HubSpot Inc (HUBS) Reports Revenue Growth and Strong Non-GAAP Performance for Q4 and Full Year 2023

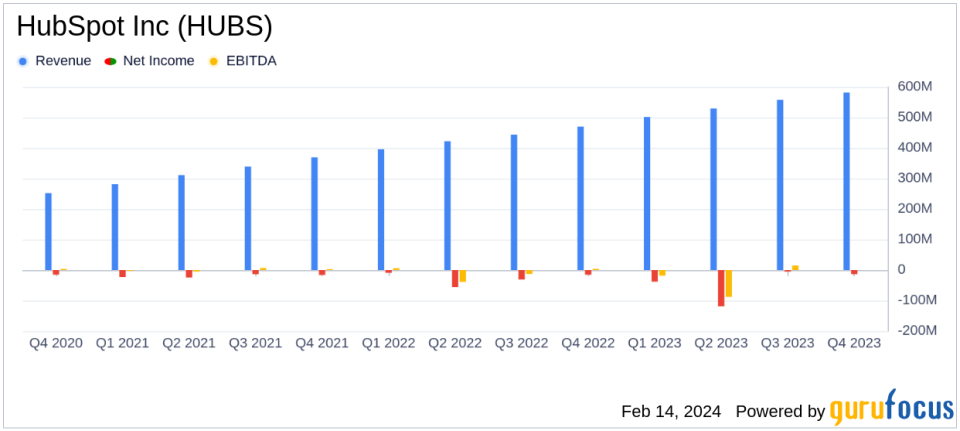

Total Revenue: $581.9 million in Q4, a 24% increase year-over-year; $2.17 billion for the full year, up 25%.

Operating Income (Loss): GAAP operating loss of ($24.3) million in Q4; non-GAAP operating income of $98.1 million.

Net Income (Loss): GAAP net loss of ($13.6) million in Q4; non-GAAP net income of $92.4 million.

Cash Flow: $104.3 million generated from operating activities in Q4; $351.0 million for the full year.

Customer Growth: Customer base grew to 205,091, a 23% increase from the previous year.

Subscription Revenue Per Customer: Increased by 1% in Q4 to $11,365.

Guidance for Q1 and Full Year 2024: Revenue expected to be in the range of $596.0 million to $598.0 million for Q1, and $2.55 billion to $2.56 billion for the full year.

On February 14, 2024, HubSpot Inc (NYSE:HUBS) released its 8-K filing, announcing its financial results for the fourth quarter and the full year ended December 31, 2023. The company, known for its cloud-based marketing, sales, and customer service software platform, reported a significant increase in total revenue, driven by a robust 24% year-over-year growth in subscription revenue for Q4 and a 25% increase for the full year.

Despite the positive revenue trends, HubSpot experienced a GAAP operating loss of ($24.3) million in Q4, which was deeper than the ($13.5) million loss in Q4'22. However, the non-GAAP operating income told a different story, with a substantial increase to $98.1 million in Q4 from $64.0 million in the same period last year. This improvement reflects the company's ability to manage expenses and achieve operational efficiency.

The GAAP net loss for Q4 was ($13.6) million, or ($0.27) per share, which is an improvement from the ($15.6) million, or ($0.32) per share, reported in Q4'22. The non-GAAP net income, however, was a robust $92.4 million, or $1.83 per basic and $1.76 per diluted share, up from $56.8 million, or $1.17 per basic and $1.11 per diluted share, in Q4'22.

HubSpot's balance sheet remains strong with $1.7 billion in cash, cash equivalents, and investments. The company's operating cash flow performance was also impressive, generating $104.3 million in Q4 and $351.0 million for the full year, indicating healthy liquidity and financial flexibility.

CEO Yamini Rangan commented on the company's performance, stating:

We saw a strong finish to a good year despite the challenging macro environment. Our customers have high confidence in our ability to help them grow in any environment and we are becoming the clear platform of choice for scaling companies."

Looking ahead, HubSpot provided guidance for Q1 2024 with total revenue expected to be between $596.0 million and $598.0 million and non-GAAP operating income anticipated to be between $83.0 million and $84.0 million. For the full year 2024, the company expects total revenue to range from $2.55 billion to $2.56 billion.

HubSpot's performance in 2023 demonstrates its resilience and adaptability in a challenging economic landscape. The company's focus on product innovation and go-to-market execution, along with its strategic shift to a seats-based pricing model, positions it well for continued growth and market leadership.

Investors and potential GuruFocus.com members interested in the detailed financials can access the full earnings report and the upcoming conference call for further insights into HubSpot's financial health and strategic direction.

Explore the complete 8-K earnings release (here) from HubSpot Inc for further details.

This article first appeared on GuruFocus.