Honeywell: Steady EPS Growth Expected, Shares Modestly Undervalued Following Acquisition News

Merger and acquisitions deals have been relatively few and far between in 2023. Higher interest rates, uncertain stock and bond markets and investors' preference for shoring up balance sheets have pressured corporate executives to shy away from sometimes-risky M&A moves.

Earlier this month, Honeywell International Inc. (NASDAQ:HON) announced plans to acquire Carrier's Global Access Solutions business for $5 billion. Honeywell has a history of strong execution, and the move could be significantly accretive to earnings within five years, said Bank of America.

I see shares of Honeywell slightly undervalued, while the technical picture is mixed. Let's dig into where things stand with this industrial conglomerate as we head into 2024.

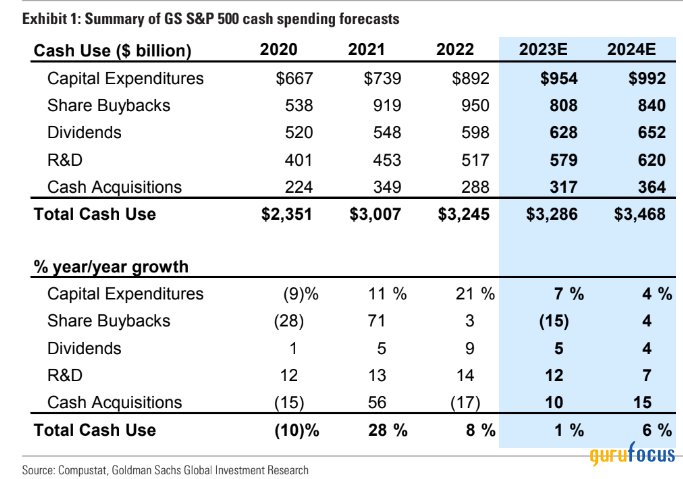

High Acquisition Case Use Expected in 2024, Says Goldman

Source: Goldman Sachs Investment Research

Company description

According to Bank of America Global Research, Honeywell International operates as a diversified technology and manufacturing company worldwide. Its operations include four segments: Aerospace, Home & Building Technologies, Safety & Productivity Solutions and Performance Materials & Technologies. The company is a major supplier of avionics, power and control systems for the aerospace industry.

Honeywell has a strong competitive position and pricing power, so key investments could be important assets during the next up cycle.

Key data

With a $128 billion market cap, the Charlotte, North Carolina-based industrial conglomerate trades at a near-market 21.3 forward 12-month non-GAAP price-earnings ratio and pays an above-market 2.2% dividend yield. Ahead of earnings in early February, shares trade with a very tame 14% implied volatility percentage while short interest on the stock is modest at just 1.2% as of Dec. 13.

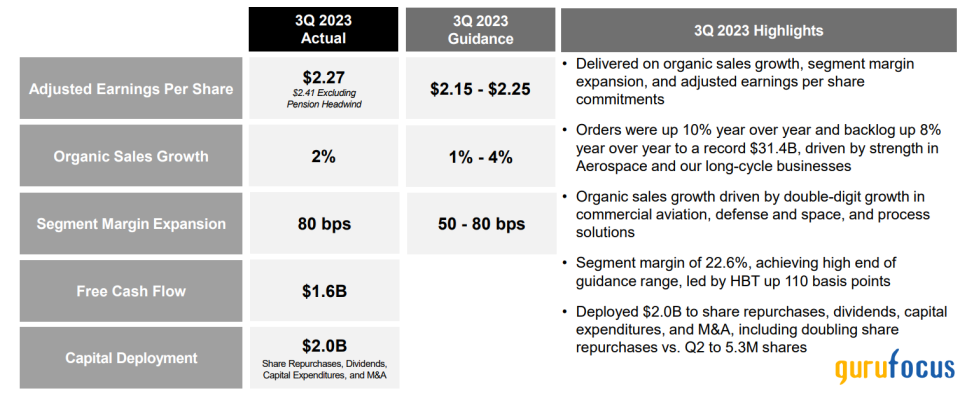

Earnings review

Back in October, Honeywell posted a solid third-quarter report. Quarterly non-GAAP earnings of $2.27 topped the consensus estimate of $2.23 while revenue of $9.2 billion was 2.8% higher compared to year-ago levels, a modest miss relative to the Wall Street forecast. The management team reported that new orders were up 10% while its backlog, a key metric for industrials sector companiess, increased 8% versus at the end of third-quarter 2021 to a record $31.4 billion aggregate figure.

Source: Honeywell IR

The strong quarter was driven by solid performance out of its Aerospace operations as well as effective cost-cutting efforts. In terms of the outlook, Honeywell narrowed its 2023 adjusted earnings per share outlook to the $9.10 to $9.30 range, which was in line with consensus expectations. The company refreshed its full-year sales outlook to be in the $36.8 billion to $37.1 billion range, supported by organic sales growth between 4% and 5% - near the consensus. Finally, free cash flow is now seen in the $3.9 billion to $5.3 billion range.

Competitor analysis

Compared to its peers, Honeywell's valuation is richer than the industry average, while its growth outlook is about on par with some of its rivals. Still, profitability is nearly the best in class despite the soft stock price momentum situation right now. Concerning me with the company versus its competitors is a sagging earnings per share revision trend, but a strong fourth quarter could help set the stage for upgrades into next year.

