Honeywell (HON), Recipharm Unite to Develop Near-Zero GWP pMDIs

Honeywell International Inc. HON recently partnered with global contract development and manufacturing organization, Recipharm, to accelerate the development of pressurized metered dose inhalers (pMDIs). These pMDIs use HON’s near-zero global warming potential (GWP) propellant Solstice Air.

Many of the patients suffering from chronic obstructive pulmonary disease (COPD) and asthma are advised to use pMDIs containing hydrofluoroalkanes (HFAs) as propellants, which have a high global warming potential. Honeywell Solstice Air uses hydrofluoroolefin propellant which has 99.9% less global warming potential compared to HFAs and is noncombustible, non-ozone-depleting and free from volatile organic compound as well.

This collaboration will allow the two companies to offer low greenhouse gas pMDIs to the patients. Also, the increased use of near-zero GWP propellant in the pMDIs will reduce the harmful effects of these life-saving medical treatments on the environment.

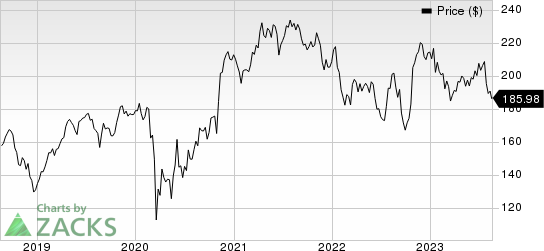

Honeywell International Inc. Price

Honeywell International Inc. price | Honeywell International Inc. Quote

Honeywell has invested more than $1 billion for research and development of the Solstice technology, which is used in refrigerants, blowing agents, aerosols and solvents. The use of this technology has reduced the potential release of 326 million metric tons of carbon dioxide into the air. This agreement between the two companies is aligned with HON’s goal to reduce carbon footprint on the environment.

Zacks Rank & Stocks to Consider

HON currently carries a Zacks Rank #3 (Hold). Some better-ranked companies are discussed below:

Caterpillar Inc. CAT presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

CAT’s earnings surprise in the last four quarters was 18.5%, on average. In the past 60 days, estimates for Caterpillar’s earnings have increased 9.5% for 2023. The stock has gained 40.6% in the past year.

A. O. Smith Corp. AOS presently carries a Zacks Rank #2 (Buy). AOS’ earnings surprise in the last four quarters was 10.5%, on average.

In the past 60 days, estimates for A. O. Smith’s earnings have increased 2.9% for 2023. The stock has gained 11.4% in the past year.

Alamo Group Inc. ALG presently carries a Zacks Rank of 2.ALG’s earnings surprise in the last four quarters was 13%, on average.

In the past 60 days, estimates for Alamo’s 2023 earnings have increased 1.1%. The stock has gained 24% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Honeywell International Inc. (HON) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report