HubSpot's Valuation Signals Irrational Exuberance Despite Uncertain Conditions Ahead

HubSpot Inc. (NYSE:HUBS) has been navigating a difficult couple of years as it emerges through a high interest rate environment and uncertain business conditions within its customer base. In the stock market, the company is beating benchmark indexes, with the stock up over 50% on a trailing 12-month basis as compared to the S&P 500, which is up 27% over the same period.

The company announced its fourth-quarter 2023 earnings a couple weeks ago. While the results looked strong, HubSpot's stock seems grossly overpriced given its forward growth rates, leaving no room for upside.

Updates to HubSpot's business model

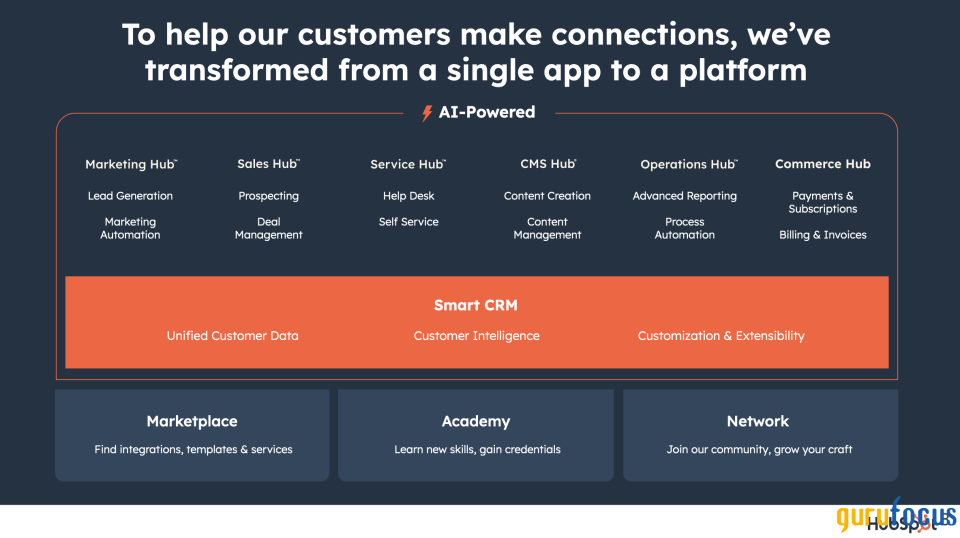

Hubspot is a business-to-business software company that provides its own software platform for its clients to help them connect with their users and grow. The company operates within the customer relationship management software space and breaks out its entire customer relationship platform into six product hubs. The Marketing Hub was one of its first product hubs in 2006, following up with the CRM hub, sales hub and service hub six years later. Most recently, the company has taken advantage of artificial intelligence to launch AI models and services that are embedded into all its product hubs, as shown below.

The company operates a software-as-a-servoce-based subscription model with a keen focus on targeting and serving customers in the mid-market segment. In addition to periodic subscriptions, the company also recently launched seat-based pricing based on the additional number of users in an organization who may use the platform on behalf of the organization.

