Honeywell (HON) Unveils FS24X Plus to Detect Hydrogen-Usage Risks

Honeywell International HON has unveiled a new infrared-based technology that helps in the early detection of hydrogen flames and prevents major fires.

HON’s FS24X Plus Flame Detector helps in the protection of workers and facilities from risks related to hydrogen production and use. The technology promotes clean hydrogen, which has a much lower carbon impact than traditional energy sources. It can also detect flames in rainy, foggy or smoky conditions, which makes it an important part of a comprehensive safety program for industrial facilities using hydrogen.

Honeywell aims to advance its sustainability goals by developing innovative technologies and collaborating with companies focused on sustainability. Last month, HON announced a strategic collaboration with energy storage company, ESS Tech, Inc. GWH to accelerate technology development and market adoption of iron flow battery (IFB) energy storage systems. As part of this agreement, HON has made an investment in ESS Tech.

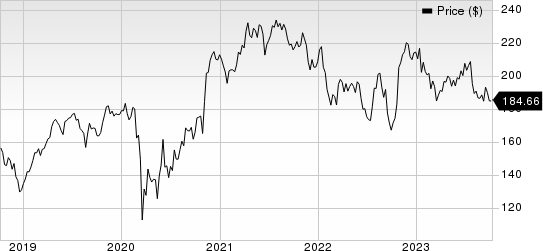

Honeywell International Inc. Price

Honeywell International Inc. price | Honeywell International Inc. Quote

ESS Tech provides safe, sustainable, long-duration energy storage to advance global decarbonization. Both Honeywell and ESS Tech carry a Zacks Rank #3 (Hold).

The partnership combines Honeywell’s advanced materials and energy systems expertise with ESS Tech’s market-leading and patented IFB design, building upon each company’s development of energy storage systems.

Key Picks

Below, we discuss some better-ranked stocks from the Diversified Operations industry:

Griffon Corporation GFF currently carries a Zacks Rank #2 (Buy). The company pulled off a trailing four-quarter earnings surprise of 30.4%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

Griffon has an estimated earnings growth rate of 7.6% for the current fiscal year. The stock has gained 10.2% in the year-to-date period.

Markel Group Inc. MKL is also a Zacks Rank #2 player. The company delivered a trailing four-quarter earnings surprise of 10%, on average.

Markel Group has an estimated earnings growth rate of 26% for the current year. The stock has gained 11.2% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Markel Group Inc. (MKL) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

ESS Tech, Inc. (GWH) : Free Stock Analysis Report