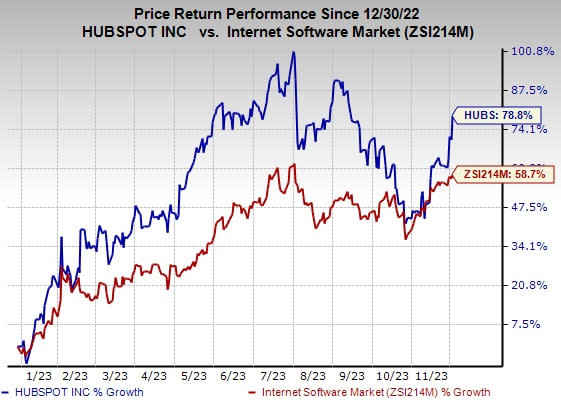

HubSpot (HUBS) Soars 79% YTD: Will the Uptrend Continue?

Shares of HubSpot, Inc. HUBS have surged 78.8% over the past year, driven by improved market demand across its portfolio on the back of a flexible business model and solid cash flow. Earnings estimates for the current and next fiscal year have increased a stellar 102.5% and 65.1%, respectively, since December 2022, implying robust inherent growth potential. With healthy fundamentals, this Zacks Rank #3 (Hold) stock appears primed for further appreciation. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Growth Drivers

Headquartered in Cambridge, MA, HubSpot provides inbound marketing and sales applications over the cloud. The software-as-a-service (SaaS) vendor helps businesses attract more customers through search engine optimization (SEO), social media, blogging, website content management, marketing automation, e-mail, Customer Relationship Management (CRM), analytics and reporting.

HubSpot is increasingly focusing on collecting and enriching customers with extensive, unified data pulled from website visits, marketing e-mails, sales calls and more. The acquisition of Clearbit, a B2B data provider for marketing intelligence, will further accelerate its vision. The integration of Clearbit premier information pool with HubSpot AI will facilitate the development of more powerful, advanced and accurate AI capabilities.

HubSpot’s inbound marketing and sales applications enable businesses to easily reach, acquire and retain customers through traditional marketing tools like cold calls, print advertisements and e-mail. The company’s strategic priority is to deliver a world-class front-office platform by investing in anchor hubs and innovating new emerging hubs. The growing adoption of inbound applications has helped develop the marketing agency partner network. Management’s focus on integrating generative AI to drive innovation and add more value to customers is likely to reap long-term benefits.

The company has significant scope in cross-selling its products to the existing customer base. The One HubSpot initiative is a key growth driver. In addition, HubSpot's App Marketplace offers a customer-centric solution by making it simple for companies to find and seamlessly connect the integrations to grow their businesses. As companies prioritize a digital-first approach, it is likely to create more opportunities for developers to build new integrations that support every stage of the customer journey.

It has rolled out multiple updates to its Sales Hub product, including a low-priced Starter tier and improvement to its sales engagement tools to make them more affordable for growing sales teams. Moreover, the company has a sizeable customer base that uses its products for free. Given the growing effectiveness of its inbound applications and innovative product portfolio, we believe that many of these free customers will eventually choose to buy HubSpot pro products for both their marketing and sales functions. This presents a significant top-line growth opportunity for the company and will likely boost its margins.

It has a long-term earnings growth expectation of 30.6% and delivered an earnings surprise of 35.7%, on average, in the trailing four quarters.

Key Picks

Comtech Telecommunications Corp. CMTL, carrying a Zacks Rank #2 (Buy), is another solid pick. Headquartered in Melville, NY, the company is a leading global provider of next-generation 911 emergency systems and secure wireless communications technologies to commercial and government customers.

Comtech’s key satellite earth station modems incorporate forward error correction and bandwidth compression technologies, which enable its customers to optimize their satellite networks by either reducing their satellite transponder lease costs or increasing data.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 20.4% and delivered an earnings surprise of 12%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

AudioCodes Ltd. AUDC is another Zacks Rank #2 stock. It has a long-term earnings growth expectation of 24.8% and delivered an earnings surprise of 14%, on average, in the trailing four quarters.

Headquartered in Lod, Israel, AudioCodes offers advanced communications software, products, and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

HubSpot, Inc. (HUBS) : Free Stock Analysis Report