HSBC's Q1 Pre-Tax Earnings Increase Y/Y, Revenues Decline

HSBC Holdings HSBC reported first-quarter 2021 pre-tax profit of $5.8 billion, up 79% from the prior-year quarter.

The company’s shares on the NYSE have rallied 2.8% in the pre-market trading. A full day’s trading session will provide a better picture.

Results benefited from net reserve releases. However, lower revenues and rise in expenses were the undermining factors.

Revenues Down, Expenses Rise

Adjusted total revenues of $13.3 billion decreased 3.2% year over year. Reported revenues were down 5.1% to $13 billion. Both declines were primarily due to lower global interest rates and weak loan demand.

Adjusted operating expenses rose 2.8% from the prior-year quarter to $8.2 billion.

Adjusted change in expected credit losses (ECL) and other credit impairment charges were net release of $435 million against a charge of $3.1 billion recorded in the year-ago quarter.

Common equity Tier 1 (CET1) ratio as of Mar 31, 2021, was 15.9%, up from 14.6% as of Mar 31, 2020. Leverage ratio was 5.4%, up from 5.3% at the end of March 2020.

Performance by Business Lines

Wealth and Personal Banking: The segment reported $1.8 billion in pre-tax profit, up substantially from $678 million recorded a year ago. The improvement was largely driven by rise in revenues, partly offset by higher costs.

Commercial Banking: The segment reported pre-tax profit of $1.8 billion, significantly up from prior-year quarter’s $659 million. ECL releases mainly supported the segment’s performance.

Global Banking and Markets: Pre-tax profit was $1.8 billion, surging 74.5% from the prior-year quarter end. Higher revenues and ECL releases supported the performance.

Corporate Centre: The segment reported pre-tax profit of $284 million, down 66.4% year over year.

Guidance

HSBC continues to expect an adjusted cost base of $31 billion or less for 2022. Also, the company projects cost savings of $5-$5.5 billion by 2022, while spending $7 billion in charges to achieve the same.

It expects to exceed its $100-billion gross risk-weighted asset reduction target by the end of 2022.

The company targets a RoTE of 10% or more for the medium term.

CET1 ratio is expected to be above 14% and between 14% and 14.5% in the medium term.

The company plans to transition toward a target payout ratio of 40-55% of reported earnings per share from 2022.

Based on the current consensus economic forecasts trajectory, management expects ECL charges for 2021 to be below the medium-term range of 30-40 basis points of average loans.

The company projects mid-single-digit percentage growth in customer lending during 2021.

Our View

Low interest rate environment across the globe and weak loan demand are expected to continue hurting HSBC’s revenue growth to some extent. However, the company’s business restructuring initiatives and efforts to strengthen market share in the U.K. and China are likely to support financials over the long term.

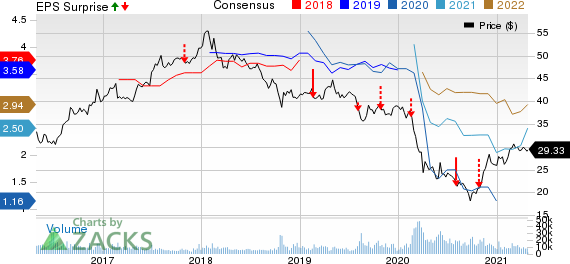

HSBC Holdings plc Price, Consensus and EPS Surprise

HSBC Holdings plc price-consensus-eps-surprise-chart | HSBC Holdings plc Quote

Currently, HSBC carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Earnings Date of Other Foreign Banks

ICICI Bank’s IBN fourth-quarter fiscal 2021 (ended Mar 31) net income was INR44.03 billion ($602 million), up substantially from INR12.21 billion ($167 million) in the prior-year quarter.

Deutsche Bank DB and Barclays BCS are scheduled to announce first-quarter 2021 results on Apr 28 and Apr 30, respectively.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ICICI Bank Limited (IBN) : Free Stock Analysis Report

Barclays PLC (BCS) : Free Stock Analysis Report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research