Hormel Foods (HRL) Battles Supply-Chain Issues & High Costs

Hormel Foods Corporation HRL is in a dull spot thanks to an inflationary environment. The leading manufacturer and marketer of various meat and food products is witnessing supply-chain bottlenecks, which hurt its third-quarter fiscal 2023 results.

Let’s discuss this in detail.

Weak Performance

During the third quarter of fiscal 2023, Hormel Foods’ top and bottom lines lagged the Zacks Consensus Estimate. Net sales declined 2.3% year over year. The company saw reduced sales across all segments. Results were hurt by weakness in the International segment and supply-chain disruptions.

Net sales in the Retail unit decreased 1.7% to $1,891.7 million. In the Foodservice unit, net sales fell 3% to $890.9 million, somewhat attributed to lower net pricing in certain categories. Net sales in the International unit declined 6% to $180.6 million, attributable to reduced branded export sales and lower results in China.

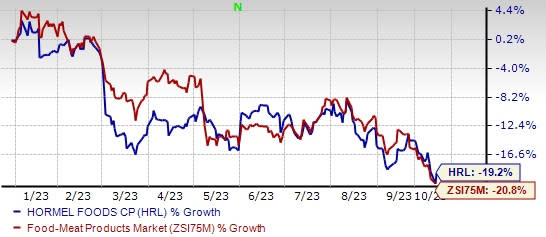

Image Source: Zacks Investment Research

Cost & Supply Chain Woes

The Zacks Rank #5 (Strong Sell) company continues to operate in a volatile, complex and high-cost environment. The company’s adjusted operating income was $286.8 million in the third quarter of fiscal 2023, 1.5% lower than last year. The downside can be attributed to the supply-chain disruption because of the third-party logistics provider shutdown. The company saw impacts from shortages, additional logistic costs and escalated distressed inventory levels.

Challenging Road Ahead

Management expects to witness continued weakness in the International segment, alongside earnings pressure from heightened competition in the Retail business in fiscal 2023. The company also expects overall consumer spending to remain under pressure in the United States due to the resumption of student loan payments

Hormel Foods projects fiscal 2023 net sales to be down 4% to flat year over year, reflecting to-date performance and expectations of raw material input costs in the fiscal fourth quarter. Fiscal 2023 adjusted earnings per share (EPS) are expected to be $1.61-$1.67, down from $1.82 reported in the year-ago period. The bottom line will likely decline year over year in the fiscal fourth quarter.

Final Thoughts

Hormel Foods is on track with strategic investments to boost its capacity. Focus on innovation, cost savings and automation also bode well. Management remains on track with initiatives like One Supply Chain, Project Orion and Digital Experience Group to aid growth.

Whether the upsides can help Hormel Foods stay afloat amid hurdles is yet to be seen.

The company’s shares have slumped 19.2% year-to-date compared with the industry’s 20.8% decline.

Top 3 Picks

Lamb Weston Holdings LW, a leading supplier of frozen potato, sweet potato, appetizer and vegetable products to restaurants and retailers worldwide, currently sports a Zacks Rank #1 (Strong Buy). LW has a trailing four-quarter earnings surprise of 46.2% on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales and earnings suggests growth of 27.4% and 20.1%, respectively, from the year-ago reported numbers.

Flowers Foods FLO emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Flowers Foods’ current financial year sales suggests growth of 6.7% from the year-ago period’s actuals. FLO has a trailing four-quarter earnings surprise of 7.6% on average.

The Kraft Heinz Company KHC, a food and beverage product company, currently carries a Zacks Rank #2. KHC has a trailing four-quarter earnings surprise of 11.3% on average.

The Zacks Consensus Estimate for Kraft Heinz’s current fiscal-year sales suggests growth of 2.2% from the corresponding year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hormel Foods Corporation (HRL) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report