Hormel Foods: Buy, Sell, or Hold?

Hormel Foods (NYSE: HRL) owns a collection of iconic food brands. But owning great brands isn't enough to make a company's stock worth buying -- the business has to put up good financial results, too. That is why Wall Street has been so negative on Hormel since the stock hit a high-water mark in 2022. Simply put, Hormel has stumbled in recent years. But this story looks like it is about to change for the better. Here's a look at the buy, sell, and hold continuum for Hormel, starting with the negative point of view and working to the positive.

The argument to sell Hormel

Starting with the bad news, Hormel's earnings were pretty dismal in 2023. You know it was bad because the company just listed the key numbers without comparing them to the prior year. To summarize, adjusted sales fell 2.8%, volume was off 4.2%, gross profit declined 7.6%, and earnings per share fell 11.4%. It was not the best year for Hormel.

The stock reacted pretty much as you would expect, with the shares dropping over 33% from their early-2022 highs. And the problems it faced are, well, still a work in progress. For example, Hormel hasn't been as successful at passing rising costs on to consumers. The turkey business continues to face headwinds from avian flu. The company bought Planters just as the nuts business was hitting a weak patch. And consumers in China haven't yet returned to pre-COVID lockdown buying patterns.

None of these problems is going away or easily solved. Hormel still has a lot of work ahead of it before the business is firing on all cylinders again. If you don't like owning businesses that are lagging behind their peers, you probably won't want to own Hormel. There are plenty of other food makers that are doing better, or at the very least face a smaller list of headwinds.

The argument to hold Hormel

If you have owned Hormel through this rough patch, however, now might not be the best time to abandon ship. The evidence for that is the sharp stock price increase following the release of fiscal first-quarter 2024 earnings. Essentially, it looks like there's a light at the end of the tunnel.

For example, volume rose across the business. Despite the tough operating environments in turkey and nuts, Hormel appears to be executing extremely well in these two areas. And China is starting to see a turnaround in the foodservice space, which at least hints that the country is starting to get back to normal life.

While Hormel is nowhere near the finish line with regard to these problems, it does appear like it is finally running in the same direction as the rest of the pack. It is probably worth sticking around for a few more quarters to see if the business upturn has some legs. If it does, Wall Street's mood will probably get more positive.

The argument to buy Hormel

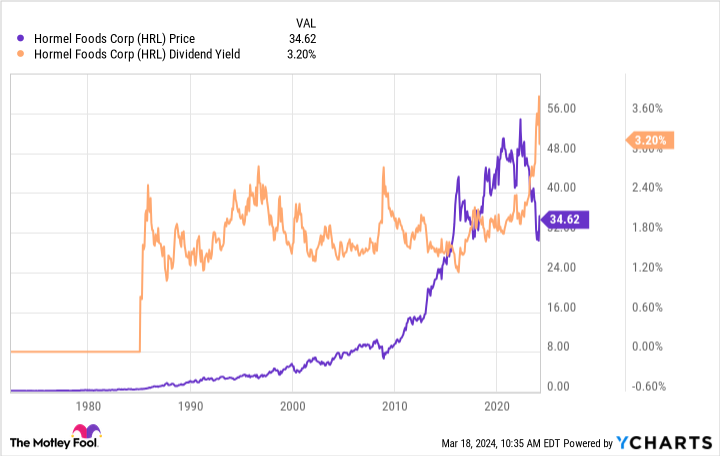

If you don't own Hormel, should you buy it? If you see the green shoots in the fiscal first-quarter results and believe that the future is going to be brighter than the recent past (and it couldn't be much worse), then the answer is a resounding yes. The reason for that is the historically attractive 3.3% dividend yield, which happens to be near the highest levels in the company's history.

Using dividend yield as a rough gauge of valuation, Hormel looks like it is on the sale rack. But don't stop with the dividend examination. Hormel is a Dividend King, with 57 consecutive years worth of dividend increases behind it. The last couple of years have seen mid-to-low-single-digit dividend growth, which makes sense given the headwinds. But over the past decade the dividend growth stood at 12% on average. When performance picks up again, dividend growth will likely follow suit.

In other words, if you buy now you are locking in a reliable dividend growth stock with a historically high yield. Even if it takes a few more quarters, or even years, for the company to really get its business growing strongly again, that's probably worth the (seemingly discounted) price of admission.

The facts lean toward buy

There's no way to predict the future, which is why investing is so frustrating. But Hormel has a long history of successfully navigating the ups and downs of the market. Right now it is in a down period, but it looks like the next up period could be starting soon. Wall Street, however, still seems overly caught up in the short term. You still have time to get into Hormel before Wall Street's view changes dramatically for the positive.

Should you invest $1,000 in Hormel Foods right now?

Before you buy stock in Hormel Foods, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Hormel Foods wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Reuben Gregg Brewer has positions in Hormel Foods. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Hormel Foods: Buy, Sell, or Hold? was originally published by The Motley Fool