Risks

Key risks for the company include a weaker-than-expected macroeconomic environment in 2024 and poor execution on its cost-cutting efforts. Competition is fierce in many of its operating segments, so the management team's execution is another important variable.

Valuation

On valuation, analysts at Bank of America see earnings rising about 5% in the current fiscal year, which is wrapping up. Per-share profits are then expected to accelerate in 2024 and 2025, though. The current consensus expectation suggests that out-year EPS growth could come close to 10% while sales growth is seen rising about 5% per year, indicating solid operating leverage.

Dividends, meanwhile, are expected to rise at a steady clip over the coming quarters with a yield that could be on the rise should the stock price hold at current levels. The valuation is not all that cheap considering the low-20s earnings multiple and given its above-market enterprise value/Ebitda ratio. Still, free cash flow is solidly in the black with Honeywell, and the company has generated $5.75 of free cash flow per share in the last 12 months.

If we assume $10 of normalized earnings per share and apply the stock's five-year historical price-earnings ratoi of 23, then Honeywell should be near $230. We may want to temper that valuation somewhat given above-market price-sales and price-to-cash flow multiples, but even when discounting the valuation by 10%, we are still looking at a slightly undervalued, high-yielding blue chip.

Hon: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

Source: BofA Global Research

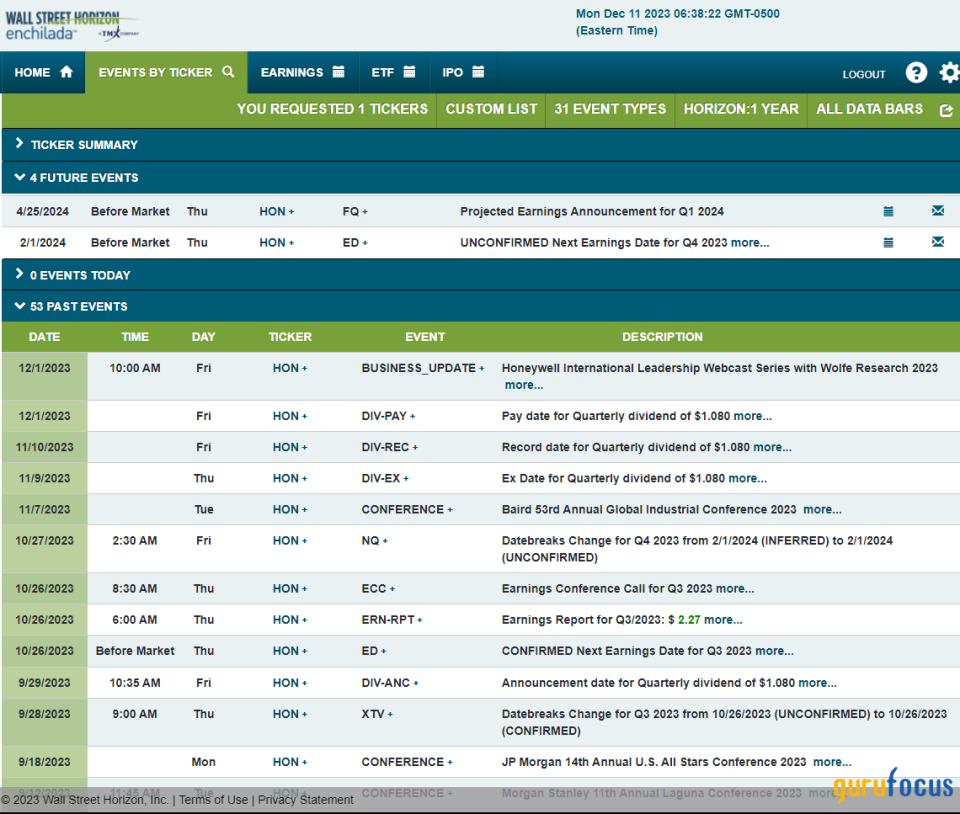

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed fourth-quarter 2023 earnings date of Thursday, Feb.1. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Source: Wall Street Horizon

The technical take

Honeywell bears were in control from the stock's peak in the middle of 2021 through a low notched more than a year ago. Notice in the chart below that a double bottom reversal pattern then took place between the second and third quarters, helping the bulls gain some momentum. The stock rallied through its 200-day moving average about a year ago, with the stock peaking just above $220 late in 2023. From there, it has been a series of lower highs, and Honeywell undercut its $183 to $184 support range during the worst of the October selloff just a handful of weeks ago. So, overall, the chart is somewhat messy.

Take a look at the downtrend resistance line off the all-time high from 2021. It currently comes into play around the $205 mark, while the long-term 200-day moving average is roughly flat in its slope, indicating no clear trend. I also noticed there is a high amount of volume by price between $180 and $220 that's further evidence the current zone could be rather sticky, a key battleground between the bulls and the bears. The good news is momentum has turned up recently the RSI momentum oscillator at the bottom of the chart hit a 52-week high earlier this month, which could portend a bullish price move.

Overall, it is a mixed chart, and Honeywell has underperformed the broad market in 2023. Long with a stop under the double-bottom low from last year could work, and resistance could be apparent up to the $220 spot.

HON: $220 resistance, double-bottom support near $167

Source: GuruFocus

The bottom line

Honeywell looks solid from an earnings growth standpoint in the quarters ahead. The M&A move is an encouraging sign, but the valuation suggests shares are not a screaming deal today. The technicals, meanwhile, are generally neutral.

This article first appeared on GuruFocus.