Honeywell's (HON) Q2 Earnings & Revenues Beat, Increase Y/Y

Honeywell International Inc.’s HON second-quarter 2022 adjusted earnings (excluding 26 cents from non-recurring items) of $2.10 per share surpassed the Zacks Consensus Estimate of $2.03. The bottom line improved approximately 4% year over year.

Total revenues of $8,953 million also outperformed the Zacks Consensus Estimate of $8,687.1 million. The top line increased roughly 2% from the year-ago quarter. Organic sales increased 4% due to growth in commercial aerospace, building products, advanced sensing technologies and advanced materials businesses.

Segmental Details

Aerospace’s quarterly revenues were $2,898 million, up 4.4% year over year. Honeywell Building Technologies’ revenues increased 9% to $1,531 million. Performance Materials and Technologies’ revenues totaled $2,694 million, up 6%, while that for Safety and Productivity Solutions decreased 12% to $1,829 million.

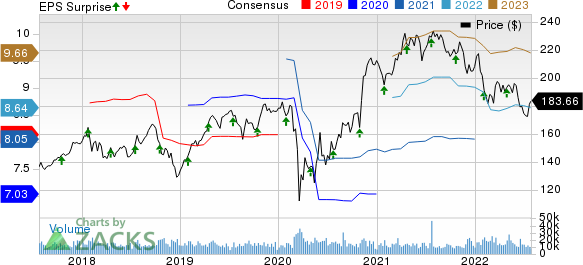

Honeywell International Inc. Price, Consensus and EPS Surprise

Honeywell International Inc. price-consensus-eps-surprise-chart | Honeywell International Inc. Quote

Costs/Margins

The company’s total cost of sales in the reported quarter was $6,046 million, up 0.7% year over year. Selling, general and administrative expenses were $1,306 million, up 8.2%. Interest expenses and other financial charges were $87 million compared with $83 million a year ago.

Operating income in the second quarter was $1,601 million, nearly flat on a year-over-year basis. The operating income margin was 17.9%, compared with 18.1% in the year-ago period. The downside was due to additional charges related to wind down of operations in Russia.

Balance Sheet/Cash Flow

Exiting the second quarter, Honeywell had cash and cash equivalents of $8,248 million compared with $10,959 million at the end of December 2021. Long-term debt was $12,491 million, lower than $14,254 million recorded at the end of 2021.

In the first half of 2022, HON generated $825 million in cash from operating activities compared with $2,256 million at the end of the year-ago period. Capital expenditures totaled $341 million in the first half of 2022 compared with $406 million incurred in the year-ago period.

Free cash flow in the quarter was $843 million, down 43% year over year.

Improved 2022 Guidance

Honeywell expects total sales of $35.50-$36.10 billion for the current year, compared with the previous expectation of $35.50-$36.40 billion. The Zacks Consensus Estimate for the same stands at $35.71 billion. Adjusted earnings per share is expected to increase 6-9% year over year (previous view: 5-9%) to $8.55-$8.80 ($8.50 - $8.80 expected earlier) in the current year. The mid-point — $8.66 — of the guided range lies above the Zacks Consensus Estimate of $8.64.

Honeywell anticipates organic growth of 5-7% for the current year, compared with 4-7% estimated earlier. Organic growth (excluding impact of COVID-driven mask sales declines and lost Russian sales) is expected to be 7-9% compared with 6-9% predicted earlier.

HON forecasts operating cash flow of $5.50-$5.90 billion compared with $5.70-$6.10 billion anticipated earlier. Free cash flow is expected to be $4.70-$5.10 billion compared with $4.70-$5.10 billion estimated earlier.

Zacks Rank & Key Picks

Honeywell carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering are as follows:

Griffon Corporation GFF sports a Zacks Rank #1 (Strong Buy). The company has an impressive earnings surprise history having outperformed the Zacks Consensus Estimate in three of the preceding four quarters, while missing in one. The average beat was 97%. You can see the complete list of today’s Zacks #1 Rank stocks.

Griffon has an estimated earnings growth rate of 117.6% for the current year. The stock gained 9.7% in a year’s time.

Greif GEF carries a Zacks Rank #1. The company’s earnings have surpassed the Zacks Consensus Estimate in each of the preceding four quarters, the average beat being 22.9%.

Greif has an estimated earnings growth rate of 36.8% for the current year. Shares of the company have rallied 13.4% in a year.

Titan International TWI flaunts a Zacks Rank #1. The company’s earnings have outperformed the Zacks Consensus Estimate in each of the trailing four quarters, the average beat being 56.4%.

Titan International has an estimated earnings growth rate of 164.7%. Shares of the company have surged 93.9% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Titan International, Inc. (TWI) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

To read this article on Zacks.com click here.