Host Hotels & Resorts Inc: A Comprehensive Analysis of its Dividend Performance

Unpacking the Dividend History, Yield, Growth, and Sustainability of Host Hotels & Resorts Inc

Host Hotels & Resorts Inc(NASDAQ:HST) recently announced a dividend of $0.18 per share, payable on 2023-10-16, with the ex-dividend date set for 2023-09-28. As investors eagerly anticipate this forthcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. This article, utilizing data from GuruFocus, delves into Host Hotels & Resorts Inc's dividend performance and evaluates its sustainability.

Understanding Host Hotels & Resorts Inc

Warning! GuruFocus has detected 3 Warning Sign with HST. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

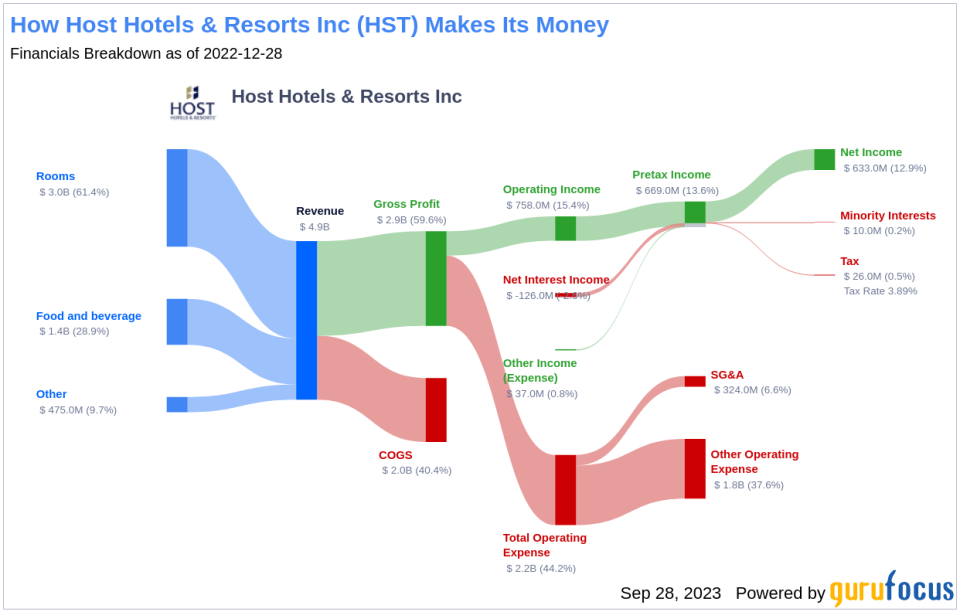

Host Hotels & Resorts owns 77 predominantly urban and resort upper-upscale and luxury hotel properties representing nearly 42,000 rooms, primarily in the United States. The company recently divested its interests in a joint venture owning a portfolio of hotels throughout Europe and other joint ventures that owned properties in Asia and the United States. The majority of Host's portfolio operates under the Marriott and Starwood brands.

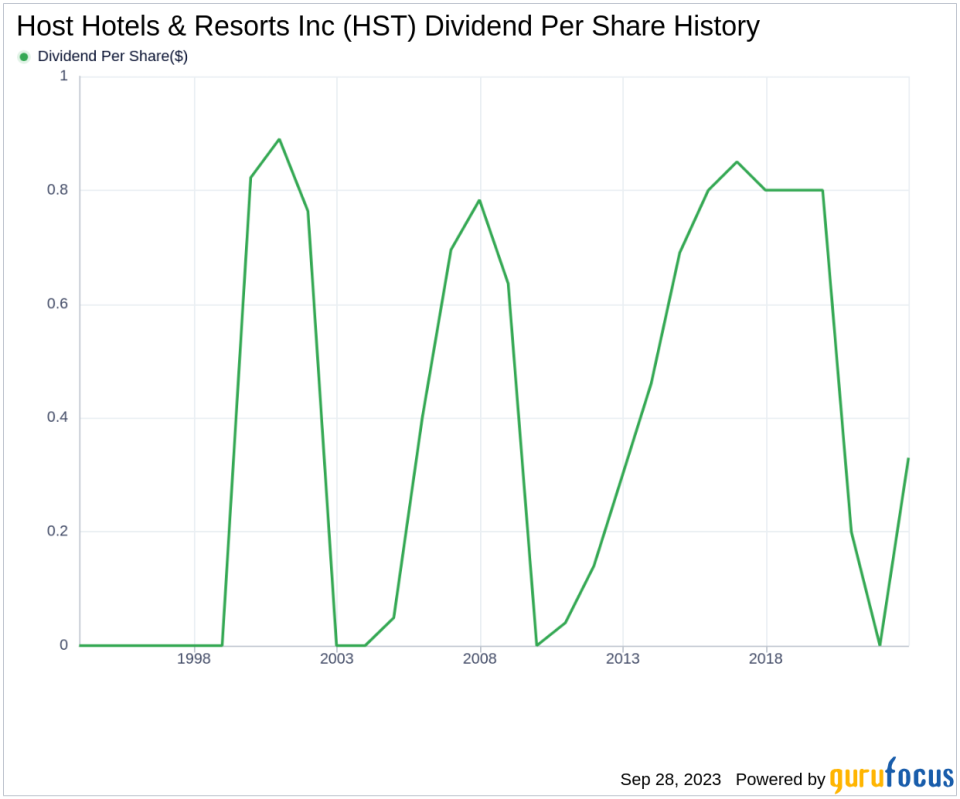

Tracing Host Hotels & Resorts Inc's Dividend History

Since 2022, Host Hotels & Resorts Inc has consistently paid out dividends on a quarterly basis. The chart below showcases the annual Dividends Per Share for tracking historical trends.

