Horizon Technology Finance Corp Reports Mixed Results Amid Market Challenges

Net Investment Income: Q4 net investment income per share increased to $0.45, and $1.98 for the full year.

Net Asset Value (NAV): NAV per share declined to $9.71 as of December 31, 2023.

Portfolio Yield: Annual debt portfolio yield stood at 16.6% for 2023.

Committed Backlog: HRZN ended the year with a committed backlog of $218 million.

Distributions: Monthly distributions declared through June 2024, totaling $0.33 per share, with a special distribution of $0.05 per share payable in April 2024.

Investment Activity: Total investment income for 2023 increased by 43.3% to $113.5 million.

Liquidity: Available liquidity of $103.9 million as of December 31, 2023.

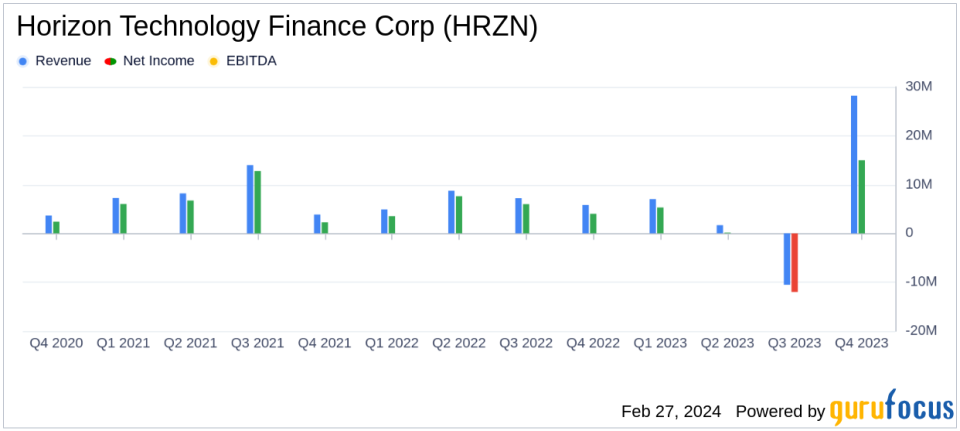

On February 27, 2024, Horizon Technology Finance Corp (NASDAQ:HRZN) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. HRZN is a specialty finance company that provides capital to venture capital-backed companies in various industries, including technology, life science, healthcare information and services, and sustainability.

Financial Performance and Challenges

HRZN's fourth quarter saw a rise in net investment income per share to $0.45, up from $0.40 in the same quarter of the previous year. For the full year, net investment income per share was $1.98, a significant increase from $1.46 in 2022. However, the company's NAV per share experienced a decrease, ending the year at $9.71 compared to $11.47 as of December 31, 2022. This decline in NAV was attributed to stressed investments in a challenging venture market.

Despite these challenges, HRZN's annual debt portfolio yield was strong at 16.6%, reflecting the company's ability to generate income from its debt investments. The company also declared regular monthly distributions totaling $0.33 per share through June 2024, with an additional special distribution of $0.05 per share payable in April 2024.

Financial Achievements and Importance

HRZN's financial achievements in 2023 include a 43.3% increase in total investment income to $113.5 million, driven by growth in interest and fee income on investments. This growth is significant for HRZN as it demonstrates the company's ability to expand its debt investment portfolio and capitalize on its investments, which is crucial for generating returns in the asset management industry.

Portfolio and Liquidity

As of December 31, 2023, HRZN's debt portfolio consisted of 56 secured loans with an aggregate fair value of $670.2 million, and the company held investments in 102 portfolio companies with an aggregate fair value of $38.9 million. The company maintained a solid liquidity position with $103.9 million in available liquidity, including cash and available funds under credit facility commitments.

Horizon's CEO, Robert D. Pomeroy, Jr., commented on the results, stating,

We capped 2023 with another quarter where our debt portfolio yield continued to generate net investment income that exceeded our distributions, while we originated new venture debt investments to add to our portfolio and committed backlog."

He also emphasized the company's focus on actively managing investments and maximizing capital recovery in a difficult market.

Analysis of HRZN's Performance

HRZN's performance in 2023 reflects its strategic focus on income generation and portfolio growth. The company's ability to maintain a high debt portfolio yield and increase its investment income is commendable. However, the decrease in NAV per share indicates the impact of market volatility and the need for vigilant management of investment risks. Going forward, HRZN's commitment to prudent portfolio growth and capital recovery will be key to navigating the uncertain venture market and sustaining its financial health.

For more detailed information and to view the full financial statements, investors and interested parties are encouraged to read the complete 8-K filing.

Horizon Technology Finance Corp will host a conference call on February 28, 2024, to discuss the financial results and corporate developments, providing an opportunity for investors to gain further insights into the company's performance and strategies.

Explore the complete 8-K earnings release (here) from Horizon Technology Finance Corp for further details.

This article first appeared on GuruFocus.