Honeywell (HON) Unveils HEM Upgrade for Boeing 737's APU

Honeywell International HON has introduced an upgrade for its 131-9B auxiliary power unit (APU) for Boeing 737 aircraft to reduce fuel consumption and carbon dioxide emissions.

The new High-Efficiency Mode (HEM) upgrade for Boeing 737 aircraft APU has an innovative diffuser controlled by software that autonomously regulates airflow to the APU compressor section. The upgrade is expected to provide fuel savings and lower carbon dioxide emissions by 1% to 2%, which is equivalent to a reduction of 0.5 to 0.6 gallons per APU hour. It is also anticipated to reduce fuel and maintenance costs by increasing time-on-wing by up to 1,500 APU flight hours.

Honeywell’s new HEM upgrade will help airlines reduce their carbon footprint and move forward in their goal of achieving net-zero emissions. With this upgrade, an airline with a fleet of 50 Boeing 737 aircraft can generate $450,000 in annual fuel savings, while also reducing up to 1,100 metric tons of carbon dioxide emissions. An increased time-on-wing will help airlines decrease servicing visits, producing an average savings of $315,000 for each avoided service visit.

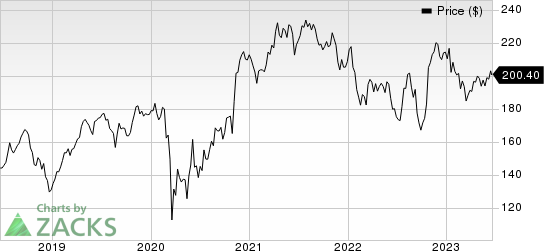

Honeywell International Inc. Price

Honeywell International Inc. price | Honeywell International Inc. Quote

The upgrade will be made available to all operators of Boeing 737-600, 737-700, 737-800, 737-900 and 737 MAX models with 131-9B APUs in the second half of this year. It can be installed during any regular scheduled maintenance event without any additional downtime to implement for newer 131-9B APUs (series 49 and above).

Zacks Rank & Key Picks

Honeywell presently carries a Zacks Rank #3 (Hold).

Some better-ranked industrial stocks are as follows:

Ingersoll Rand IR presently sports a Zacks Rank #1 (Strong Buy). The company delivered a trailing four-quarter earnings surprise of 12.6%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingersoll Rand has an estimated earnings growth rate of 14.8% for the current year. Shares of the company have jumped 53.5% in a year.

Graco GGG currently flaunts a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 7.9%, on average.

Graco has an estimated earnings growth rate of 16.4% for the current year. Shares of the company have rallied 44.5% in a year.

Flowserve FLS currently carries a Zacks Rank #2 (Buy). The company pulled off a trailing four-quarter earnings surprise of 2.5%, on average.

Flowserve has an estimated earnings growth rate of 64.5% for the current year. Shares of the company have gained 26.8% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report