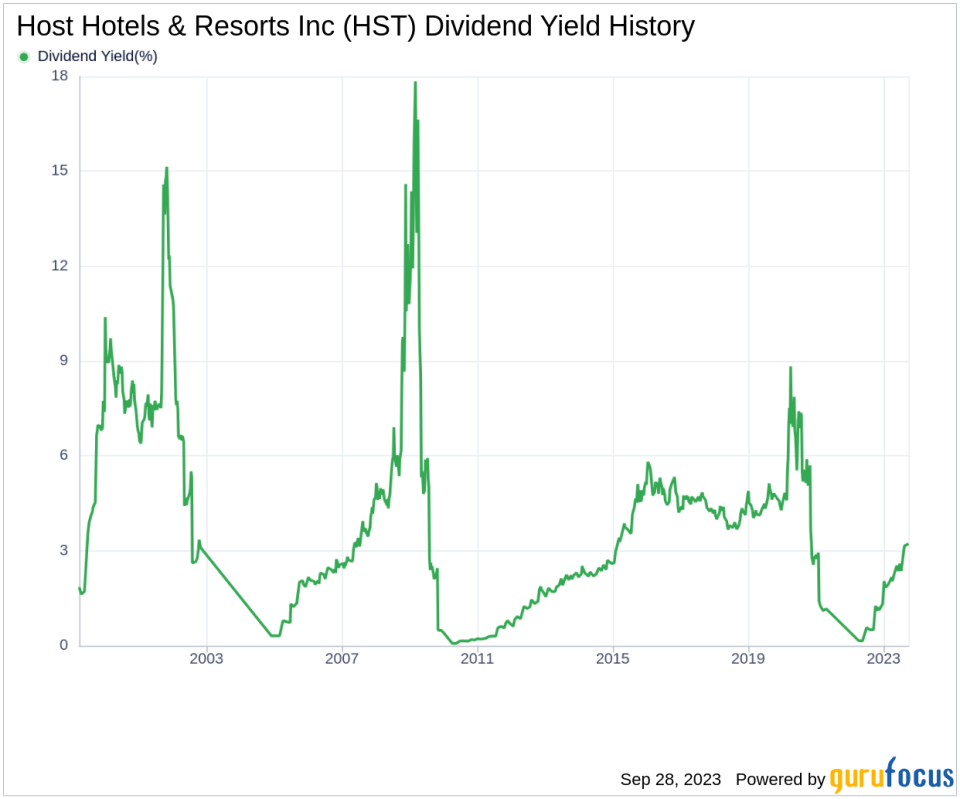

Decoding Host Hotels & Resorts Inc's Dividend Yield and Growth

Currently, Host Hotels & Resorts Inc has a 12-month trailing dividend yield of 3.19% and a 12-month forward dividend yield of 4.52%. This indicates an anticipated increase in dividend payments over the next 12 months.

In the past three years, Host Hotels & Resorts Inc's annual dividend growth rate was -25.60%. Based on the company's dividend yield and five-year growth rate, the 5-year yield on cost of Host Hotels & Resorts Inc stock is approximately 3.19% as of today.

Assessing Dividend Sustainability: Payout Ratio and Profitability

The sustainability of a dividend can be gauged by examining the company's payout ratio. The dividend payout ratio reveals the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-06-30, Host Hotels & Resorts Inc's dividend payout ratio is 0.48.

Host Hotels & Resorts Inc's profitability rank provides an understanding of the company's earnings prowess relative to its peers. As of 2023-06-30, GuruFocus ranks Host Hotels & Resorts Inc's profitability 6 out of 10, suggesting fair profitability. The company has reported net profit in 8 years out of the past 10 years.

Future Outlook: Examining Growth Metrics

A company must have robust growth metrics to ensure the sustainability of dividends. Host Hotels & Resorts Inc's growth rank of 6 out of 10 suggests that the company has a fair growth outlook.

Revenue is the lifeblood of any company, and Host Hotels & Resorts Inc's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. Host Hotels & Resorts Inc's revenue has increased by approximately -2.90% per year on average, a rate that underperforms approximately 67.92% of global competitors.

The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, Host Hotels & Resorts Inc's earnings increased by approximately -11.30% per year on average, a rate that underperforms approximately 71.96% of global competitors.

Conclusion

While Host Hotels & Resorts Inc has a consistent dividend payment history, its growth rate and profitability rank present a mixed picture. The company's payout ratio suggests a good balance between dividend payments and retained earnings. However, the negative growth rates in revenue and earnings per share indicate potential challenges in sustaining dividends in the long run. Therefore, investors should carefully consider these factors before making investment decisions.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.