Houlihan Lokey Inc CFO J Alley Sells 10,000 Shares

In a notable insider transaction, J Alley, the Chief Financial Officer of Houlihan Lokey Inc, sold 10,000 shares of the company on November 30, 2023. This move has caught the attention of investors and analysts, as insider sales can provide valuable insights into a company's financial health and future prospects.

Who is J Alley of Houlihan Lokey Inc?

J Alley serves as the Chief Financial Officer of Houlihan Lokey Inc, a global investment bank with expertise in mergers and acquisitions, capital markets, financial restructuring, and valuation. The CFO plays a critical role in the financial management of the company, overseeing the fiscal operations and strategy. J Alley's position grants a comprehensive view of the company's financial landscape, making their trading activities particularly noteworthy to the market.

Houlihan Lokey Inc's Business Description

Houlihan Lokey Inc is a prominent investment banking firm that provides a wide array of financial services to corporations, institutions, and governments worldwide. The company's core areas of service include financial advisory services, corporate finance, and financial restructuring. With a strong focus on middle-market companies, Houlihan Lokey has established itself as a leader in M&A advisory, consistently ranking among the top firms in transaction volume. The firm's expertise in complex financial transactions and its commitment to providing personalized service have contributed to its reputation as a trusted advisor in the financial industry.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading activities, such as the recent sale by J Alley, can be a double-edged sword when it comes to interpreting their impact on a company's stock price. On one hand, a sale might suggest that the insider believes the stock is fully valued or potentially overvalued, prompting them to lock in profits. On the other hand, insiders might sell shares for personal reasons that have no bearing on their outlook for the company.

Over the past year, J Alley has sold a total of 10,000 shares and has not made any purchases. This one-sided activity could be interpreted as a lack of confidence in the company's future growth or valuation. However, without additional context, it is difficult to draw definitive conclusions.

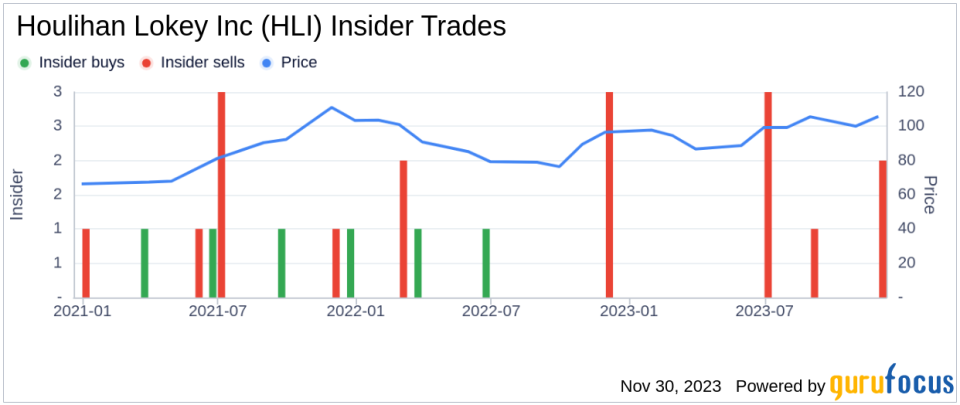

The insider transaction history for Houlihan Lokey Inc shows a trend of more insider selling than buying over the past year, with 6 insider sells and 0 insider buys. This pattern may raise questions among investors about the insiders' collective sentiment towards the stock.

On the valuation front, Houlihan Lokey Inc's shares were trading at $107.48 on the day of J Alley's sale, giving the company a market cap of $7,431.080 million. The price-earnings ratio of 27.24 is higher than both the industry median of 18.09 and the company's historical median, suggesting a premium valuation compared to its peers.

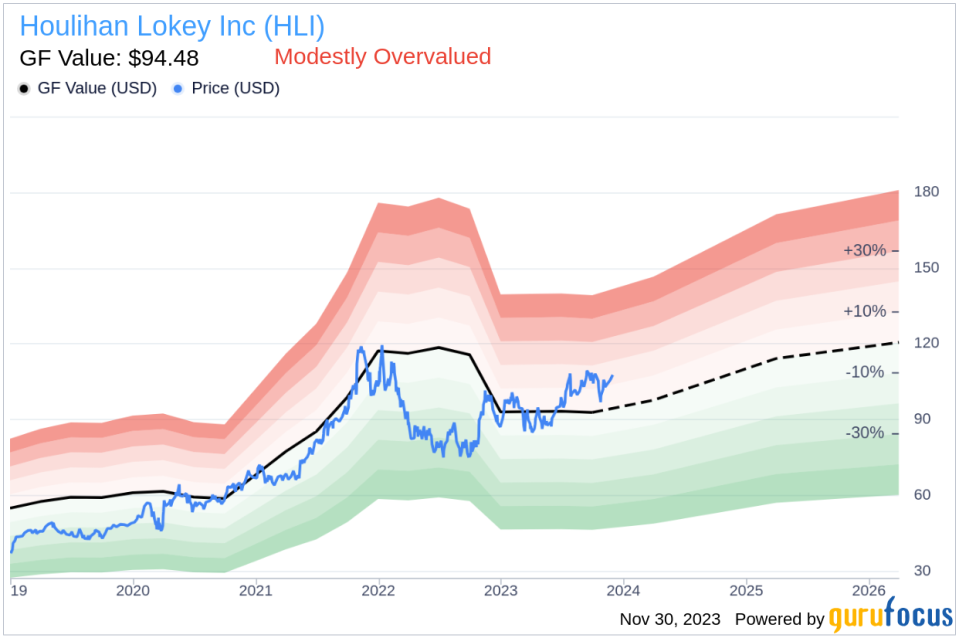

Moreover, with a price-to-GF-Value ratio of 1.14, the stock appears to be modestly overvalued based on its GF Value of $94.48. This valuation metric indicates that the stock's current price exceeds its estimated intrinsic value, which could be another factor influencing insider selling decisions.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. While this is a comprehensive approach, it is important to remember that intrinsic value estimates are not infallible and should be used as one of many tools in an investor's analysis.

Conclusion

The recent insider sale by CFO J Alley of Houlihan Lokey Inc may raise some eyebrows among investors, particularly given the company's current valuation metrics. While the insider's actions could be interpreted as a lack of confidence in the stock's future appreciation, it is essential to consider the broader context, including the company's financial performance, market conditions, and individual circumstances of the insider.

Investors should weigh insider trading patterns alongside other fundamental and technical analyses to make informed decisions. As always, a single insider transaction should not be the sole basis for any investment decision, but rather a piece of the puzzle that investors must put together to see the complete financial picture.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.