Honeywell (HON) to Acquire Cybersecurity Business, SCADAfence

Honeywell International Inc. HON has reached a deal to acquire SCADAfence, a provider of operational technology (OT) and Internet of Things cybersecurity solutions for monitoring large-scale networks.

The move is prudent as the OT cybersecurity industry is expected to increase by more than $10 billion in the next several years. Cybersecurity risks are a growing concern today. Cyberattacks focused on OT systems can result in trillions of dollars in lost revenues for the industrial and critical infrastructure sectors.

The acquisition will expand Honeywell's OT cybersecurity portfolio in Tel Aviv, Israel. Simultaneously, it will fortify Honeywell’s existing capabilities in cybersecurity, offering customers enhanced security, reliability and efficiency.

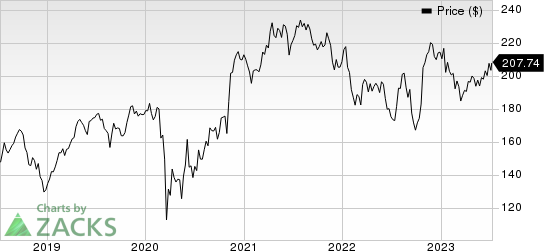

Honeywell International Inc. Price

Honeywell International Inc. price | Honeywell International Inc. Quote

SCADAfence will be integrated into the Honeywell Forge Cybersecurity+ suite within Honeywell Connected Enterprise, HON’s software unit focusing on digitalization, sustainability and OT cybersecurity SaaS offerings and solutions. The integration will provide enhanced asset discovery, threat detection and compliance management capabilities to site managers, operations management, and chief information security officers, who seek enterprise security management.

Subject to regulatory approvals and customary closing conditions, the acquisition is expected to close in the second half of 2023.

Zacks Rank & Other Stocks to Consider

Honeywell presently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks are as follows:

ITT Inc. ITT presently carries a Zacks Rank #2. The company pulled off a trailing four-quarter earnings surprise of 3.5%, on average.

ITT has an estimated earnings growth rate of 9.7% for the current year. The stock has rallied 44.2% in a year.

Xylem Inc. XYL currently sports a Zacks Rank #1 (Strong Buy). The company delivered a trailing four-quarter earnings surprise of 17.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Xylem has an estimated earnings growth rate of 21.7% for the current year. The stock has surged 45.5% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

Xylem Inc. (XYL) : Free Stock Analysis Report