Hotel REITs 2024: Golden Opportunity Or Fool's Gold?

As 2023 nears completion, investors in real estate investment trusts (REITs) are feeling more optimistic. After a prolonged slump throughout 2022 and the first 10 months of 2023, REITs have rallied over the past two months. Pauses in interest rate hikes, along with the likelihood of three interest rate cuts in 2024, have generated strong appreciation of REITs across multiple subsectors.

As investors look toward 2024, they will be forced to differentiate between REITs that will likely continue making gains from undervalued levels versus those that could struggle if the economy falls into recession.

Pyrite is a mineral commonly referred to as fool's gold for its strong resemblance to gold. Stocks can sometimes be fool's gold as well, luring in inexperienced investors with ultra-high-yield dividend traps. Another example of fool's gold is an inferior stock that piggybacks on a rally along with superior stocks from the same sector, only to fall back when that sector is no longer hot.

Don't Miss:

Investing in real estate just got a whole lot simpler. This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

Warren Buffett once said, "If you don't find a way to make money while you sleep, you will work until you die." Here are 3 high-yield investments to add significant income to your portfolio.

On Dec. 22, Wells Fargo Securities analyst Dori Kesten maintained positions on 10 different hotel REITs, while raising price targets on all of them. Only Pebblebrook Hotel Trust (NYSE:PEB) and Service Properties Trust (NASDAQ:SVC) have already reached or surpassed the new price targets. The new price target is still above the present share price of the other eight. These were the10 hotel REITs maintained by the analyst:

Name | Symbol | Rating Maintained | Previous Price Target | New Price Target |

Apple Hospitality REIT Inc. | APLE | Equal-Weight | $17 | $18 |

Diamondrock Hospitality Co. | DRH | Equal-Weight | $9 | $10 |

Host Hotels & Resorts Inc. | HST | Overweight | $20 | $22 |

Park Hotels & Resorts Inc. | PK | Equal-Weight | $15 | $17 |

Pebblebrook Hotel Trust | PEB | Equal-Weight | $14 | $16 |

RLJ Lodging Trust | RLJ | Equal-Weight | $11. | $12.50 |

Ryman Hospitality Properties Inc. | RHP | Overweight | $114 | $125 |

Service Properties Trust | SVC | Underweight | $6.75 | $7.50 |

Sunstone Hotel Investors Inc. | SHO | Underweight | $9.50 | $10 |

Xenia Hotels & Resorts Inc. | XHR | Equal-Weight | $13 | $14 |

Over the past 13 weeks, all of these REITs have performed well, but there are clear differences between them in longer-term performance.

Park Hotels & Resorts Inc. (NYSE:PK) is a Tysons, Virginia-based hotel REIT with more than 26,000 rooms in 43 hotels and resorts in prime U.S. markets with high barriers to entry. Properties in Hawaii account for 36% of its portfolio.

Park was established as an independent company in January 2017 following its spinoff from Hilton. In September 2019, Park acquired Chesapeake Lodging Trust to add premium-brand hotels and resorts in prime markets such as Miami, Boston, Los Angeles and San Francisco.

Although Park Hotels is the leading hotel REIT with a 41.44% gain over the past 13 weeks, it should be noted that it's still well below its pre-COVID and 2021 highs near $23.20.

Park Hotels is about to pay out two special cash dividends from two properties closed out of receivership, and that has recently helped its share price, but it's fool's gold when compared with Ryman Hospitality and Host Hotels. There is a good reason why the analyst has Ryman and Host Hotels rated as Overweight, while Park and the rest of the group are either Equal-Weight or Underweight.

Both Ryman Hospitality and Host Hotels have surpassed their previous pre-COVID levels. Ryman just touched an intra-day all-time high of $112.26 and Host Hotels is closing in on its all-time high of $20.54 from May 2022.

