Honeywell (HON) to Acquire HUD Assets of Saab Technology

Honeywell International Inc. HON has entered into a definitive agreement to acquire heads-up-display (HUD) assets of Swedish aerospace and defense company Saab Technology. The financial terms of the transaction are kept under wraps.

The HUD system reduces the workload for pilots, helps them with increased situational awareness and increases flight safety. Per the deal, the companies will collaborate to advance and strengthen HON’s HUD product portfolio. The acquisition will expand Honeywell’s avionics and safety offerings

The addition of HUD will also enable Honeywell to offer a balanced cockpit environment to its customers. The HUDs technology will be integrated into Honeywell Anthem, which is HON's first cloud-connected cockpit system that can be customized for virtually every type of aircraft. It will also be available for aircraft equipped with Primus Epic flight decks, as well as for standalone retrofits. The acquisition of HUD assets is subject to regulatory approvals and customary closing conditions.

Honeywell has been strengthening its business through acquisitions. In April, the company entered into an agreement to acquire Compressor Controls Corporation from INDICOR, LLC. The acquisition will fortify HON’s expertise in industrial control, automation and process solutions, while simultaneously bolstering its sustainability portfolio with new carbon capture control solutions. The acquired entity will be integrated into HON’s Process Solutions business. The deal is expected to close in the second half of 2023.

The Zacks Consensus Estimate for Honeywell’s 2023 earnings per share is currently pegged at $9.16, suggesting a 4.6% increase from the year-ago reported figure. The same for 2024 stands at $10.03, indicating growth of 14.5% from the prior-year reported number.

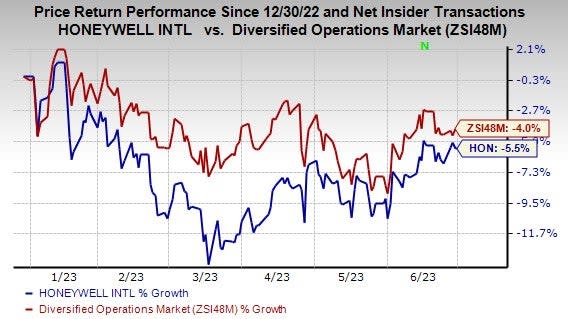

Price Performance

Shares of HON have decreased 5.5%, compared with the industry’s 4% decline in the year-to-date period.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

HON currently carries Zacks Rank #3 (Hold). Some better-ranked companies are discussed below:

Griffon Corporation GFF sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks.

GFF delivered a trailing four-quarter earnings surprise of 12.5%, on average. In the past 60 days, Griffon’s earnings estimates have increased 12.5% for fiscal 2023. The stock has surged 11.9% in the year-to-date period.

Ingersoll Rand Inc. IR presently sports a Zacks Rank of 1. IR delivered a trailing four-quarter earnings surprise of 12.6%, on average.

In the past 60 days, estimates for Ingersoll Rand’s 2023 earnings have increased 6.7%. The stock has improved 21.8% in the year-to-date period.

Alamo Group Inc. ALG currently sports a Zacks Rank of 1. ALG delivered a trailing four-quarter earnings surprise of 17.7%, on average.

In the past 60 days, estimates for Alamo’s 2023 earnings have increased 12.7%. The stock has increased 28.4% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report