Honeywell (HON), Analog Devices Partner on Building Automation

Honeywell International Inc. HON has signed a Memorandum of Understanding with Analog Devices, Inc. ADI to help in the digitization of commercial premises without replacing existing wiring. The strategic alliance was announced at CES 2024 in Las Vegas. Through this partnership, the two companies will bring new digital connectivity technologies to building management systems to lower costs, waste and downtime.

Based in Norwood, MA, Analog Devices is an original equipment manufacturer of semiconductor devices, specifically analog, mixed-signal and digital signal-processing integrated circuits. The company is engaged in offering analog, digital and RF switches and multiplexers, analog microcontrollers, clock and timing products, among others.

It is worth noting that there are many buildings in the United States that were built before 2000 and are obsolete and inefficient. Analog Devices' single-pair Ethernet connection allows long-reach Ethernet connectivity and lets the building owners utilize the building's existing wiring while lowering installation time, costs and waste.

As noted, Honeywell will integrate Analog Devices' single-pair Ethernet and software configurable input/output solutions into its building management systems. ADI's single-pair Ethernet solution complements existing Ethernet connectivity in building management systems, enhancing connectivity from the edge to the cloud and optimizing asset utilization. ADI’s offerings will enable HON to make a single product version to cater to various needs, which will allow more future-proof control and automation for a building being remodeled. This will boost the speed of product installation. It will also bring down the inventory needs and will enable economic changes as well.

Zacks Rank

Honeywell currently carries a Zacks Rank #2 (Buy). Strength in the commercial aviation, defense and space, aerospace and process solutions businesses, solid operational execution and improving supply chains are driving Honeywell’s growth. Despite cost inflation, pricing actions and cost-control measures are driving the company’s margin performance.

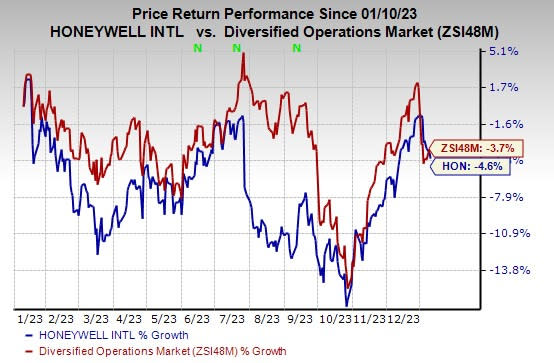

Price Performance

In the past year, the HON stock declined 4.6% compared with the industry’s 3.7% decrease.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked companies from the same space are discussed below:

Griffon Corporation GFF presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

It has a trailing four-quarter average earnings surprise of 28.6%. The Zacks Consensus Estimate for GFF’s fiscal 2024 earnings has increased 13% in the past 60 days. Shares of Griffon have jumped 52% in the past year.

General Electric Company GE currently sports a Zacks Rank of 1. The company delivered a trailing four-quarter average earnings surprise of 53.4%.

In the past 60 days, the Zacks Consensus Estimate for General Electric’s 2023 earnings has remained steady. The stock has risen 71.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report