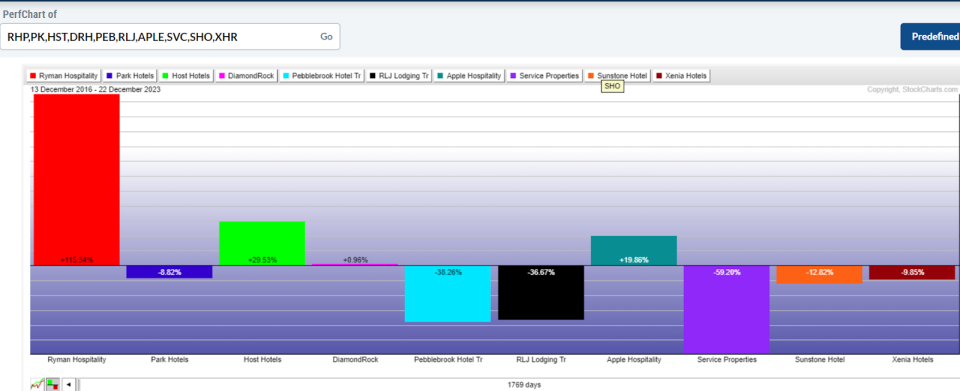

The performance chart below compares the 10 hotels over the last seven years. Notice that only three hotels, Ryman (red), Host (light green) and Apple (dark green), have positive performances (not including dividends). The 115.34% gain for Ryman is superior to all others.

(Chart courtesy of stockcharts.com)

Ryman Hospitality Properties Inc. (NYSE:RHP) is a Nashville, Tennessee-based hotel REIT that specializes in large, upscale convention center resorts and entertainment venues. Its portfolio of nine hotels includes over 10,400 rooms and almost three million square feet of meeting spaces. Ryman also has a 70% controlling ownership interest in Opry Entertainment Group, which owns the Grand Ole Opry and other entertainment attractions.

On Dec. 14, JP Morgan analyst Joseph Greff upgraded Ryman Hospitality from Underweight to Neutral and raised the price target from $89 to $102. At a recent closing price of $110.38, Ryman has surpassed that target.

Ryman Hospitality Partners has risen 35.05% over the past 13 weeks.

Host Hotels & Resorts Inc. (NYSE:HST) is a Bethesda, Maryland-based hotel REIT with 77 hotels containing 42,000 rooms in large markets across the U.S. Host Hotels is the only lodging REIT in the S&P 500 and has been in the index since 2007. Its hotel brands include Marriott, Hyatt, Four Seasons and Hilton.

On Dec. 15, Host Hotels & Resorts announced an 11% increase in its fourth-quarter dividend from $0.18 to $0.20 per share and a special dividend of $0.25 per share. The dividend is payable on Jan. 16 to shareholders of record on Dec. 29. The ex-dividend date is Dec. 28.

Host Hotels & Resorts was up 25.13% over the past 13 weeks.

Apple Hospitality REIT Inc. (NYSE:APLE) is a Richmond, Virginia-based hotel REIT formed in 2007. It has 29,600 rooms in 224 hotels across 37 states. Its portfolio includes 99 Marriott, 120 Hilton and five Hyatt hotels.

Apple was the laggard of the group, up only 9.66%. However, that's deceiving because unlike many of the other hotel REITs that touched lows in October, Apple Hospitality bottomed out in March and has since risen 26.2%.

Hotel REITs as a group have seen increases in revenue per available room (RevPAR) in 2023, which has contributed to improving share prices in the fourth quarter. In general, REITs are helped by declining interest rates as it allows them to refinance outstanding or maturing debt at lower costs.

With the possibility of a mild or moderate recession in 2024, hotel REITs could suffer declines in RevPAR as businesses and consumers curtail travel plans. It's far less expensive for businesses to use Zoom meetings than to pay for multiple employees to travel to a central location for a meeting.

The recent gains in hotel REITs could be tempered in 2024, depending on the degree to which the economy slows. Investors are cautioned that several of the hotel REITs above may appear from recent performance to be ready to continue with large gains in 2024, but it could just be fool's gold. The best way to invest in hotel REITs in 2024 might be to buy a basket of stocks with only the strongest long-term performers: Ryman Hospitality, Host Hotels & Resorts and Apple Hospitality.

Weekly REIT Report: REITs are one of the most misunderstood investment options, making it difficult for investors to spot incredible opportunities until it's too late. Benzinga's in-house real estate research team has been working hard to identify the greatest opportunities in today's market, which you can gain access to for free by signing up for the Weekly REIT Report.

Read Next:

Elon Musk has reportedly bought 6,000 acres of land just outside of Austin. Here’s how to invest in the city’s growth before he floods it with new tech workers.

Commercial real estate has historically outperformed the stock market, but few investors have the capital or resources needed to invest in this asset class. A platform backed by industry giant Marcus & Millichap is changing that, allowing individuals to invest in commercial real estate with as little as $5,000.

Collecting passive income from real estate just got a whole lot simpler. A new real estate fund backed by Jeff Bezos gives you instant access to a diversified portfolio of rental properties, and you only need $100 to get started.

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Hotel REITs 2024: Golden Opportunity Or Fool's Gold? originally appeared on Benzinga.com

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.