The Honest Company (NASDAQ:HNST) Delivers Impressive Q4, Stock Jumps 29%

Personal care company The Honest Company (NASDAQ:HNST) reported Q4 FY2023 results beating Wall Street analysts' expectations , with revenue up 10.3% year on year to $90.26 million. It made a GAAP profit of $0.01 per share, improving from its loss of $0.14 per share in the same quarter last year.

Is now the time to buy The Honest Company? Find out by accessing our full research report, it's free.

The Honest Company (HNST) Q4 FY2023 Highlights:

Revenue: $90.26 million vs analyst estimates of $84.14 million (7.3% beat)

Adjusted EBITDA: $4.3 million vs analyst estimates of ($2.3) million LOSS

EPS: $0.01 vs analyst estimates of -$0.08 ($0.09 beat)

Encouraging 2024 and longer-term guidance: low-to-mid single digit percentage revenue growth and positive low-single digit to mid-single digit millions adjusted EBITDA; improving to 4% to 6% annual revenue growth and continued adjusted EBITDA margin expansion beyond 2024

Free Cash Flow of $9.67 million, up 83.5% from the previous quarter

Gross Margin (GAAP): 33.5%, up from 27.5% in the same quarter last year

Market Capitalization: $285.5 million

“Our fourth quarter results demonstrate the benefit that our Transformation Initiative has had on the business. Our clear focus on Brand Maximization, Margin Enhancement, and Operating Discipline has enabled us to achieve both positive Net Income and positive Adjusted EBITDA,” said Chief Executive Officer, Carla Vernón.

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ:HNST) sells diapers and wipes, skin care products, and household cleaning products.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

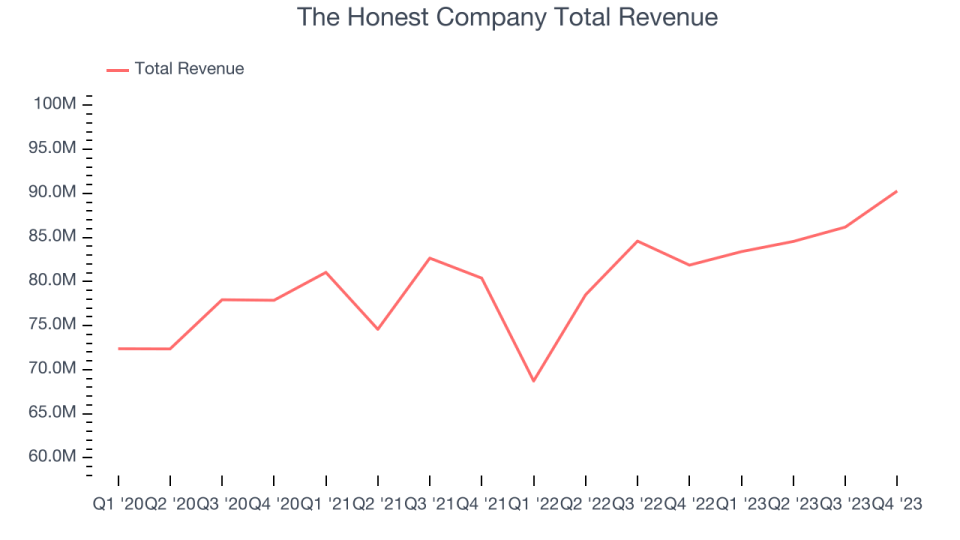

Sales Growth

The Honest Company is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

As you can see below, the company's annualized revenue growth rate of 4.6% over the last three years was weak for a consumer staples business.

This quarter, The Honest Company reported robust year-on-year revenue growth of 10.3%, and its $90.26 million in revenue exceeded Wall Street's estimates by 7.3%. Looking ahead, Wall Street expects sales to grow 1.6% over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

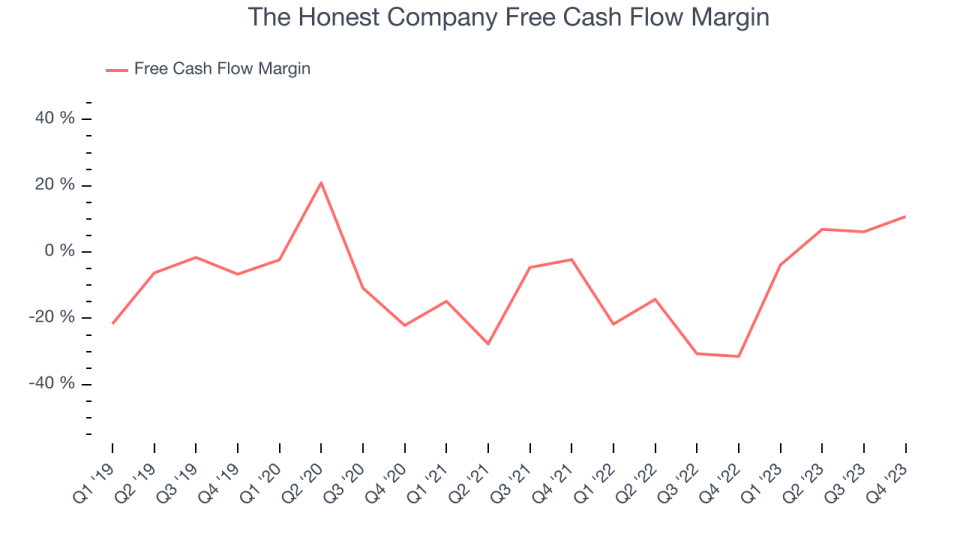

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

The Honest Company's free cash flow came in at $9.67 million in Q4, representing a 10.7% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to positive this quarter.

While The Honest Company posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, The Honest Company's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer staples sector, averaging negative 9.2%. However, its margin has averaged year-on-year increases of 29.9 percentage points over the last 12 months, showing the company is taking action to improve its situation.

Key Takeaways from The Honest Company's Q4 Results

We were impressed by how significantly The Honest Company blew past analysts' revenue, adjusted EBITDA, and EPS expectations this quarter. The market was expecting negative EBITDA and the company delivered positive EBITDA. Full year 2024 guidance for revenue calls for "low-to-mid single digit percentage" revenue growth and "positive low-single digit to mid-single digit millions adjusted EBITDA", which is encouraging. Even better news is that beyond 2024, this algorithm will improve to 4% to 6% annual revenue growth and continued adjusted EBITDA margin expansion. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 29% after reporting and currently trades at $4 per share.

The Honest Company may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.