Honeywell (HON) Rewards Shareholders With 5% Dividend Hike

In a shareholder-friendly move, Honeywell International HON has raised its quarterly dividend by approximately 5% to $1.08 per share (annually: $4.32). The move underscores the company’s sound financial health as it utilizes free cash flow to enhance shareholders’ returns.

The new dividend will be paid to shareholders on Dec 1, of record as of Nov 10. The dividend yield, based on the new payout and its Oct 2 closing price, is 2.4%.

The latest dividend hike marks Honeywell’s 14th consecutive raise since 2010. In the first six months of 2023, HON rewarded shareholders with $1.42 billion in dividends and $1.18 billion in share repurchases. Strong free cash flow generation supports the company’s shareholder-friendly activities. In the second quarter, free cash flow was $1.13 billion compared with $843 million in the year-ago period. The company expects free cash flow of $3.9-$4.3 billion for 2023.

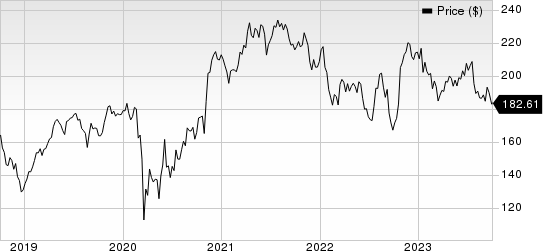

Honeywell International Inc. Price

Honeywell International Inc. price | Honeywell International Inc. Quote

Apart from repurchasing shares and paying out dividends, Honeywell deploys its capital to make acquisitions. Recently, the company completed the acquisition of Compressor Controls Corporation from INDICOR, LLC. The acquisition fortifies HON’s expertise in industrial control, automation and process solutions while simultaneously bolstering its sustainability portfolio with new carbon capture control solutions.

In July, HON entered into a deal to acquire SCADAfence, a provider of operational technology (OT) and Internet of Things cybersecurity solutions. The acquisition will expand Honeywell's OT cybersecurity portfolio in Tel Aviv, Israel, while simultaneously fortifying its existing capabilities in cybersecurity, offering customers enhanced security, reliability and efficiency. SCADAfence will be integrated into the Honeywell Forge Cybersecurity+ suite within Honeywell Connected Enterprise. The acquisition is expected to close in the second half of 2023.

Zacks Rank & Key Picks

Honeywell carries a Zacks Rank #3 (Hold).

Some better-ranked stocks within the broader Industrial Products sector are as follows:

Graham Corporation GHM currently flaunts a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of 243.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Graham has an estimated earnings growth rate of 400% for the current fiscal year. The stock has rallied around 68% so far this year.

Applied Industrial Technologies AIT currently sports a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 15%, on average.

Applied Industrial has an estimated earnings growth rate of 3.1% for the current fiscal year. The stock has gained 22.7% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Graham Corporation (GHM) : Free Stock Analysis Report