Horace Mann (HMN) Q4 Earnings and Revenues Beat, Shares Dip

Horace Mann Educators Corporation HMN incurred fourth-quarter 2022 adjusted loss of 6 cents per share, narrower than the Zacks Consensus Estimate loss of 11 cents. The bottom line compared unfavorably with $1.03 per share earned in the year-ago quarter. Shares of HMN lost 0.2% in the last three trading sessions, reflecting the soft performance.

The quarter suffered due to the disappointing results of the P&C segment, given inflationary pressures resulting in higher loss costs. However, better performance in the Supplemental and Group Benefit and Life and Retirement Benefit segment partially mitigated the volatility in P&C segment.

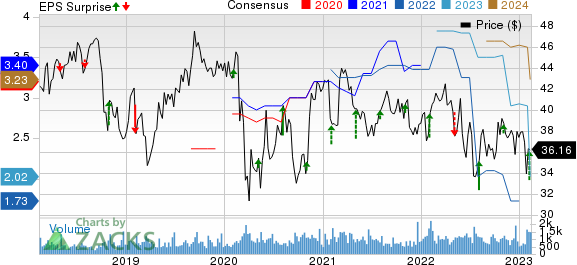

Horace Mann Educators Corporation Price, Consensus and EPS Surprise

Horace Mann Educators Corporation price-consensus-eps-surprise-chart | Horace Mann Educators Corporation Quote

Quarterly Operational Update

Total revenues of $346.8 million decreased 4.6% year over year in the quarter under review. The top line beat the consensus mark by 1.6%.

The net investment income of HMN deteriorated 12.2% year over year to $100.2 million in the fourth quarter.

Operating expenses increased 25.5% year over year to $86.2 million. Total benefits, losses and expenses increased 33.1%, attributable to higher benefits, claims and settlement expenses, interest credited, and interest expenses.

Catastrophe losses, net of reinsurance, were $9.8 million, wider than $8.8 million incurred in the year-ago quarter.

Quarterly Segmental Update

The Property & Casualty segment’s premiums written amounted to $153.5 million, which improved 4.7% year over year. The slight upside was due to improving average premiums for auto and property over the year. The segment contributed 47% to the total revenues in 2022.

The core loss totaled $25 million against a profit of $14.5 million in the year-ago quarter. The benefits of improving premiums were offset by persistently higher loss costs in the Property and Casualty segment.

The combined ratio deteriorated 2810 basis points year over year to 128.

The Supplemental and Group Benefit segment’s sales amounted to $4.5 million, which grew 104.5% year over year on the back of new employer-sponsored products, which contributed 75% to the total sales for the quarter. Adding to the positives was strong Worksite direct persistency at 90.4%. This segment contributed 21% to the total revenues in 2022.

Premiums earned from the segment skyrocketed 115.8% year over year to $68.2 million. Core earnings of $14.9 million improved 33% year over year in the quarter under review.

The Life and Retirement segment’s net annuity contract deposits inched up 0.8% year over year to $105 million in the fourth quarter. Life annualized sales grew 34.8% year over year to $3.1 million. Volatility in financial markets, coupled with inflationary trends, offset the gain from sales momentum, diversification of business and focus on the education market. Adding to the negatives were commercial mortgage loan portfolio returns declining in 2022 due to rising interest rates. The segment contributed 36% to the total revenues in 2022.

Core earnings from the segment amounted to $10.8 million, which deteriorated 49.5% year over year.

The segment witnessed a net investment income of $84.3 million, down 7.6% year over year.

Financial Position (as of Dec 31, 2022)

Total assets were $13,447 million, down from $14,384 million at 2021-end.

Horace Mann exited 2022 with shareholders’ equity of $1,088 million, which plunged from $1807 million at 2021-end.

HMN’s total debt amounted to $498 million, which decreased by a minuscule 0.9% from $502.6 million at 2021-end.

Annualized core return on equity (ROE) was a negative figure at 1.3%, a steep decline from 10.9% at 2021-end. Adjusted book value per share was $35.33.

As of Dec 31, 2022, HMN had $41.3 million remaining under its authorization. The insurer repurchased $2.3 million worth share this year through Feb 3.

Full-Year Results

Adjusted earnings per share of HMN plunged 69.6% year over year to $1.09.

Revenues of Horace Mann moved up 4% year over year to $1,382 million.

2023 Outlook

HMN anticipates full-year earnings per share of $2-$2.3. ROE is forecast to be 6%.

Net investment income is expected between $434 million and $444 million.

Core earnings of the Property & Casualty segment are anticipated to be $5-$10 million.

While core earnings for the Life & Retirement segment are projected to be $67-$70 million, the same for the Supplemental & Group Benefits segment is estimated to be $40-$44 million.

Long-Term Outlook

Horace Mann aims to achieve a double-digit ROE of 10% in 2024 and an average annual EPS growth of 10% in 2025 and thereafter.

Zacks Rank

Horace Mann currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Multi-Line Insurers

MGIC Investment Corporation MTG reported fourth-quarter 2022 operating net income per share of 64 cents, which beat the Zacks Consensus Estimate by 8.5% and our estimate of 59 cents. The reported figure increased 4.9% year over year. Insurance in force increased 7.6% from the prior-year quarter to $295.3 billion. The figure was higher than our estimate of $294.9 billion. The insurer witnessed a 20.7% decrease in primary delinquency to 26,387 loans.

Assurant Inc. AIZ reported fourth-quarter 2022 net operating income of $3.23 per share, which beat the Zacks Consensus Estimate by 24.7%. The bottom line increased 15% from the year-ago quarter. Total revenues were up 3.7% year over year to $2.7 billion, driven by higher net earned premiums and net investment income. The top line beat the Zacks Consensus Estimate by 1.2%.

MetLife MET reported fourth-quarter 2022 adjusted operating earnings of $1.55 per share, which missed the Zacks Consensus Estimate of $1.74 and our estimate of $1.77. The bottom line declined 29% year over year. Adjusted operating revenues of MetLife amounted to $15,836 million, which decreased 21.6% year over year. The top line missed the consensus mark of $16,996 million and our estimate of $16,303.1 million. Adjusted premiums, fees and other revenues, excluding pension risk transfer, were $11,375 million, down 1% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

MetLife, Inc. (MET) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Horace Mann Educators Corporation (HMN) : Free Stock Analysis Report