a leading builder of luxury homes. The company has been benefiting from its strategy of broadening its product lines, price points and geographies. Also, it has been gaining from the lack of competition in the luxury new home market, its build-to-order approach and solid backlog level. This, combined with its focus on operational efficiency, has been helping TOL to drive growth.

TOL — a Zacks Rank #1 stock — has gained 58.2% this year so far. The Zacks Consensus Estimate for its fiscal 2023 and 2024 earnings has been upwardly revised by 22.5% and 29.7%, respectively, in the past 60 days. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 24.4%. It has an impressive VGM Score of A.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

Beazer Homes USA, Inc. (BZH) : Free Stock Analysis Report

Taylor Morrison Home Corporation (TMHC) : Free Stock Analysis Report

Landsea Homes Corporation (LSEA) : Free Stock Analysis Report