How to save Social Security? Some candidates are looking at your capital gains

Currently, the funds for Social Security come from taxes levied on wages, bonuses and self-employment income. Everyone who brings in this “earned income” pays into the system.

Earned income taxes are capped at $132,900. So-called “unearned income” (capital gains, interest, and dividends) is also exempt.

The Democratic presidential candidates have a variety of plans to raise more revenue, mostly centered around raising the $132,900 cap.

But a survey of the campaigns by Yahoo Finance and the Bipartisan Policy Center’s Funding our Future campaign found that a sizable portion of the field is also willing to look at “unearned income” to bridge a Social Security shortfall and expand benefits. (The average Social Security retirement benefit in June 2019 was about $1,470 a month, or about $17,640 a year.)

"Traditionally, Social Security has relied primarily on payroll taxes to fund the program,” says Jason Fichtner, a former official at the Social Security Administration. “There are some questions now about whether we want to keep raising taxes on payroll, which could make labor more expensive and harm the ability to hire workers."

Between public plans and survey responses, close to half of the candidates who have qualified for the November debate (and more are expected to miss the cut) have expressed support for the idea in general.

Sen. Ron Wyden (D-OR) has a proposal in the Senate that includes this idea and welcomes the debate on the presidential campaign trail.

"I believe that as people come to understand it, we are going to pick up a lot of enthusiasm," he says of his proposal.

Looking at ‘unearned household income’

Sen. Cory Booker's campaign said that a Booker administration, in addition to taxing "all wages above $250,000," would subject "unearned household income above $250,000 ($200,000 for single individuals) to a tax of 6.2%." Montana Gov. Steve Bullock has a similar plan, saying he would tax "income – not solely wages – above $250,000 (as is now done with Medicare)."

The Bernie Sanders campaign declined to complete the survey but his Social Security plan would "apply the payroll tax on all income over $250,000" as a means to expand Social Security. Sanders has also introduced a Social Security bill in the Senate that would expand the “tax on investment gain” and direct the additional funds toward Social Security. Fellow candidates Cory Booker and Kamala Harris are co-sponsors.

Sen. Elizabeth Warren’s public plan and would go even further: “My plan establishes a new 14.8% Social Security contribution requirement on net investment income that applies only to the top 2% — individuals making more than $250,000 in annual income or families making more than $400,000 in annual income.”

Marianne Williamson supports the Senate bill authored by Sanders. She brought up another idea to shore up the program saying additional funds for Social Security "could be covered by a wealth tax of 2% on assets above $50 million and 3% on assets above $1 billion." Other candidates, notably Warren and Sanders, have also proposed a wealth tax but say they would direct the proceeds elsewhere.

Outside of the campaign trail, Wyden is pushing for taxes on capital gains. His Treat Wealth like Wages plan would raise new revenue with the order that “every dime raised by these new accounting rules would go toward keeping the Social Security guarantee for future generations.”

"We've got two tax systems in American," he noted in an interview with Yahoo Finance. One for "nurses and cops" and another “for those at the top of the economic pyramid,” he said, adding that "you can make 100 million dollars worth of capital gains income and not pay a penny into Social Security."

Wyden’s plan would also include new accounting rules to assess taxes on investment income each year as opposed to when the investments are sold, as the rules now dictate.

David Kamin, a law professor at New York University focusing on tax and budget policy and a former Obama administration official, puts these moves into context. “A number of the candidates are thinking through how to more effectively tax those with the most resources in the country, including potentially for things like Social Security,” he says. “In the end I think what matters overall for the country is how much high-income Americans are making and how much they then pay into the system.”

‘Any revenue source...should be considered’

Other candidates don’t appear to be looking specifically at capital gains but are interested in alternative funding sources to shore up Social Security.

Sen. Michael Bennet has a plan that would “start by lifting the payroll tax cap, so higher-income taxpayers cannot exempt a large share of their wages from paying into the system.” At the same time, Bennett says that "any revenue source that could shore up Social Security should be considered."

