Horizon's (HZNP) Daxdilimab Fails to Meet Goal in Lupus Study

Horizon Therapeutics plc HZNP announced the failure of the phase II study evaluating daxdilimab for the treatment of systemic lupus erythematosus (SLE) to meet its primary endpoint of low SLE disease activity. Per the data readout, treatment with daxdilimab did not witness a statistically significant benefit over treatment with placebo in achieving a low SLE disease activity and reduction from the baseline oral glucocorticoid dose (OGC) at 48 weeks.

However, numerical differences were reportedly observed in other endpoints. Treatment with daxdilimab did not give rise to any safety concerns during the study. Management will assess the data from the study to determine the next steps for Horizon’s SLE clinical program.

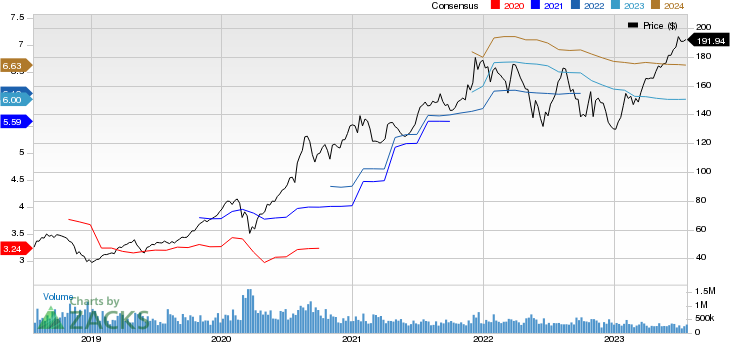

Year to date, shares of HZNP have decreased 11% compared with the industry’s 10% decline.

Image Source: Zacks Investment Research

Horizon’s investigational candidate, daxdilimab, is an anti-ILT7 human monoclonal antibody that depletes certain dendritic cells potentially stopping inflammation of those cells from damaging tissue. The company is evaluating daxdilimab for several other indications, including alopecia areata, discoid lupus erythematosus and lupus nephritis. Additionally, HZNP is also planning to investigate daxdilimab in treating dermatomyositis or anti-synthetase inflammatory myositis.

The phase II study evaluating daxdilimab for the treatment of SLE enrolled 214 patients with moderate-to-severely active SLE. The total patient population was randomized into three parallel arms, receiving either daxdilimab given subcutaneously 200 mg every four weeks, 200 mg every 12 weeks or placebo every four weeks. Additional endpoints of the study included other measures of lupus disease activity and reduction in OGC.

We would like to remind the investors that Horizon is set to be acquired by biotech giant Amgen AMGN for $116.5 per share in cash or $27.8 billion. In May 2023, the Federal Trade Commission (FTC) filed a lawsuit in Federal Court to halt Amgen’s $28 billion acquisition of Horizon.

Per the FTC, if the acquisition is allowed to go through, a large-cap giant like Amgen could leverage its position with insurance companies and pharmacy benefit managers to entrench the monopoly positions for two of Horizon's key products — Tepezza and Krystexxa. Per the agency, the drugs currently face little to no competition in the market and are sold at very high prices to patients.

Horizon, however, stated that the objective of the acquisition deal is to accelerate the availability of important rare disease medicines, with significant unmet needs, to more patients worldwide. HZNP also stated that it has no plans to bundle any of its rare disease medicines, thereby addressing the FTC’s potential concern.

The lawsuit has already postponed the date of closing the transaction from June-end to mid-December 2023.

Horizon Therapeutics Public Limited Company Price and Consensus

Horizon Therapeutics Public Limited Company price-consensus-chart | Horizon Therapeutics Public Limited Company Quote

Zacks Rank and Stocks to Consider

Horizon currently has a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the same industry are ADC Therapeutics ADCT and Acadia Pharmaceuticals ACAD, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for ADC Therapeutics’ 2023 loss per share has widened from $2.58 to $2.61. During the same period, the estimate for ADC Therapeutics’ 2024 loss per share narrowed from $2.72 to $2.45. Year to date, shares of ADCT have lost 63%.

ADCT beat estimates in three of the trailing four quarters, missing the mark on one occasion, delivering an average earnings surprise of 10.70%.

In the past 90 days, the Zacks Consensus Estimate for Acadia Pharmaceuticals’ 2023 loss per share has narrowed from 58 cents to 31 cents. The estimate for Acadia Pharmaceuticals’ 2024 earnings per share is pegged at 47 cents. Year to date, shares of ACAD have rallied 93.5%.

ACAD beat estimates in two of the trailing four quarters, missing the mark on other two occasions, delivering an average negative earnings surprise of 2.75%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amgen Inc. (AMGN) : Free Stock Analysis Report

ADC Therapeutics SA (ADCT) : Free Stock Analysis Report

Horizon Therapeutics Public Limited Company (HZNP) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report