Houlihan Lokey Inc (HLI) Reports Growth in Q3 Fiscal 2024 Earnings

Revenue: Increased to $511 million in Q3 FY24, up from $456 million in Q3 FY23.

Net Income: Rose to $71 million, or $1.04 per diluted share, compared to $63 million, or $0.90 per diluted share in the prior year.

Adjusted EPS: Adjusted diluted EPS was $1.22, up from $1.14 year-over-year.

Dividend: Announced a dividend of $0.55 per share for Q4 FY24.

Segment Performance: Corporate Finance revenues grew by 6%, Financial Restructuring by 30%, and Financial and Valuation Advisory by 9%.

Effective Tax Rate: Increased to 31.0% in Q3 FY24 from 24.6% in Q3 FY23.

Balance Sheet: $591 million in cash and cash equivalents and investment securities as of December 31, 2023.

Houlihan Lokey Inc (NYSE:HLI) released its 8-K filing on February 2, 2024, detailing its financial results for the third quarter ended December 31, 2023. The investment bank, known for its expertise in mergers and acquisitions, capital markets, financial restructuring, valuation, and strategic consulting, operates in three segments: Corporate Finance, Financial Restructuring, and Financial and Valuation Advisory Services.

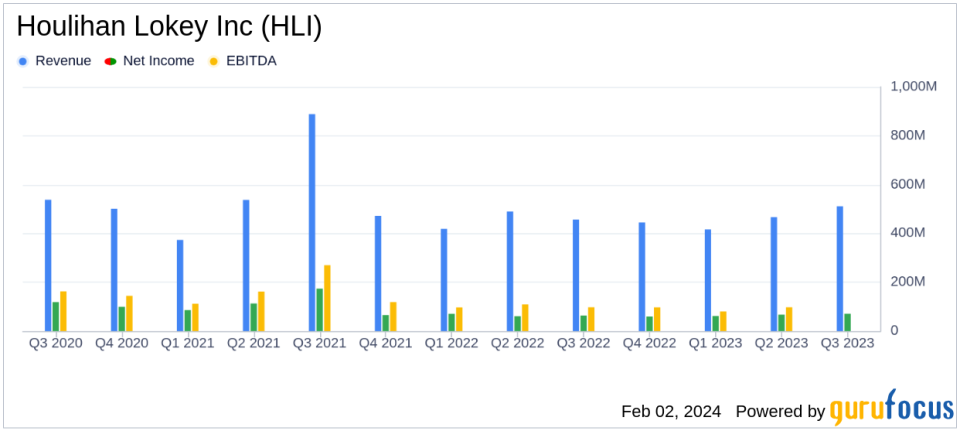

The company reported a revenue increase to $511 million, up from $456 million in the same quarter of the previous year. This growth reflects a 9% increase in revenues compared to the second fiscal quarter, signaling improvements in the M&A markets. Net income for the quarter was $71 million, or $1.04 per diluted share, an increase from $63 million, or $0.90 per diluted share, in the third quarter of the previous fiscal year. Adjusted net income was also up, reaching $84 million, or $1.22 per diluted share, compared to $79 million, or $1.14 per diluted share, year-over-year.

Segment Breakdown and Financial Highlights

Each of Houlihan Lokey's business segments contributed to the revenue growth. Corporate Finance revenues increased by 6% to $311 million, Financial Restructuring revenues surged by 30% to $129 million, and Financial and Valuation Advisory revenues grew by 9% to $72 million. The company's CEO, Scott Beiser, highlighted the firm's industry recognition, including being named the No. 1 M&A advisor globally based on the number of completed transactions.

Employee compensation and benefits expenses rose to $324 million, in line with the increase in revenues. Non-compensation expenses also increased, primarily due to higher professional fees and rent expenses. The provision for income taxes for the quarter was $32 million, representing an effective tax rate of 31.0%, up from 24.6% in the previous year, mainly due to increased state taxes and taxes related to foreign operations.

Strategic Positioning and Future Outlook

Despite the challenges posed by the market environment, Houlihan Lokey's performance demonstrates its strategic positioning and ability to navigate complex financial landscapes. The company's diversified service offerings and global reach continue to drive growth and create long-term value for shareholders. With the announcement of a regular quarterly cash dividend of $0.55 per share, the company reaffirms its commitment to delivering shareholder returns.

As of December 31, 2023, Houlihan Lokey had a robust balance sheet with $591 million in cash and cash equivalents and investment securities, and $50 million in other liabilities. This financial stability positions the firm to capitalize on market opportunities and support its growth initiatives.

Investors and analysts interested in further details are invited to join the company's conference call and webcast scheduled for 5:00 p.m. Eastern Time on February 1, 2024.

For value investors and potential GuruFocus.com members, Houlihan Lokey's latest earnings report underscores the company's resilience and adaptability in a dynamic market. The firm's consistent performance and strategic market positioning make it a noteworthy consideration for investment portfolios focused on the capital markets industry.

For more information on Houlihan Lokey's financial results and strategic direction, please visit the company's website or refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Houlihan Lokey Inc for further details.

This article first appeared on GuruFocus.