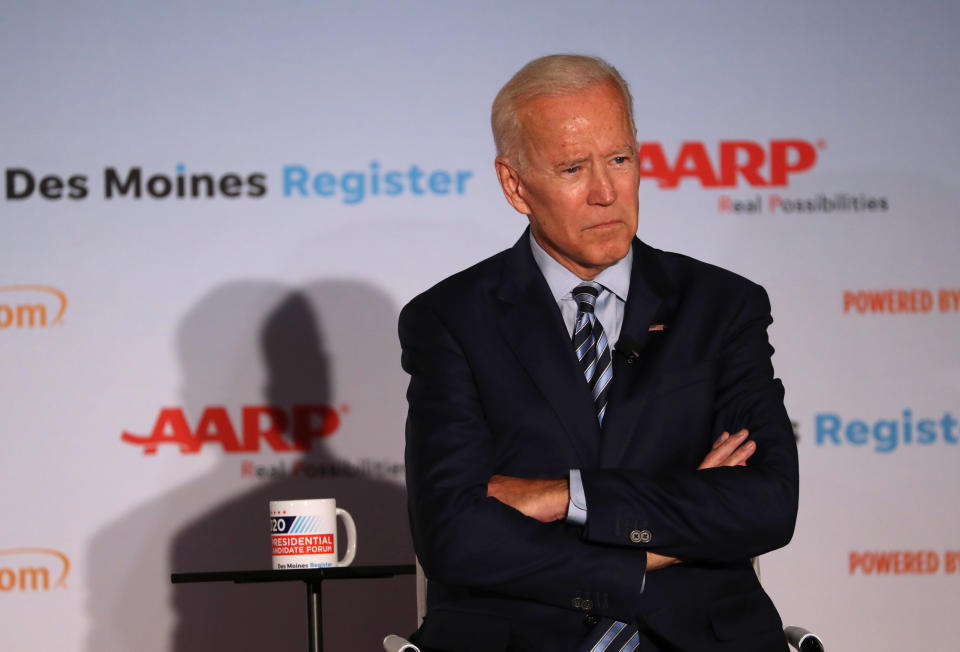

Joe Biden’s campaign declined to participate in the survey but during a July speech at an AARP forum, he suggested he would limit any new sources of funding to wages. When discussing his plan to lift the payroll cap on wages above $400,000 annually, Biden said “every penny that you make above that employed, I’m not talking about capital gains,” he said to the crowd in Iowa. He also discussed closing tax loopholes.

In a statement to Yahoo Finance, a Biden campaign spokesman said that “Biden for President is dedicated to making a secure retirement possible for all Americans and will be releasing related plans in the coming months.”

Mayor Pete Buttigieg’s position is similar to the former vice president’s. In an AARP video, he discussed raising the cap on “income that is eligible.”

Sen. Amy Klobuchar, in her response to the survey, said, "Social Security should continue to be funded through payroll taxes," but also brought up alternative sources of funding to pay for an expansion of Social Security. A Klobuchar administration would “close the trust fund loopholes that allow the wealthy to avoid paying taxes on inherited wealth.”

Only a few of the survey’s respondents directly argued for keeping the funding source solely from wages. The Social Security 2100 Act is a popular plan for reforming Social Security in the House of Representatives that does not target unearned income. Former Congressman Beto O'Rourke is a supporter and says that viability for Social Security would be possible "purely through payroll taxes." John Delaney and Joe Sestak, two lower-tier candidates, also expressed no interest in looking beyond payroll taxes.

Moving toward action on funding Social Security

The Social Security payroll tax rate on wages is currently 6.2% for the employer and 6.2% for the employee. The Social Security trust fund will be depleted in about 15 years without action, according to the 2019 Trustees report. Cuts in benefits for current and future retirees would follow.

So far, the fate of Social Security hasn’t been a front-burner issue in the campaign. On the debate stage, the words “Social Security” has only been said a few times and usually as a point of comparison on another issues. Joe Biden brought it up in June to make a point about immigration. John Delaney brought it up in July to make a point about health care. Elizabeth Warren brought it up on Tuesday during a conversation about universal basic income.

President Trump hasn’t said much Social Security, either. During the 2016 campaign, he suggested reforming the entitlement programs wasn’t a top priority for him. In March, Office of Management and Budget Acting Director Russell Vought said the president was “keeping his commitment to American seniors by not making changes to Medicare and Social Security.” Some of Trump’s Republican allies on Capitol Hill have suggested that entitlement reform — code to many for cutting Social Security or Medicare benefits — could be a “second-term project.”

The survey was developed by Yahoo Finance and the Funding our Future campaign, which is an alliance of organizations dedicated to making a secure retirement possible for all Americans.

Ben Werschkul is a producer for Yahoo Finance in Washington, DC.

Read more:

On Social Security, 2020 candidate plans miss this one critical issue

A plan that could save Social Security and boost the economy — with one big catch

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.