Hope Bancorp Inc (HOPE) Reports Q4 and Full-Year 2023 Financial Results

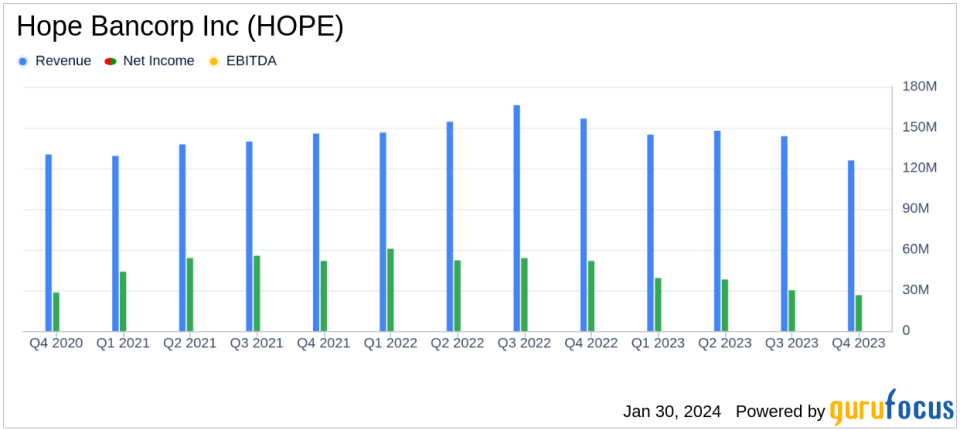

Net Income: Q4 net income of $26.5 million, or $0.22 per diluted share; full-year net income of $133.7 million, or $1.11 per diluted share.

Excluding Notable Items: Adjusted Q4 net income of $38.3 million, up 26% from Q3; adjusted earnings per diluted share of $0.32.

Net Interest Income: Decreased by 7% quarter-over-quarter to $125.9 million in Q4; net interest margin contracted to 2.70%.

Noninterest Income and Expense: Noninterest income grew by 12% to $9.3 million; noninterest expense was $99.9 million, including restructuring costs and FDIC special assessment.

Loan and Deposit Portfolios: Loans receivable decreased by 3% to $13.85 billion; total deposits fell by 6% to $14.75 billion.

Credit Quality: Nonperforming assets decreased by 26% to $45.5 million; net charge offs improved to 0.05% of average loans.

Capital Ratios: Common equity tier 1 capital ratio at 12.3%, total capital ratio at 13.9%, both showing year-over-year growth.

On January 30, 2024, Hope Bancorp Inc (NASDAQ:HOPE) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 31, 2023. The bank holding company, which offers a range of financial services to small and medium-sized businesses and individuals, reported a Q4 net income of $26.5 million, or $0.22 per diluted common share. The full-year net income stood at $133.7 million, or $1.11 per diluted common share.

Chairman, President, and CEO Kevin S. Kim highlighted the company's strategic reorganization and its impact on financial performance. Excluding the FDIC special assessment and restructuring charges, the adjusted net income for Q4 was $38.3 million, a 26% increase from the previous quarter. This growth was attributed to disciplined expense management and improved credit quality metrics, with nonperforming assets and criticized loans decreasing by 26% and 11%, respectively.

Financial Performance and Challenges

Despite the positive net income growth, Hope Bancorp faced challenges in the fourth quarter. Net interest income before provision for credit losses decreased by 7% to $125.9 million, and the net interest margin contracted by 13 basis points to 2.70%. This was due to a higher cost of interest-bearing deposits and a decrease in the average balance of loans, partially offset by higher yields on investment securities and other earning assets.

Noninterest income saw a 12% increase to $9.3 million, with growth across various fee income lines. However, noninterest expense for Q4 was $99.9 million, including $11.1 million of pre-tax restructuring costs and a $4.0 million FDIC special assessment. Excluding these items, noninterest expense was down 2% from the previous quarter.

Balance Sheet and Credit Quality

Hope Bancorp's balance sheet reflected a decrease in cash and cash equivalents to $1.93 billion, driven by a decrease in deposit balances. Loans receivable also decreased by 3% to $13.85 billion, with declines in commercial and commercial real estate loans, partially offset by growth in residential mortgage loans.

The company's credit quality improved, with nonperforming assets totaling $45.5 million, a 26% decrease from the previous quarter. Net charge offs for Q4 were a low five basis points, annualized, of average loans. The allowance for credit losses stood at $158.7 million, with an increased coverage ratio of 1.15% of loans receivable.

Capital Strength and Future Outlook

Hope Bancorp's capital ratios remained strong, with all regulatory risk-based capital ratios expanding. The common equity tier 1 capital ratio was 12.3%, and the total capital ratio was 13.9%. This robust capital position enables the bank to support customer growth plans for the new year.

The company's strategic reorganization is expected to enhance operational efficiency, support loan and deposit growth, and deliver improved returns, ultimately enhancing shareholder value over the long term. The bank's focus on serving its multi-ethnic customer base and expanding its full suite of financial services positions it well for future growth.

For more detailed financial information and to access the investor conference call, stakeholders can visit the Investor Relations section of Hope Bancorp's website.

Value investors and potential GuruFocus.com members interested in Hope Bancorp Inc's detailed financials can find further information in the accompanying financial tables and on the company's website.

Explore the complete 8-K earnings release (here) from Hope Bancorp Inc for further details.

This article first appeared on GuruFocus.