Household Products Stocks Q4 Earnings Review: Clorox (NYSE:CLX) Shines

Looking back on household products stocks' Q4 earnings, we examine this quarter's best and worst performers, including Clorox (NYSE:CLX) and its peers.

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

The 10 household products stocks we track reported a strong Q4; on average, revenues beat analyst consensus estimates by 2.3% Inflation (despite slowing) has investors prioritizing near-term cash flows, but household products stocks held their ground better than others, with the share prices up 6.1% on average since the previous earnings results.

Best Q4: Clorox (NYSE:CLX)

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE:CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

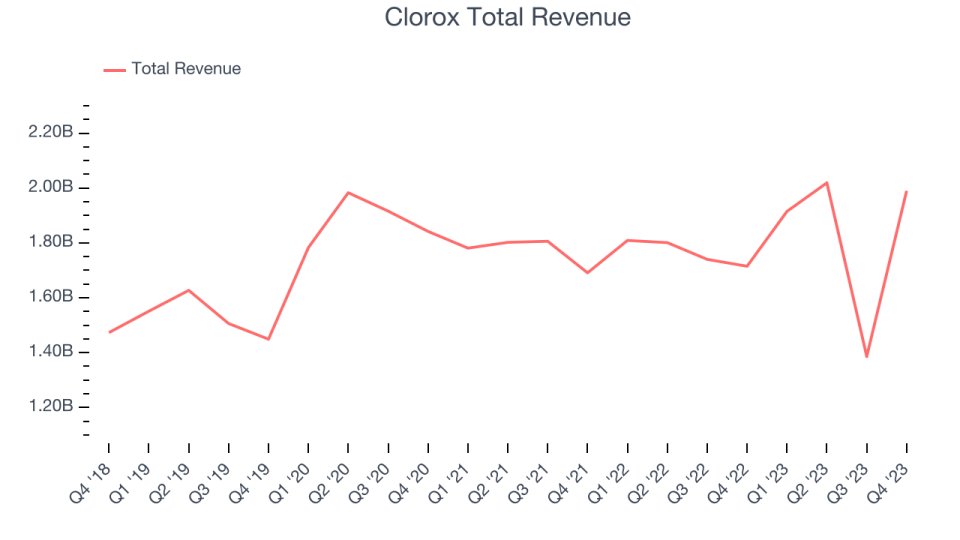

Clorox reported revenues of $1.99 billion, up 16% year on year, topping analyst expectations by 10.3%. It was an incredible quarter for the company, with an impressive beat of analysts' earnings estimates, although some large one-time charges that were added back to arrive at the EPS (non-GAAP) figure likely made it difficult for Wall Street to model and project. In addition, its revenue and gross margin outperformed Wall Street's estimates.

"Our second quarter results reflect strong execution on our recovery plan from the August cyberattack," said Chair and CEO Linda Rendle.

Clorox achieved the biggest analyst estimates beat and fastest revenue growth of the whole group. The stock is up 1.7% since the results and currently trades at $150.55.

Is now the time to buy Clorox? Access our full analysis of the earnings results here, it's free.

Spectrum Brands (NYSE:SPB)

A leader in multiple consumer product categories, Spectrum Brands (NYSE:SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

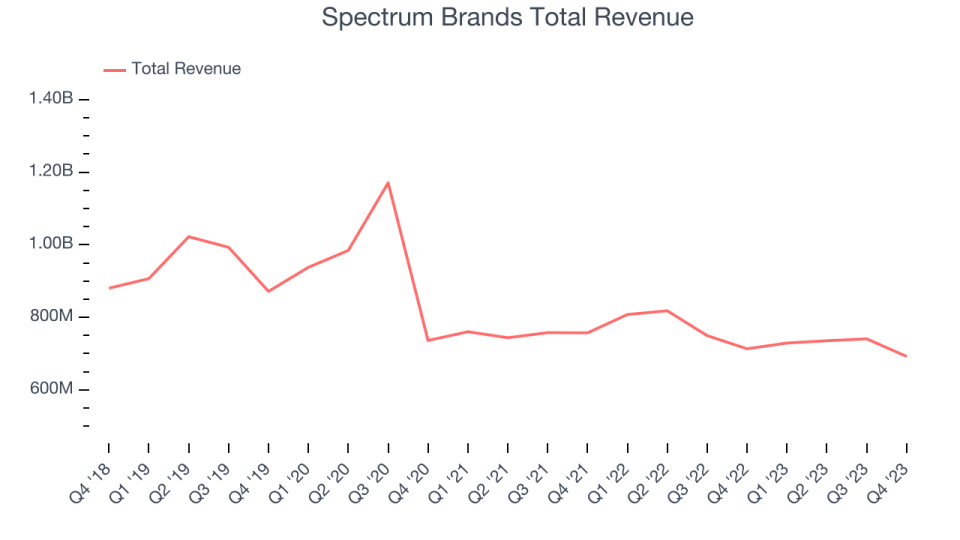

Spectrum Brands reported revenues of $692.2 million, down 3% year on year, outperforming analyst expectations by 2.8%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings estimates. While a raise of full year guidance would have been icing on the cake, the company's maintenance of its previous outlook shows that Spectrum Brands is staying on track.

The stock is up 11.6% since the results and currently trades at $89.25.

Is now the time to buy Spectrum Brands? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Kimberly-Clark (NYSE:KMB)

Originally founded as a Wisconsin paper mill in 1872, Kimberly-Clark (NYSE:KMB) is now a household products powerhouse known for personal care and tissue products.

Kimberly-Clark reported revenues of $4.97 billion, flat year on year, falling short of analyst expectations by 0.5%. It was a weak quarter for the company, with a miss of analysts' operating margin and EPS estimates due to $170 million of currency headwinds from its developing markets experiencing hyperinflation.

Kimberly-Clark had the weakest performance against analyst estimates in the group. The stock is up 1.6% since the results and currently trades at $126.88.

Read our full analysis of Kimberly-Clark's results here.

Church & Dwight (NYSE:CHD)

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE:CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

Church & Dwight reported revenues of $1.53 billion, up 6.4% year on year, surpassing analyst expectations by 1.1%. It was a mixed quarter for the company, with an impressive beat of analysts' organic revenue growth estimates but underwhelming earnings guidance for the next quarter.

The stock is up 2.2% since the results and currently trades at $104.

Read our full, actionable report on Church & Dwight here, it's free.

Procter & Gamble (NYSE:PG)

Founded by candle maker William Procter and soap maker James Gamble, Proctor & Gamble (NYSE:PG) is a consumer products behemoth whose product portfolio spans everything from facial tissues to laundry detergent to feminine care to men’s grooming.

Procter & Gamble reported revenues of $21.44 billion, up 3.2% year on year, falling short of analyst expectations by 0.3%. It was a mixed quarter for the company, with volume and organic growth falling short of expectations, leading to a slight revenue miss. However, EPS beat and full year guidance was raised and now stands above Consensus expectations.

The stock is up 9.9% since the results and currently trades at $162.5.

Read our full, actionable report on Procter & Gamble here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.