Howard Marks' Oaktree Capital Exits Vistra Corp with a 4.99% Portfolio Impact

Insight into Oaktree Capital's Q4 Moves and the Strategic Exit from Vistra Corp

Howard Marks (Trades, Portfolio), the Chairman of Oaktree Capital Management LP, has made significant changes to the firm's investment portfolio in the fourth quarter of 2023. Known for his emphasis on alternative investments and a focus on less efficient markets, Marks has steered Oaktree since its inception in 1995, upholding a philosophy that prioritizes deep understanding of market structures and risk control. The latest 13F filing reveals a series of strategic decisions, including new acquisitions, increased stakes, and notable exits, reflecting the firm's dynamic approach to value investing.

Summary of New Buys

Howard Marks (Trades, Portfolio) has broadened Oaktree Capital's portfolio with the addition of 7 new stocks. Noteworthy new positions include:

America Movil SAB de CV (NYSE:AMX), with 2,298,858 shares valued at $42.57 million, making up 0.72% of the portfolio.

H World Group Ltd (NASDAQ:HTHT), comprising 1,090,795 shares worth $36.48 million, accounting for 0.62% of the portfolio.

Alibaba Group Holding Ltd (NYSE:BABA), with 120,271 shares valued at $9.32 million, representing 0.16% of the portfolio.

Key Position Increases

Strengthening existing positions, Howard Marks (Trades, Portfolio) increased stakes in 15 stocks. Significant increases include:

TPI Composites Inc (NASDAQ:TPIC), with an additional 3,899,903 shares, bringing the total to 4,600,642 shares. This represents a 556.54% increase in shares and a 0.27% portfolio impact, valued at $19.05 million.

Liberty Global Ltd (NASDAQ:LBTYA), with an additional 785,000 shares, bringing the total to 2,731,000 shares. This adjustment marks a 40.34% increase in shares, valued at $48.53 million.

Summary of Sold Out Positions

In a significant move, Howard Marks (Trades, Portfolio) exited 16 holdings in the fourth quarter of 2023, including:

Vistra Corp (NYSE:VST), where all 9,000,000 shares were sold, impacting the portfolio by -4.99%.

Frontier Communications Parent Inc (NASDAQ:FYBR), with the complete liquidation of 2,800,846 shares, causing a -0.73% portfolio impact.

Key Position Reductions

Howard Marks (Trades, Portfolio) also trimmed positions in 12 stocks. The most substantial reductions were:

Star Bulk Carriers Corp (NASDAQ:SBLK), reduced by 9,959,500 shares, a -61.99% decrease, impacting the portfolio by -3.21%. The stock traded at an average price of $19.71 during the quarter and has returned 19.23% over the past 3 months and 2.82% year-to-date.

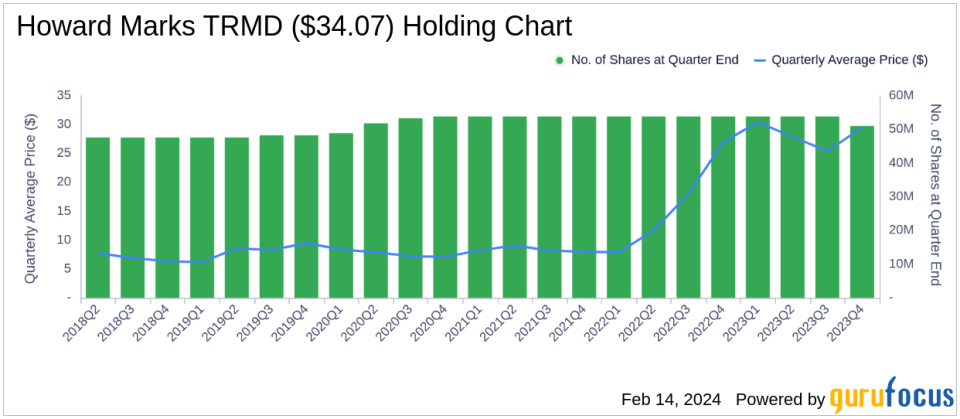

TORM PLC (NASDAQ:TRMD), reduced by 2,806,450 shares, a -5.22% decrease, impacting the portfolio by -1.27%. The stock traded at an average price of $29.49 during the quarter and has returned 13.74% over the past 3 months and 12.04% year-to-date.

Portfolio Overview

As of the fourth quarter of 2023, Howard Marks (Trades, Portfolio)'s portfolio at Oaktree Capital included 71 stocks. The top holdings were:

26.15% in TORM PLC (NASDAQ:TRMD)

9.13% in Chesapeake Energy Corp (NASDAQ:CHK)

7.22% in Garrett Motion Inc (NASDAQ:GTX)

5.15% in Sitio Royalties Corp (NYSE:STR)

3.53% in Runway Growth Finance Corp (NASDAQ:RWAY)

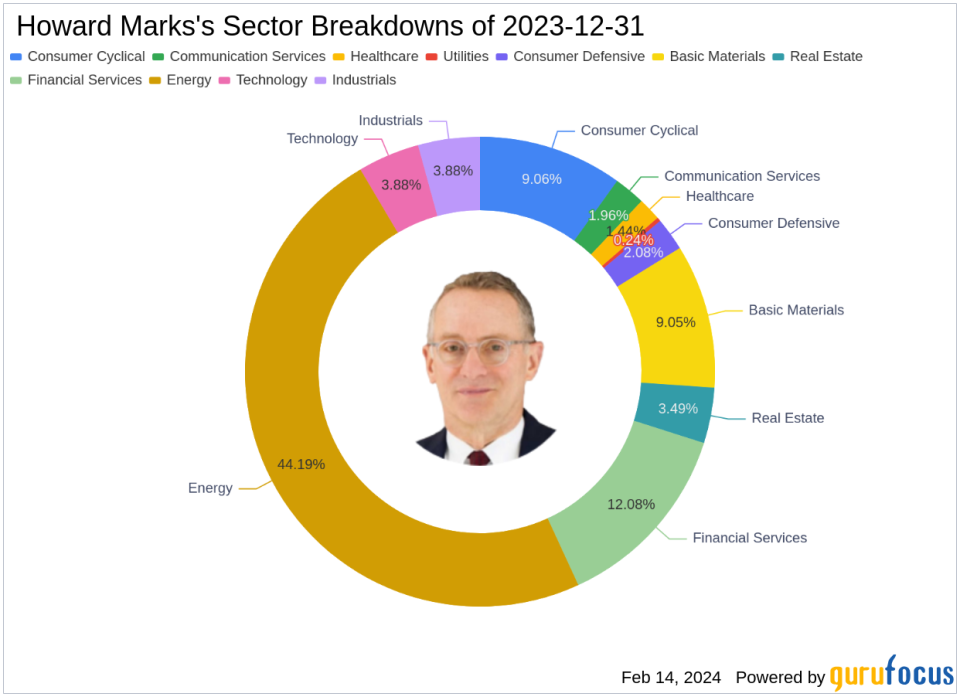

The portfolio is primarily concentrated across 11 industries, with significant investments in Energy, Financial Services, Consumer Cyclical, and other sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.