Hovnanian Enterprises Inc (HOV) Reports Strong Fiscal 2024 First Quarter Results

Total Revenues: Increased by 15.3% to $594.2 million year-over-year.

Net Income: Rose to $23.9 million, or $2.91 per diluted common share.

Income Before Income Taxes: Jumped 80.4% to $32.6 million year-over-year.

Homebuilding Gross Margin: Remained stable at 21.8% before cost of sales interest expense and land charges.

Contracts: Consolidated contracts increased 43.0% to 1,127 homes.

SG&A Expenses: Excluding phantom stock expense, was 13.2% of total revenues.

Liquidity: Ended the quarter with $313.1 million, above the targeted range.

On February 22, 2024, Hovnanian Enterprises Inc (NYSE:HOV), a prominent national homebuilder, released its 8-K filing, announcing the financial results for its fiscal first quarter ended January 31, 2024. The company, known for designing, constructing, and selling a variety of homes across the United States, reported a robust start to the fiscal year with significant increases in income and contracts.

Financial Highlights and Performance

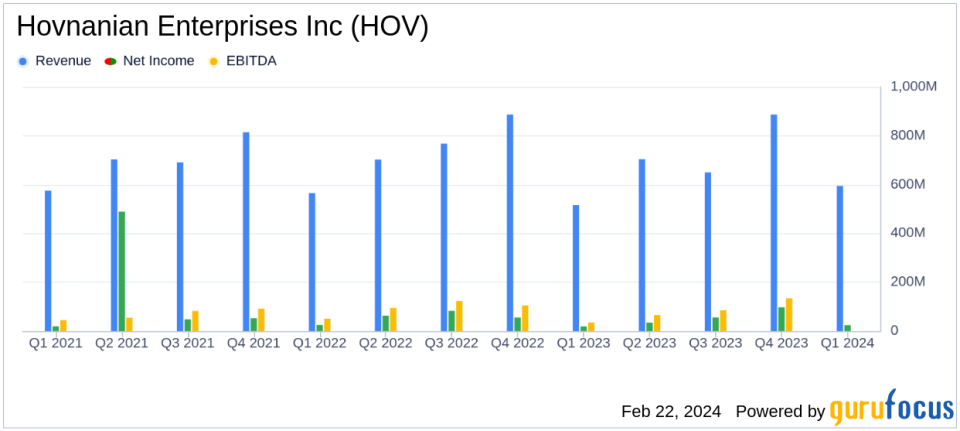

Hovnanian Enterprises Inc (NYSE:HOV) saw its total revenues grow by 15.3% to $594.2 million, including 1,063 deliveries, compared to $515.4 million in the prior year's first quarter. The company's net income also increased to $23.9 million, or $2.91 per diluted common share, up from $18.7 million, or $2.26 per diluted common share, in the same period of the previous fiscal year. This performance underscores the company's ability to capitalize on the housing market's demand and maintain profitability.

Income before income taxes saw a significant year-over-year increase of 80.4%, reaching $32.6 million. This growth was partly attributed to a 48% increase in net contracts per community, indicating a strong demand for Hovnanian's homes. The company's homebuilding gross margin percentage remained stable at 21.8% before cost of sales interest expense and land charges, reflecting efficient cost management in a competitive industry.

Operational Efficiency and Market Position

Operational efficiency was evident in the company's SG&A expenses, which, excluding a $7.5 million incremental phantom stock expense, was 13.2% of total revenues. This demonstrates Hovnanian's ability to control costs while scaling operations. The company's liquidity position was strong, ending the quarter with $313.1 million, well above the targeted liquidity range, providing flexibility for future growth and investment.

Chairman of the Board, President, and CEO Ara K. Hovnanian highlighted the company's solid start to the fiscal year, with growth in profitability and demand for new homes. He noted, "Total internet leads in January 2024 increased 16% year over year and 43% from December 2023, giving us confidence that demand remains strong." This optimism is bolstered by the company's strategic initiatives to make homes more affordable and focus on growing revenues and profitability.

"We are off to a solid start to fiscal 2024, with 80% year over year growth in our income before income taxes for the first quarter. Excluding incremental phantom stock expense, we were at or above the high end of the guidance range for our first quarter total revenues, adjusted income before income taxes and adjusted EBITDA," stated Ara K. Hovnanian.

Looking Forward

For the second quarter of fiscal 2024, Hovnanian Enterprises Inc (NYSE:HOV) expects total revenues to be between $675 million and $775 million, with an adjusted homebuilding gross margin between 21.5% and 23.0%. The company anticipates adjusted income before income taxes to be between $45 million and $55 million and adjusted EBITDA to be between $80 million and $90 million, assuming market conditions remain favorable.

The company's strong performance in the first quarter, coupled with positive market indicators and strategic initiatives, positions Hovnanian Enterprises Inc (NYSE:HOV) for continued success in the competitive homebuilding industry. Investors and potential members of GuruFocus.com can find more detailed financial information and analysis on our website, providing valuable insights into Hovnanian's growth trajectory and financial health.

Explore the complete 8-K earnings release (here) from Hovnanian Enterprises Inc for further details.

This article first appeared on GuruFocus.