HubSpot's customer base continues to grow, but uncertainty remains

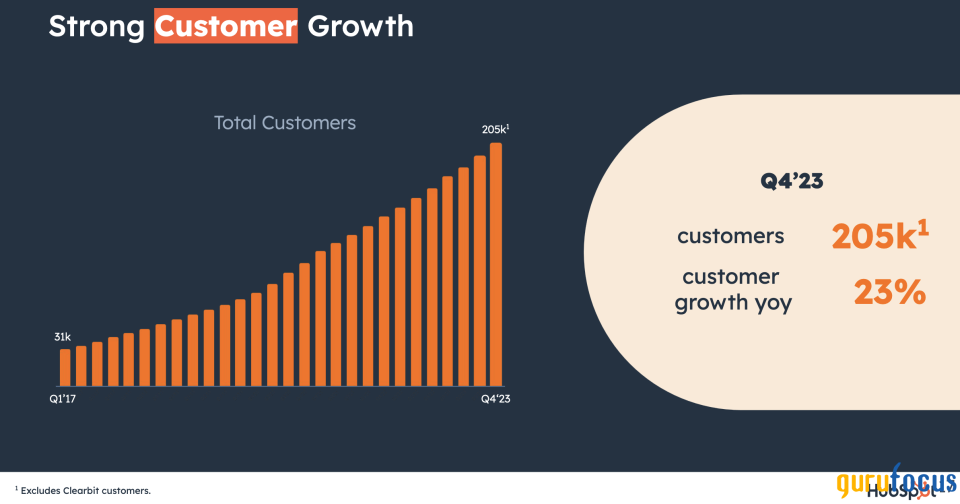

Based on the recent earnings presentation, Hubspot is adding customers at a respectable pace. In the fourth quarter, the software company's base consisted of 205,000 customers, 23% higher than the previous year. Its customer base grew at approximately the same rate as in the previous year. In 2022, HubSpot's customer base grew 23.50%, as per its 2023 10-K filing.

While the headline customer volume metrics looked healthy, HubSpot saw weakness in its net revenue retention rate, signaling its customer base was spending less on its platform as compared to the previous year. The 2023 NRR was at 103.9%, around 6% less than the 110.3% the company saw in 2022. One of the primary reasons could be Hubspot hiked rates to its product hubs in 2022 by 12%. As the company was lapping a full year of price increases, management did warn of some impact on its revenue.

The company will be launching another update to its pricing model by introducing seat-based pricing, as noted earlier. On the fourth-quarter earnings call, management noted they would see some impact from the pricing change in the back half of 2024 since the pricing change will impact its existing customer base as they see another 5% increase. Management noted these price changes will likely impact revenue in 2024 as well in the short term.

Impressive revenue growth and margin expansion

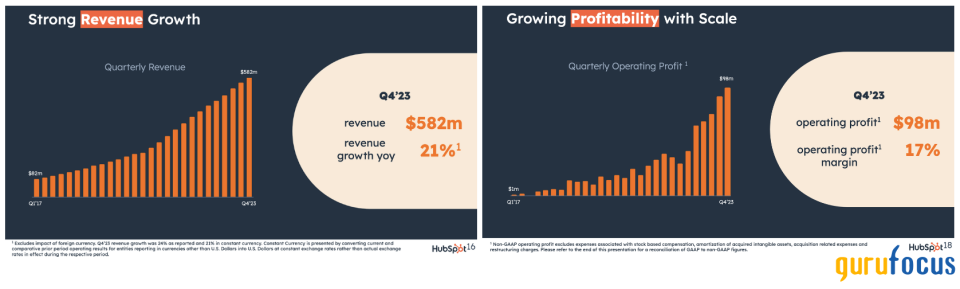

HubSpot's full-year revenue grew at a respectable 25%, aided by stronger growth in subscription revenues, which increased 26%. In 2023, subscription revenues accounted for 98% of the company's overall subscription. Taking into account 2023 full-year revenue, the company has grown at a compound annual rate of 34% since 2017, which is impressive.

