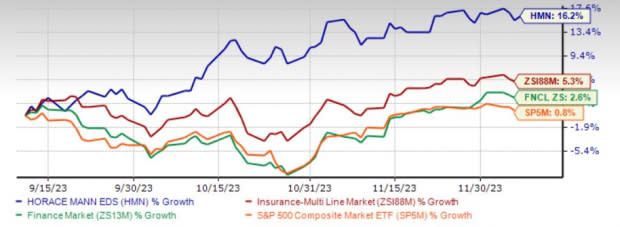

Horace Mann's (HMN) Up 16.2% in 3 Months: More Upside Left?

Horace Mann Educators Corporation’s HMN shares have gained 16.2% in the three months, outperforming the industry’s increase of 5.3%, the Finance sector’s rise of 2.6% and the Zacks S&P 500 Composite’s gain of 0.8%. With a market capitalization of $1.4 billion, the average volume of shares traded in the last three months was 0.2 million.

Strategic initiatives to fuel profitability, niche market focus and a solid capital position drive HMN shares. This Zacks Rank #2 (Buy) insurer delivered earnings surprise in the last four quarters, the average beat being 19.30%.

The largest financial services company serving the U.S. educator market expects to generate a return on equity of around 10% in 2024, banking on the strength of its diversified business.

Image Source: Zacks Investment Research

Can It Retain the Bull Run?

The Zacks Consensus Estimate for 2024 earnings per share (EPS) is pegged at $3.00, indicating an increase of 122.2% on 9.4% higher revenues of $1.6 billion. HMN estimates an average annual core EPS growth of 10% in 2025 and beyond.

Horace Mann’s compelling portfolio well-poise the insurer to capitalize on the solid opportunity in the K-12 educator market. A 4% increase in K-12 teachers is anticipated between 2023 and 2028. A demographic shift is expected as baby boomers retire and millennials make up a higher percentage of the workforce. The company stays focused on increasing its market share via a strong distribution model.

In fact, in 2023, the insurer aims for net premiums and contract charges earned to be primarily driven by Supplemental & Group Benefits. Also, banking on solid year-to-date performance, the company estimates Supplemental & Group Benefits segment core earnings between $52 million and $55 million in 2023.

Horace Mann remains focused on improving product offerings, better pricing, strengthening distribution and modernizing infrastructure. This, in turn, should help it deliver core earnings of $50 million-$60 million or $1.20 to $1.45 per share.

HMN is also on track to deliver earned premium growth ahead of loss cost growth thus improving the combined ratio for the company. It targets a long-term Auto combined ratio target of 97% to 98% by late 2024. The insurer bundled auto with home, with continuous improvement of Property & Casualty pricing segmentation. The company is on track to achieve a longer-term combined ratio target of 92% to 93% by 2025.

The company estimates generating about $50 million in excess capital annually to support growth initiatives, buy back shares and hike dividends.

Banking on operational excellence, Horace Mann increased its dividend for 15 straight years at a CAGR of 14%. Its current dividend yield of 4.2% is higher than the industry average of 2.8%. HMN targets a 50% dividend payout over the medium term.

Other Stocks to Consider

Some other top-ranked stocks from the insurance industry are Assurant Inc. AIZ, Everest Group, Ltd. EG and Enact Holdings ACT.

The Zacks Consensus Estimate for Assurant’s 2023 and 2024 earnings has moved 15.8% and 7% north, respectively, in the past 30 days. AIZ’s delivered a four-quarter average earnings surprise of 42.38%. Its shares have gained 34.1% year to date. It presently sports Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Everest Group delivered a four-quarter average earnings surprise of 24.50%. Year to date, EG’s shares have gained 15.8%. The Zacks Consensus Estimate for EG’s 2023 and 2024 earnings has moved north by 5.3% and 4.6%, respectively, in the past 30 days. It currently flaunts a Zacks Rank of 1.

Enact delivered a four-quarter average earnings surprise of 21.82%. Year to date, ACT’s shares have gained 13.6%. The Zacks Consensus Estimate for ACT’s 2023 and 2024 earnings has risen 4.9% and 1.1%, respectively, in the past 30 days. It presently carries Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Enact Holdings, Inc. (ACT) : Free Stock Analysis Report

Horace Mann Educators Corporation (HMN) : Free Stock Analysis Report

Everest Group, Ltd. (EG) : Free Stock Analysis Report