Honeywell (HON), ESS Tech to Accelerate IFB Energy Storage

Honeywell International HON has announced a strategic collaboration with energy storage company, ESS Tech, Inc. GWH to accelerate technology development and market adoption of iron flow battery (IFB) energy storage systems. As part of this agreement, HON has made an investment in ESS Tech.

ESS Tech provides safe, sustainable, long-duration energy storage to advance global decarbonization. Both Honeywell and ESS Tech carry a Zacks Rank #3 (Hold).

The partnership combines Honeywell’s advanced materials and energy systems expertise with ESS’ market-leading and patented IFB design, building upon each company’s development of energy storage systems.

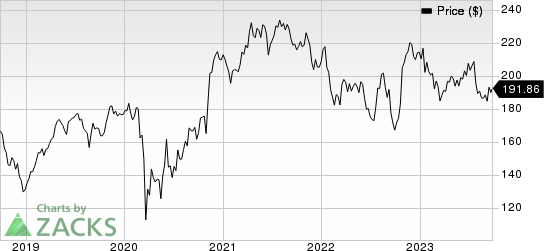

Honeywell International Inc. Price

Honeywell International Inc. price | Honeywell International Inc. Quote

The agreement is aimed at meeting the growing demand for long-duration energy storage (LDES) globally, thanks to the rapid increase in renewable power generation. Per LDES Council and McKinsey & Co., the global energy storage market is estimated to grow significantly from its current $50 billion per year, with a cumulative investment of up to $3 trillion by 2040.

The agreement will streamline the transition to clean energy through the usage of safe and IFB technology that allows for energy storage by leveraging iron, salt, water and other materials available abundantly, instead of relying on those available in limited quantities such as lithium, cobalt or vanadium.

Key Picks

Below, we discuss some better-ranked stocks from the Industrial Products sector:

Flowserve Corporation FLS presently sports a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of 6.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Flowserve has an estimated earnings growth rate of 79.1% for the current year. The stock has jumped 27.9% so far this year.

Graham Corporation GHM currently flaunts a Zacks Rank #1. The company pulled off a trailing four-quarter earnings surprise of 243.1%, on average.

Graham has an estimated earnings growth rate of 400% for the current fiscal year. The stock has rallied 67.4% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Graham Corporation (GHM) : Free Stock Analysis Report

ESS Tech, Inc. (GWH) : Free Stock Analysis Report