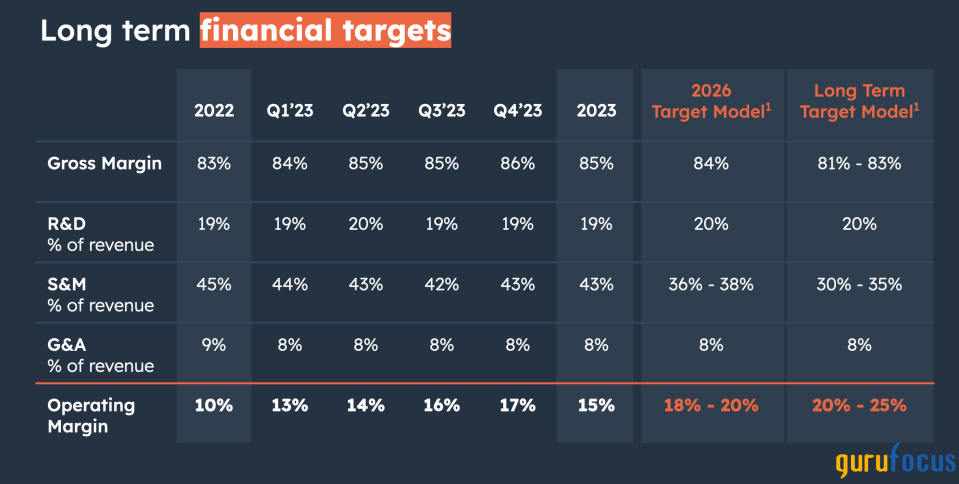

HubSpot's non-GAAP operating margin significantly expanded by over 5% to 15.20%. Optimization in HubSpot's workforce headcount as well as changes to its partner commission fee structure led to a significant expansion of operating margin. However, a deeper analysis of adjusted operating income shows the company's operating income was aided by a 57% increase in stock-based compensation.

HubSpot's balance sheet carries moderate levels of debt

Per the full-year earnings report, the company is carrying slightly elevated levels of debt on its balance sheet as compared to its cash position. As of December 2023, HubSpot held $1.30 billion in shareholder equity, around $388 million in cash and about $1 billion in short-term investments. HubSpot's balance sheet also carries about $456 million in convertible senior notes due next year, in addition to the roughly $270 million it carries in contractual obligations toward prior vendor commitments and operating leases.

Valuation shows HubSpot's stock is fully priced in

On the earnings call, management projected some relative headwinds in the business as it continues to navigate through the latest round of price increases. Moreover, the company continues to see an uncertain macro environment. Some of these observations are reflected in the growth in the calculated billings metric, which grew 21% in constant currency, slower than the actual full-year revenue growthr. Management's 2024 guidance further solidifies the argument about HubSpot seeing some relative slowdown in its business this year.

The company is projected to grow its revenue at a pace of 18% year over year, lower than the 25% annual growth rate it witnessed in 2023. Management expects 2024 operating income to be in the range of $408 million to $412 million on an adjusted basis. Assuming the company is able to actually beat the top end of its operating income guidance, that would imply operating income would grow by 25% on a year-over-year basis. This seems impressive given that the S&P 500 is expected to grow its earnings by 11% in 2024. Such growth rates for HubSpot would warrant a forward earnings multiple of 50 at most, given that the index's forward price-earnings ratio is currently at 20. However, the stock currently trades at a forward ratio of 87, which is irrationally exuberant, leaving the stock overpriced.

Risks and other factors to consider

HubSpot also faces severe competition in this space. Some of its direct competitors include Klaviyo (NYSE:KVYO) and Freshworks (NASDAQ:FRSH), which also compete with HubSpot in the market for small-to-mid market customers. In addition, HubSpot also faces stiff competition from larger incumbents in the industry, which include Salesforce (NYSE:CRM) and Intuit (NASDAQ:INTU). While both of these companies target and serve larger enterprise customers, should they choose to enter HubSpot's mid-market customer base, it could potentially impact the company.

Takeaways

HubSpot has had some impressive growth rates so far, but the company is starting to feel the impact of discernible customers who may be choosing to spend less on the platform. With growth slowing and the macro conditions continuing to remain choppy, there is no reason why the company's stock should continue to trade at a forward earnings premium. Such extreme valuation multiples may cause significant volatility in the stock. Given the uncertainty looming in its outlook, the risks far outweigh the rewards in holding the stock. Investors must proceed with caution with the stock looking overvalued at current levels.

This article first appeared on GuruFocus.