Host Hotels' (HST) Q2 FFO & Revenues Lag, '23 View Narrowed

Shares of Host Hotels & Resorts, Inc. HST lost 4.13% in the after-hours trading in response to lower-than-anticipated second-quarter 2023 results.

Adjusted funds from operations (AFFO) per share of 53 cents lagged the Zacks Consensus Estimate of 56 cents. The figure fell 8.6% from the prior-year quarter.

Results reflect lower-than-anticipated revenues. Although growth in city center markets aided the rise in comparable hotel revenue per available room (RevPAR), moderating rates at the company’s resorts hurt it. It also narrowed its 2023 outlook.

Host Hotels generated total revenues of $1.39 billion, missing the Zacks Consensus Estimate of $1.42 billion. Also, the top line declined nearly 1% on a year-over-year basis.

Per James F. Risoleo, president and CEO of the company, “Our results were driven by improvements in the group business segment and continued rate strength across the portfolio, despite some moderation at our resort properties. Overall, transient demand was affected by headwinds in San Francisco and Seattle and elevated international outbound travel without a corresponding increase in international inbound travel, which led to RevPAR results below our second quarter guidance range.”

Behind the Headlines

Host Hotels’ comparable hotel RevPAR was $255.12 in the reported quarter, climbing 2.7% from the year-ago quarter’s $219.23. The same improved 6.2% from the second-quarter 2019 tally. The rise was backed by growth in city center markets, offset by moderating rates at its resorts. Our estimate for comparable hotel RevPAR for the quarter was pegged at $229.92.

Comparable hotel EBITDA came in at $449 million, falling 8.4% from $490 million reported a year ago. The figure, however, surpassed the second-quarter 2019 tally of $412 million.

The average room rate of $303.29 in the second quarter increased from $296.18 reported in the year-ago quarter. The figure also compared favorably with $258.56 reported in second-quarter 2019.

The comparable average occupancy percentage in the quarter was 74.2%, up 20 basis points from the prior-year quarter. However, the figure was lower than the comparable average occupancy of 81.9% in second-quarter 2019. We estimated comparable average occupancy to be 71.8% for the second quarter.

The room nights for its transient business fell 0.8% year over year. While the same for group business remained unchanged, contract businesses witnessed 12.6% growth from the prior-year period. Host Hotels’ transient, group and contract businesses accounted for roughly 65%, 32% and 3% of its 2022 room sales, respectively.

Balance-Sheet Position

Host Hotels exited second-quarter 2023 with cash and cash equivalents of $802 million, down from $563 million as of Mar 31, 2023.

HST’s liquidity totaled $2.5 billion, including FF&E escrow reserves of $213 million as of Jun 30, 2023. It had $1.5 billion available under the revolver portion of the credit facility as of the same date.

Capital Expenditure

As of Jun 30, 2023, Host Hotels’ capital expenditure aggregated $323 million. Of this, $97 million was the total return on investment project spend, $133 million was renewal and replacement expenditure, and $93 million was renewal and replacement insurable reconstruction.

2023 Outlook Narrowed

Host Hotels narrowed its outlook for 2023 based on its performance in the first half of the year and the macroeconomic backdrop for the second half of the year.

It now projects full-year AFFO to lie in the range of $1.82-$1.89, down from the prior-guided range of $1.84-$1.95. This suggests a negative 4 cents change at the midpoint. The Zacks Consensus Estimate for the same is presently pegged at $1.90.

The company lowered its comparable hotel RevPAR projection for the current year to $210-$214 from $211-$216 guided earlier. The adjusted EBITDAre is now estimated between $1.535 billion and $1.585 billion, down from $1.545 billion and $1.625 billion.

For 2023, management revised its expectations for total capital expenditure in the range of $625-$725 million from $600-725 million stated earlier.

Host Hotels currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

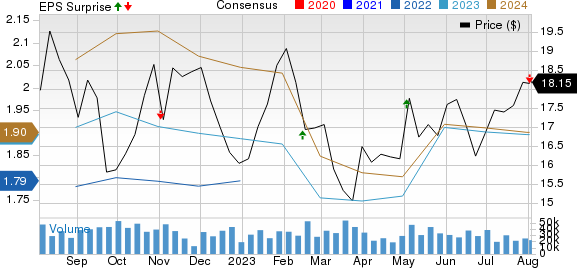

Host Hotels & Resorts, Inc. Price, Consensus and EPS Surprise

Host Hotels & Resorts, Inc. price-consensus-eps-surprise-chart | Host Hotels & Resorts, Inc. Quote

Performance of Other REITs

Healthpeak Properties, Inc. PEAK reported second-quarter 2023 FFO as adjusted per share of 45 cents, beating the Zacks Consensus Estimate by a whisker. The reported figure improved 2.3% from the year-ago quarter.

Results reflected better-than-anticipated revenues. Moreover, year-over-year improvement in same-store portfolio cash (adjusted) net operating income (NOI) was witnessed across the portfolio. PEAK revised its 2023 outlook.

Welltower Inc.’s WELL second-quarter 2023 normalized FFO per share of 90 cents surpassed the Zacks Consensus Estimate of 86 cents. The reported figure improved 4.7% from the prior-year quarter’s actual.

Results reflected better-than-anticipated revenues. The total same-store net operating income (SSNOI) increased year over year, driven by SSNOI growth in the seniors housing operating (SHO) portfolio. Welltower also raised its guidance for 2023 normalized FFO per share.

Equinix Inc.’s EQIX second-quarter 2023 AFFO per share of $8.04 surpassed the Zacks Consensus Estimate of $7.51. The figure improved 6.1% from the prior-year quarter.

EQIX’s results reflect steady growth in colocation and inter-connection revenues on the back of strong demand for digital infrastructure. The company also raised its AFFO per share guidance for 2023.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST) : Free Stock Analysis Report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

Healthpeak Properties, Inc. (PEAK) : Free Stock Analysis Report